354: Oil prices sky-rocketting "Peak Oil" - pre-curser to a crash mid 2011

12-25-2010

www.google.co.uk

www.google.co.uk

Dynamics: The key economic dynamic happening at present is that underlying inflationary pressures are building up from:

-

USA printing $1 Trillion

-

Oil prices rising above $90/bbl

-

Chinese and eastern economies are roaring ahead creating global demand for commodities that is escalating costs in western countries - an energy and commodities power struggle

Smart Money: We think the smart investor's money should avoid the dollar because this will drop like a stone because the US economy is in such critical shape. The US debt is mind-blowing and is totally unsustainable. A family of four has a medicare bill of $26,000 a year and oil import bill of $8,000. There is a global currency war raging where nations are competing to try to reduce their currency rates to inflate their economies and reduce their debts in the process. But it's a very dangerous and likely unsustainable short term game that will more than likely end in tears. The tears could start flowing as soon as mid 2011 as oil prices sky-rocket well above $100/bbl.

will drop like a stone because the US economy is in such critical shape. The US debt is mind-blowing and is totally unsustainable. A family of four has a medicare bill of $26,000 a year and oil import bill of $8,000. There is a global currency war raging where nations are competing to try to reduce their currency rates to inflate their economies and reduce their debts in the process. But it's a very dangerous and likely unsustainable short term game that will more than likely end in tears. The tears could start flowing as soon as mid 2011 as oil prices sky-rocket well above $100/bbl.

Dollar Decline, Oil Incline: What we expect is that as more national governments become disillusioned with the dollar, more money will be put into oil as a hedge against both inflation and the dollar decline. This will in turn lead to inflation globally, higher interest rates in a vain attempt to control inflation, then another global financial crash and subsequent recession. We see this all happening in the next 12 months. Yes, we are predicting a crash mid 1930s style.

Spending Binge: The key problem has been that after the initial crash in mid 2008, socialist governments thought they could just print money and buy their way out of the problem meanwhile putting up taxes. But when taxes go up, normally tax revenues actually drop. In the UK, the public spending cuts have not been fast enough to lower debt and deficit levels spending is still increasing and tax revenues are the stable despite rising tax levels. November was a miserable month for the UK deficit. In the USA the situation is even worse with Obama continuing to increase spending on healthcare and public sector when he should bringing it down and unemployment is still rising. Most of this money is finding it's way to foreign markets.

Printing Money: As printed money makes its way into the economy people na turally take on risk by buying stocks and shares hence most stock markets have re-inflated something of a phantom rally. Gold prices have soured as inflationary uncertainty has increased but the threat of government seizing gold has kept prices below what they would have been if this key threat was not identified by many investors.

turally take on risk by buying stocks and shares hence most stock markets have re-inflated something of a phantom rally. Gold prices have soured as inflationary uncertainty has increased but the threat of government seizing gold has kept prices below what they would have been if this key threat was not identified by many investors.

Oil Import Costs: The bottom lines is the western oil importing worlds economies were built on low cost oil that built great cities and expanded the consumer base then allowed millions of public sector jobs and lawyers, business services private sector workers all producing very little but keeping the money "washing machine" turning. As oil prices have risen, this has put huge pressures on all oil importing nations economies and anything over about $100/bbl is likely to send most of them into recession especially Italy, Greece, Spain, Portugal, Ireland and Iceland. As energy prices rise, there will be less growth. As populations age in many countries and decline in many others this will also cause growth to stagnate especially in Greece, Italy, possibly Spain and eastern parts of Germany. If oil prices rise to $150/bbl, Greece's oil import bills alone totals 15% of the country's GDP - any wander why the country is broke. For the USA, it's still a prohibitive 5% of GDP - its like a massive tax or additional borrowing cost.

2011 Outlook: So what about 2011. Take a seat in the theatre of western economic destruction. There is currently a mini-bull run occurring as oil prices rise, peoples confidence improves and everyone starts to think the good times are back again. But lingering deep in the closets of governments are some nasty surprises that they have not told us yet:

2011 Outlook: So what about 2011. Take a seat in the theatre of western economic destruction. There is currently a mini-bull run occurring as oil prices rise, peoples confidence improves and everyone starts to think the good times are back again. But lingering deep in the closets of governments are some nasty surprises that they have not told us yet:

· Oil supply will not match demand starting end 2010 and by mid 2011 oil prices will have skyrocketted again

· Iran will take OPEC presidency in Jan 2011 for a year and will use its influence to destabilize oil markets and drive prices high, and further their regional nuclear power strategy

· Banks already in deep trouble will find that governments cannot afford to bail them out any further as oil import costs sky-rocket

· Property prices will drop further by June 2011 onwards in UK and USA after a possible short increase in prices from Jan 2011 to May 2011

· By August 2011 all hell will break loose just as everyone is taking their summer holidays it will be messy

· Oil prices will then crash down to somewhere around $50/bbl as recession starts to bite again

OPEC Asserting Themselves - Power & Control: Its interesting to note two or three OPEC member coming out end December saying they think $100/bbl is a good price. Its even possible that oil production could drop if oil prices rise significantly because O PEC member may want to safeguard future reserves and production for the next few generations and their own internal use. In the western world, we seem to think if the price goes up everyone gets out and starts producing more, but in the eastern world, normal western type market/economics do not hold true. The state runs the show and controls the economy rather than the any market.

PEC member may want to safeguard future reserves and production for the next few generations and their own internal use. In the western world, we seem to think if the price goes up everyone gets out and starts producing more, but in the eastern world, normal western type market/economics do not hold true. The state runs the show and controls the economy rather than the any market.

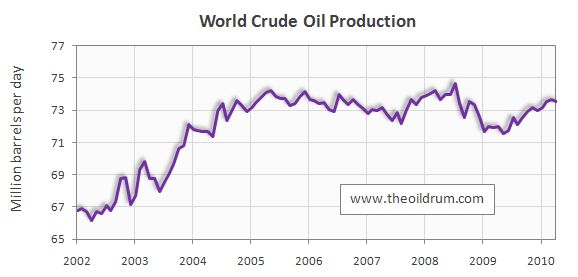

Undulating Peak Oil Plateau - Not Enough Oil: Bigger picture, it will be further confirmation the economy is controlled by oil (supply/ demand/ price). And that the world is bumping along the Peak Oil Growth Ceiling an undulating Peak Oil plateau. Just when it looks like the economy is set to fly, it will be set back by the same old issue. But it wont become obvious until 2012 or later.

Iraqi Oil Critical: The only really good piece of news is that Iraq's oil production is finally increasing. On 27 Dec it reached a 20 year high of 2.6 million barrels a day. Huge multi-billion dollar oil investment contracts have been signed that commit foreign oil companies to work with the Iraqi government to deliver oil production increases to at least 5.5 million barrels/day by 2016 - with upside to 8 or more. Without this oil, the world would be believe suffer a massive oil crisis - this new oil is the only reason why the world can just about maintain an undulating plateau. Another positive development is the agreement by the Iraqi government that oil exports from Kurdistan can commence once more. As oil revenues massively increase, gigantic new wealth will be created in Iraq in the next ten years. We expect security to improve, unemployment to drop, wealth to increase and indigenous tensions to drop. The country will become even more peaceful and economic conditions improve - there will be less reason for people to be disaffected once this wealth starts feeding through into jobs, homes and better living conditions.

a day. Huge multi-billion dollar oil investment contracts have been signed that commit foreign oil companies to work with the Iraqi government to deliver oil production increases to at least 5.5 million barrels/day by 2016 - with upside to 8 or more. Without this oil, the world would be believe suffer a massive oil crisis - this new oil is the only reason why the world can just about maintain an undulating plateau. Another positive development is the agreement by the Iraqi government that oil exports from Kurdistan can commence once more. As oil revenues massively increase, gigantic new wealth will be created in Iraq in the next ten years. We expect security to improve, unemployment to drop, wealth to increase and indigenous tensions to drop. The country will become even more peaceful and economic conditions improve - there will be less reason for people to be disaffected once this wealth starts feeding through into jobs, homes and better living conditions.

Conservation - Too Late: The only alternative will be to conserve energy and use it more wisely and efficiently but government have not woken up to this simple model yet. One would hope they will next time there is a crash and a deeper crisis than mid 2008.

Investment Steer: So for our website visitors whats our steer for 2011 for Uk and US investors?

· Only invest in residential high yielding buy to let properties with good rental demand in areas with mainly private sector jobs (low borrowing costs and high rents) where asset prices are less important for you to make market profits - avoid commercial property of all types

· Buy oil company stocks and shares for the period now until May 2011 then sell down before the oil price crashes

· Avoid buying anything in dollars initially the dollar will decline steeply. Then it could gain if there is a medium level global recession, but it could also crater if the recession is driven by US debt default quite plausible with Obamas economy policies of printing money then spending on public sector - and private sector with capital outflows.

US Oil Imports Rising, Production Dropping: Remember also that US oil production should drop next year because of the 2010 ban on drilling in the Gulf of Mexico and the regulatory tightening and slowing down of drilling because of the Macondo oil spill. Just as oil demand increases in the USA early 2011, indigenous oil supply will drop. The outdated suburban lifestyle fuelled by low cost oil and massive interstate highways with gas guzzling trucks will start to look rather absurd. For 100 years, cars have been burning oil at 25 miles to the gallon the only difference now is that cars are five times more powerful and  three times larger than in 1910. But they dont go any faster than 50 mph and traffic jams mean getting around is often even more difficult than 1910. This highly inefficient oil burning way of life will need to change in the next ten years as oil scarcity starts to kick in and everyone will notice at the gas pumps. But dont expect the politician to explain the truth to the masses the optimistic "good old times "are around the corner will be the message rather than the bad news oh, we have no oil left and we import loads from unfriendly countries and have therefore transferred power to these people. Some people will point out that in 2010 US oil production actually increased. Yes, this is the case after ten years of stimulative pro-oil Bush policies - and developments that were kicked off 2-6 years ago. But now we will see a decline as business unfriendly policies of the current administration start to take affect in earnest.

three times larger than in 1910. But they dont go any faster than 50 mph and traffic jams mean getting around is often even more difficult than 1910. This highly inefficient oil burning way of life will need to change in the next ten years as oil scarcity starts to kick in and everyone will notice at the gas pumps. But dont expect the politician to explain the truth to the masses the optimistic "good old times "are around the corner will be the message rather than the bad news oh, we have no oil left and we import loads from unfriendly countries and have therefore transferred power to these people. Some people will point out that in 2010 US oil production actually increased. Yes, this is the case after ten years of stimulative pro-oil Bush policies - and developments that were kicked off 2-6 years ago. But now we will see a decline as business unfriendly policies of the current administration start to take affect in earnest.

Oil Prices Sky-rocket Then Crash As Next Recession Kicks-In: Expect in the next six months oil prices rocketing to about $150/bbl before recession kicks back in and the oil prices, stock prices and all other asset prices in western oil importing nations crash again. A sorry tale. But you need to make sure you see this as an opportunity in the next six months then get the heck out of the market before it crashes again. As the boom in asset prices takes hold things will likely look good and sustainable the markets will start thinking the good times are back again. But what no-one will be telling everyone is that the oil imports fuelling government debts will be massively expanding and the banks will start feeling the pressure by May 2011. By summer 2011 we think the whole financial system could meltdown after a brief and severe commodities rally.

Where Is All The Money Going?: Looking at it another way where do you th ink the $1 Trillion that Obama has printed has disappeared to? The banks have hoarded a lot, paid off masses of their debts and companies are also hoarding cash but they are also investing abroad outside the USA this is why so few jobs have been created. Investing in emerging markets is less risky and the currency performance will be stronger - especially if the country has strong manufacturing growth and oil exports. This is the unintended consequence. Anyone with some low cost dollars are of course likely to look to invest abroad in more stable currencies as they diversity away from a dollar that is likely to crash. Also, much of this money has likely been put straight into commodities oil, gold, metals, gems as a hedge against inflation and the declining dollar. So the printed money has found its way into exactly what the US government did not want it to go into. Its creating another asset bubble with unstable foundations.

ink the $1 Trillion that Obama has printed has disappeared to? The banks have hoarded a lot, paid off masses of their debts and companies are also hoarding cash but they are also investing abroad outside the USA this is why so few jobs have been created. Investing in emerging markets is less risky and the currency performance will be stronger - especially if the country has strong manufacturing growth and oil exports. This is the unintended consequence. Anyone with some low cost dollars are of course likely to look to invest abroad in more stable currencies as they diversity away from a dollar that is likely to crash. Also, much of this money has likely been put straight into commodities oil, gold, metals, gems as a hedge against inflation and the declining dollar. So the printed money has found its way into exactly what the US government did not want it to go into. Its creating another asset bubble with unstable foundations.

Unintended Consequences: Regrettably as this phantom money has made oil prices sky-rocket, this will then put further pressure on the US balance of payments because oil import costs have sky-rocketted. This in turn will lead to inflationary pressures building and this could then see interest rates rise, debt payments rise and a whole new round of bankruptcies and home repossessions as businesses and households struggle to pay off their debts. Obama is frankly clueless on economics and the US Treasury is leading him into a very dangerous place. The Chinese have started shifting out of the dollar. OPEC are likely to want to see oil priced in a basket of currencies if this happens the dollar would then not be the global standard and there would be a further run on the dollar.

The Truth: Surely the US administration can predict that flooding the market with dollars will lead to a decline in the dollar, therefore an increase in oil prices, increase in speculative commodities trades and hence an increase in deficit. It's basic mathematical common sense. Furthermore, they must realise that a decline in the value of the dollar upsets t he OPEC member countries and that they will then want to get their own back by restricting oil supply to get the equivalent (or more) value back in real Euro, Swiss Franc of Yen currency terms.

he OPEC member countries and that they will then want to get their own back by restricting oil supply to get the equivalent (or more) value back in real Euro, Swiss Franc of Yen currency terms.

Reserves: We believe the OPEC oil reserves are about 40% overstated. We also think the claimed spare capacity of 5 million barrels of oil per day is more like 2 million barrels a day. 2011 oil demand is expected to rise about 1.5 million barrels a day. As you know from all our previous Special Reports oil production is not rising. Peak Oil (crude oil production) was 2005 and Peak Oil (all liquid oils) was July 2008. Production levels are unlikely to increase from these levels. So this means, if demand increase and production is not able to increase - prices have to go up to cause demand destruction. That's why we think shares of small to medium oil companies are set to rise strongly following the oil price high - until the next recession kicks in. OPEC compliance to cut instigated late 2008 is about 60% - they claim the markets are well supplied with oil but prices keep running higher. It will be the same old finger pionting exercise we saw end 2007 and early 2008 - OPEC blaming speculators and western nation politicians blaming OPEC for not producing enough (holding back). The truth is probably somewhere in between. In a way it doesn't really matter - the key thing is, cheap oil is scarce, expensive oil is here to stay and oil importing nations better get used to conserving oil as a valuable versatile commodity that is the lifeblood of economies (plastics, building materials, drugs, computers) - rather than something one burns to propel vehicles and fuel airlines that transport people away from your country and spend their money in other places.

Absurd Taxation: What we find incredible is that workers in the UK are taxed 75% on petrol - for car they need to get to work in (on top of a 50% tax on oil producers in the North Sea). But if you take a plane and use far more fuel to travel an equivalent distance, the tax is about 5%. So peo ple are penalized for going about their business of working - but encouraged to travel vast distances burning huge quantities of CO2 in the process of a rapidly depleting resource - so they can then go on holiday and spend their money in someone else's country! Its about time the UK government got real and started taxing aviation fuel at the same rate is petrol (or higher rate). Or use increases in aviation tax to reduce petrol tax. Especially as the UK hardly imports any oil - so why do we are pay 87% tax on our petrol but almost no tax on airline travel? At least the current government have no intension of building another runway at Heathrow - this would likely become a white elephant when the ravages of Peak Oil hit in a few years time. Any oil price over $100/bbl makes airlines uneconomic and many will go bankrupt when prices rise over $120/bbl because they use such massive amounts of fuel per person per flight.

ple are penalized for going about their business of working - but encouraged to travel vast distances burning huge quantities of CO2 in the process of a rapidly depleting resource - so they can then go on holiday and spend their money in someone else's country! Its about time the UK government got real and started taxing aviation fuel at the same rate is petrol (or higher rate). Or use increases in aviation tax to reduce petrol tax. Especially as the UK hardly imports any oil - so why do we are pay 87% tax on our petrol but almost no tax on airline travel? At least the current government have no intension of building another runway at Heathrow - this would likely become a white elephant when the ravages of Peak Oil hit in a few years time. Any oil price over $100/bbl makes airlines uneconomic and many will go bankrupt when prices rise over $120/bbl because they use such massive amounts of fuel per person per flight.

It Will Note Be Stable: Many investment banks are now predicting rising oil prices through 2011 and into 2012 and 2013, in a nice straight line. But lets face it, they are hardly going to predict oil to rise then crash - because they will be the first to want to get their money off the table - before or whilst the crash happens - they are paid to be "ahead of the game". All small private investors take note - yes, there will be an unstable increase, but then it surely will crash back again when the next recession starts. Why would it continue to rise in a nice controlled predictable way? Who are the investment banks trying to kid? Well, at least hats of to them for being honest and predicting an oil price increase.

Short Term: What all this means is that:

· Oil prices will rise

· Food prices will rise

· The dollar will decline

· House prices will rise a little early in 2011 then could crash again late 2011

· Stock prices will likely rise strongly from January 2011 to early May 2011 then probably crash in phases probably three big down-legs over a six month period

So watch out in 2011 it will all look benign and stable up until May 2011 then without warning we think it will implode. Another trigger event will be blamed - but the underlying cause will be the lack of ability to pay high oil import and energy bills. Best put stop orders in to prevent loosing too much when it goes into a big downswing just before the summer holidays. Remember the last global crash was blamed on the collapse of Lehman Brothers - but we think it was because of broadly high oil prices at the end of a speculative credit bubble.

Head for the Hills:  Many wealthy babyboomer investors will likely think this is their last chance to make serious money before retiring and they should want to pull all their money off the table by 1st June 2011 then put their feet up for nice summer holiday and leave the mess behind. They will head for the hills. It's a phantom bubble that will quickly pop.

Many wealthy babyboomer investors will likely think this is their last chance to make serious money before retiring and they should want to pull all their money off the table by 1st June 2011 then put their feet up for nice summer holiday and leave the mess behind. They will head for the hills. It's a phantom bubble that will quickly pop.

After The Crash: After the crash, there will be many good opportunities but it will take time to stabilize at a low level. The key message is watch the oil price like a hawk it will tell us what part of this short cycle we are in. Then get out before oil reaches $150/bbl because the western world cannot afford these prices and at this level most oil importing nations will drop into recession again and banks will start to fold plus some governments will default on their debt payments.

Interest Rates: What we haven't yet addressed is, after the next crash, what interest rates will be. There is a body of thought that these could actually be very high since no credit will be available after governments default on their loans. The last time in mid 2008, base rates crashed to 0.5% (albeit mortgages only came down to 5%, a whopping 4.5% premium for the banks). The next time, base rates may drop to 0.5% but loan rates could be 10% because of a massive shortage of cash in the system. It's possible governments will start to default in a contagion effect that could lead to a general meltdown of the global financial system. The biggest risk for residential property investors would then be mass unemployment and rental demand dropping (or defaulting renters) - that could then lead to cashflow problems in the medium term. This without the more obvious crash in asset prices and possible negative equity. So be careful not to over-stretch - and have plenty of cash in reserves - because it could all go pear shaped in a matter of six months if oil prices rise strongly over $100/bbl.

| UK and US | Oil Price $/bbl | Risk | GDP |

| Property prices strong | 55 | Low | 4 |

| Property prices drift higher | 70 | Medium-Low | 3 |

| Property prices stagnate | 85 | Medium | 2 |

| Property prices drift down | 100 | Medium-High | 1 |

| Property prices fall sharply | 120 | High | -1 |

| Property prices crash | 140 | Very high | -3 |

Euro: Any oil price over $120/bbl should lead to debt default in Greece and Portugal, and possibly Italy, Spain and Ireland and the partial or full collapse of the Euro currency.

We Are The Optimists: This is coming from us some of the most optimistic people around! Be careful. Dont trust what you see. Make sure you get at least half your money off the table before the western US lead oil importing world goes broke at $150/bbl.

We hope you found this Special Report helpful in giving some insights into what is likely to happen in 2011 - to help you protect your wealth and portfolio. If you have any comments, contact us on enquiries@propertyinvesting.net

"Bumping Along an Undulating Peak Oil Plateau"

"Bumping Along an Undulating Peak Oil Plateau"

Iran

Gas Prices Rising

US Trucks - huge gas guzzling cars averaging same 25 mph as Model T Ford in 1910 - 100 years ago

Artic Oil - too expensive, too late, to difficult - with environmental pressures

Oil Investment Boom Kurdistan - Meydanke lake region

Beautiful Kurdistan - investment hot-spot