367: Oil price, 3/11/11 and outlook

03-06-2011

.net team

.net team

· Peak Oil production was 2005 for crude oil – from our analysis dating back to June 2007

· Peak Oil production was 2008 for all types of oil – most likely – based on our analysis dating back to June 2007 – we considered it possible this could rise slightly above the previous high July 2008 when we reviewed this late 2010, but this now seems increasingly unlikely in view of the disruptions to oil flows from North Africa and the Middle East

· Global oil demand grew 2.7 million bbls/day in 2010

· Global oil demand is expected to grow 1.7 million bbls/day in 2011

· China is growing its strategic reserves by 0.6 million bbls/day through to 2020

· India is growing its strategic reserves by 0.15 million bbls/day through to 2015

Little or No Spare capacity: All countries are producing at maximum rates we believe – except for Saudi Arabia. But we dispute Saudi’s ability to raise production – by their claimed 5 million bbls/day. Even if they could do so, they would not. They would rather produce the oil later for use by themselves or when the oil price is higher. Also, the oil is medium-low quality, and the production losses in Libya are high quality (38 API Bent equivalent blends). Refiners want and need higher quality on sour light crude oil.

Little or No Spare capacity: All countries are producing at maximum rates we believe – except for Saudi Arabia. But we dispute Saudi’s ability to raise production – by their claimed 5 million bbls/day. Even if they could do so, they would not. They would rather produce the oil later for use by themselves or when the oil price is higher. Also, the oil is medium-low quality, and the production losses in Libya are high quality (38 API Bent equivalent blends). Refiners want and need higher quality on sour light crude oil.

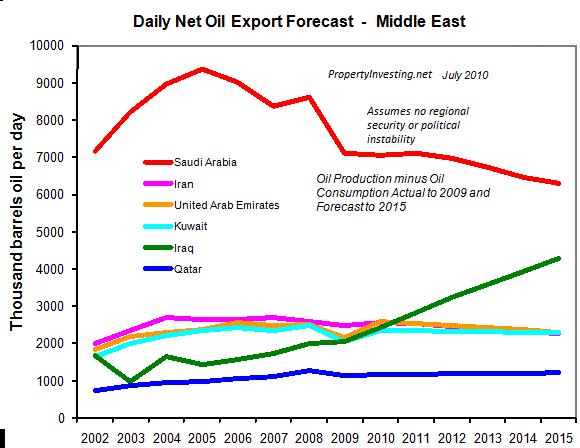

Saudi Oil Analysis: Our analysis of oil exports (that's production minus national consumption) shows Saudi oil production rising to close 10 million barrels a day by end 2015 - but interestingly the exports decline. The reason is simple - consumption is sky-rocketting by >8% a year as the massive population explosion and increasing electricity usages sucks away ore oil from exports. If anything, this forecast is optimistic. There is a real chance Saudi will cut exports still further because they will need the oil themselves. the good news is, we expect Iraqi oil production to rocket - and its only Iraq that will stem a serious decline in global oil production.

Note: We dispute the dark blue numbers - Saudi Arabia is more likely to have 1-2 million bbls/day spare capacity only, of which this is not likely to be flowed (unless oil prices rose to say $200/bbl)

Demand Destruction: Unless their is demand destruction by either higher oil prices and/or a recession in the "west", then oil prices will rise higher even without further Middle East turmoil. But there are massive threats – one or more of which will likely lead to oil shortages in 2011:

· Saudi Arabia – Shiite uprising in the eastern oil province (close to Bahrain)

· Iran – the current OPEC President and a wildcard with its regional strategic ambitions, nuclear power programmes and dislike of Israel

· Nigeria – elections in April 2011 could destabilize oil national production

· The Tunisian Black Swan contagion could spread from Egypt and Libya to Algeria, Oman, Yemen, Saudi, Kuwait, Qatar, Iran and other big oil exporters

· A broader regional conflict could begin if new governments gang up against Israel, or sectarianism reared its ugly head

Black Swan: Overall – as you can see the risk levels have shot up triggered by Tunisia and indeed it now looks like a Black Swan as we thought it could be back on 17th January this year.

11/3/11 (or 3/11/11): A critical day to watch out is Friday March 11th 2011 – that’s 11/3/11 – a day or rage in planned in Saudi Arabia. If violent demonstrations break out – and it looks likely the House of Saud could topple – then all bets are off for both the oil price and global economy. To put it into prospective, if Saudi oil production is disrupted, oil prices would skyrocket in short order well over $200/bbl and inflation would become rampant globally. This would then almost certainly lead to a financial and sovereign debt crisis in Euroland and possibly even the USA. It could be a seminal moment in the history of global capitalism. We will know by 4pm UK time that day. If the protests are peaceful, no issue. But if there is a widespread violent uprising – then expect oil prices could sky-rocket. Then the only stocks that will be going up are oil and mining stocks – for a short time anyway.

Crash on the Cards: We still maintain their is a high chance of a general stock market crash by end April 2011 – in 5 weeks time. At oil prices over $100/bbl – make no mistake, western developed nations cannot afford these price levels because their deficits simple rise to well over -13% - this makes such countries like Italy, Greece, Spain and possible even the USA unviable economically and they will crash into recession. Oil prices would follow suit at this point, but not until another recession is confirmed.

Debt Default: Also note that, in our view, the USA and much of the European mainland is already in recession – it’s just that no-one has noticed yet or told us. The GDP numbers in April-May then over the summer should confirm this. Western governments are in total denial of the extent of the problems cause by Peak Oil – and mid 2011 will be like mid 2008 all over again except this time it will be sovereign debt crisis following on from the government’s bad debt, after bailing out too many failed banks with taxpayer's money.

Printed Money, Debt, Payments: The other serious consideration is that in the next few years – because the Obama Administration has printed $2 Trillion – many overseas nations will want to switch away from the US dollar as the reserve currency. There has already been discussion of pricing oil in a basket of currencies after the dollar was allowed to drop in value 2010 - but instead for now OPEC has merely gone slow on raising oil production rates to get revenues back in price rather than currency value. After all, if the USA cannot service its debt after the mammoth $12 Trillion spending spree (yes, that's the size of the US debt mountain) - why would any sane person want to tie their money up in dollars? It’s a historic legacy based on the USA having large oil reserves, military strength (“policeman of the world”), the biggest world economy and massive consumption. But now the global world is changing – and if there is a major flight away from the dollar – then the US living standards could drop by 25% as all their import costs increase. It really is a very bleak picture for the USA because they can hardly afford to service their current debt, never mind future debt projections. Why would anyone want to lend the US more money? And why would they want to invest in dollars when the Obama Administration continues to print money to dilute it’s value? It’s like a company that makes a massive -15% loss each year (as a proportion of their revenue), then does a rights issue asking for more money at the end of each year. One day, the investors will vote with their feet, especially if oil is priced in a basket and the USA shows no global security or military leadership and/or support.

Not Enough Revenue: The current tax revenues of the USA are $1.75 Trillion but the government spends $2.75 Trillion and their debt is $12 Trillion. If the dollar drops, inflation rises and interest rates rise, then the USA will not be able to service this debt and will likely default – yes, we are serious – there is a chance – a not insignificant chance – the USA could default in the next few years – particularly if oil prices rise, inflation rises, interest rates rise and foreign investors get cold feet – all things that on the face of it seem likely. It's an accident waiting to happen, regrettably cause by uncontrolled public spending and printing of money by the current administration. Governments like to blame the bankers and their bonuses, but average public sector wages in both the USA and UK are higher than private sector wages - and the difference has increased dramatically in the last ten years. No other country in the world but the USA could get away with printing money – its only off the back of “goodwill” and “trust” but this is starting to wane or run out. Most of the printed money seems to have left the USA and is being invested abroad and also causing bubbles in commodity prices that then affect other countries economies. It looks like early 2008 all over again – but this time the bankers bonuses are bigger despite the governments bailing the banks out and the collapse will be government debt with the underlying cause "Peak Oil" (a nd China massive draw on oil stocks causing a demand-supply imbalance).

nd China massive draw on oil stocks causing a demand-supply imbalance).

Positioning: Because oil prices are so clearly point in one direction, of cause there is a degree of panic setting in. All national governments are thinking if they don't stock up on oil supply, then they could lose out even further in the next few years. It's commonly known as "panic buying". There is probably also some speculative money pumping up the bubble - from the $2 Trillion of printed dollars - but just ask yourself, if you were a national government, would you want to buy oil at this time (or would you keep your fingers crossed and hop it comes back down again?).

Property: In the USA we expect property prices to continue to fall. In the UK we expect London to weather the storm better than most places and areas far from London that are more oil intensive to be the worst affected. Eastern Scotland is a likely except because o f its North Sea oil employment and successful oil and service companies in this region. Just don’t even consider buy property in Greece, Italy, Spain or Ireland because these countries might have to leave the Euro at which time their currency values would plummet by 20-50% - to enable them to become competitive. Yes, this is a serious possibility – we would rate this a 50% chance sometime in the next 2 years –with chances increasing every time the oil price rises further.

f its North Sea oil employment and successful oil and service companies in this region. Just don’t even consider buy property in Greece, Italy, Spain or Ireland because these countries might have to leave the Euro at which time their currency values would plummet by 20-50% - to enable them to become competitive. Yes, this is a serious possibility – we would rate this a 50% chance sometime in the next 2 years –with chances increasing every time the oil price rises further.

Downbeat: We wish we could be a little more hopeful or upbeat, but frankly, the situation is now critical and all our eyes are now on March 11th 2011 to see what happens. Fingers cross – it will be okay. But our gut feeling is regrettably – it will be the real tipping point.

If you have any comments, please contact us on enquiries@propertyinvesting.net

If none of the above work, we can just pray for oil or energy or whatever is needed to keep the world going.