368: Current situation update

03-12-2011

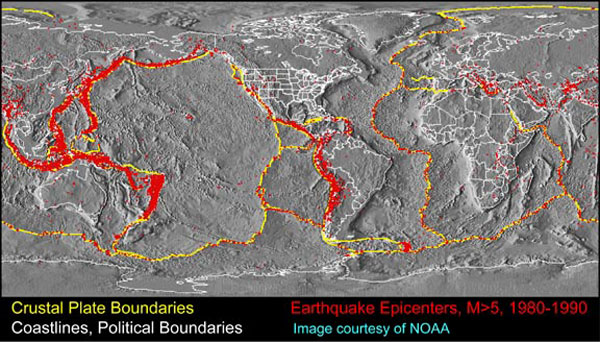

Earthquake - not "Day of Rage": The show keeps on the road for a while longer. The Day of Rage 11/3/11 was a non event but replaced instead by a gigantic earthquake in Japan and Tsunami a natural rage. Its been very distressing seeing the extent of the mortality and damage. The tragic event highlights the risks of living in an earthquake zone and it's only through incredible engineering solutions that all the buildings did not fall down from the initial shock - buildings in Japan are generally "earthquake proof". Otherwise the death toll would have been ten times higher.

Earthquake Map

When one looks at the market reaction, we can only wander about when this economic bull run will end. Hedge funds initially sold the Yen then drove the Yen higher as they predicted new inflows of money back home to the Yen will be required to build the north-eastern coastal part of t he country again. Oil prices dropped because of the oil refinery fire and a hypothesis that Japanese oil demand would drop.

he country again. Oil prices dropped because of the oil refinery fire and a hypothesis that Japanese oil demand would drop.

Libya: Meanwhile the Libyan civil war looks more protracted and engrained by the day. For the rebels it's a win or die situation. For the loyalist forces it could be similar. Both sides seem to have too much to lose now most distressing and it looks likely to lead to the partition of the country or the loyalist winning back control in a brutal manner.

Investors: Overall, these events do nothing for global investor confidence. But one of the key concerns of property investors is now the end of the US printing of money (politely known as "quantitative easing") on 30th June 2011. If no further money is printed, an d budget cuts are enacted expect the following to happen:

d budget cuts are enacted expect the following to happen:

-

Interest rates rise and with it borrowing rise

-

Stock market drops

-

Company profits drop

-

Savings rates rise

-

Conversion of stock/equity (risk) to cash (savings)

-

Unemployment rises

-

Growth slows

-

The dollar may stabilizes, or decline further if debt default risk rises

Printing Money: Overall for the USA is a pretty bleak picture. The USA cannot afford to print any further money. Only 30% of the printed money is actually bought by private or international institutions 70% is purchased by the Treasury. The demand for dollars is likely to d rop over time further as other currencies gain attractiveness in part because the $12 Trillion of US debt is just so gigantic and the debt payments are prohibitively high. Remember that the public sector budget is $2.75 Trillion in 2011, whilst tax receipts are $1.75 Trillion a net deficit of $1 Trillion per annum. Thats about $3500 per person per year ($14,000 for a family of four). Thats a massive ongoing deficit and if the global markets loose trust in the dollar in part because it is being devalued by the printing of money, then interest rates will sky-rocket and debt default could be just around the corner. The way the US economy is being managed is far from ideal to put it very mildly. We continue to have grave reservations about whether the US economy can continue to grow with such huge debt overhangs, massive oil import bills and gigantic military and healthcare spending.

rop over time further as other currencies gain attractiveness in part because the $12 Trillion of US debt is just so gigantic and the debt payments are prohibitively high. Remember that the public sector budget is $2.75 Trillion in 2011, whilst tax receipts are $1.75 Trillion a net deficit of $1 Trillion per annum. Thats about $3500 per person per year ($14,000 for a family of four). Thats a massive ongoing deficit and if the global markets loose trust in the dollar in part because it is being devalued by the printing of money, then interest rates will sky-rocket and debt default could be just around the corner. The way the US economy is being managed is far from ideal to put it very mildly. We continue to have grave reservations about whether the US economy can continue to grow with such huge debt overhangs, massive oil import bills and gigantic military and healthcare spending.

China Deficit: China is now running a monthly deficit off the back of reducing exports and rising oil import bills. Yes, China has a deficit! One wanders if there are any countries left that actually have a budget surplus? (Norway is one).

Resource Pressures: We cannot quite anticipate what will happen next. The underlying issues are:

· Peak Oil this was 2005 for crude oil and 2008 for all oils

· Population 7 billion rising to 9 billion by 2050 (the worlds population was 3.5 billion in 1960)

· Water and fertile land shortages many of the billions live in deserts and unfertile areas requiring oil dependant food imports a completely unsustainable situation

· Rainforests denuded the size of rainforests has halved in 50 years and may disappear within another 50 years

· Climate change this still seems uncertain and erratic but it seems likely the weather will become more extreme as the rainforests are denuded and many turn to desert or scrubland

120 years ago, few people lived in deserts. Now we have cities like Cairo that are 20 million in population gigantic growing cities in the desert build from concrete using vast amounts of energy to build, maintain and feed.

Technical Gains Small: Surely pressure on resources will increase over time, particularly if technical and efficiency gains cannot keep pace with demand. If input costs rise, and growth drops the living standard would likely drop in the developed world. They would still be quite capable of rising in the developing world. Much would depend on the population pyramid.

US Ponzi: Someone equated the printing of US dollars and the mushrooming of US debt as a sort of massive Ponzi scheme. One could also argue the increase in population is similar. The few older people cling to power and the money whilst the young get disaffected and start to riot the first signs are beginning to break out. The old world order is breaking down because:

· The US foreign policy is to let nations get on with whatever they need or have to do US military and security leadership has gone missing and the is no policeman of the world anymore (example inability to declare a no fly zone over Libya that helps the loyalist cling to power).

· Facebook, twitter, mobile phones and the internet have opened up communication lines for organised demonstrations and emboldened opposition to autocracies

· Peak Oil has escalated food prices causing hardship for the poor in overpopulated desert countries

· The older autocrats cling to the oil revenue no enough equitable sharing of wealth and jobs amongst tribes

Upheaval: The wave of unrest could create new stable democracies. But they could also lead to violent upheavals and civil wars. Israel and Iran lurk in the wings an unknown volatile mix.

Oil Price Drop Delaying Final Blow Off: Oil prices have dropped back again for a while but we expect this to reverse and the final bull blow-up to occur in the next six weeks. It will probably be before the 30th June when the printing of the money presses stop.

For all property investors i n the western world, be very careful because we think there will be:

n the western world, be very careful because we think there will be:

· Oil prices rising then crash

· Stock market stable then crash

· Interest rates rising just as there is a crash

· Depressing recession or depression by second half of 2011

The fact that oil prices have dropped back a little might delay things for a few weeks. But if interest rates rise as they have started to do, few people will be able to afford the new rates and defaults will start then banks we begin to suffer then topple as they did in 2008. Our gut feeling is the whole pack of cards will start to fall end April 2011 in a staged downswing a number of deep steps down as panic sets in. Anyone that has been visited our website for the past six years will know that we are the optimists and when we are sounding like this its time to start worrying.

Crash: Yes expect the final blow off up then a crash sometime in the next 6 weeks to 6 months.