375: Prepare for the stock market crash and recession this summer

04-17-2011

Human Nature: Humans have an amazing habit of thinking on the bright side, and assuming things will be fine. The people that have negative thoughts are normally ignored – or accused of being scaremongers. After all, it's easy to make negative predictions and if they don’t transpire, there is normally little or no recourse.

Conventional Views: The Bankers, Regulators and Governments – assisted by the mainstream media – like to finger-poin t and blame for previous crises. Classic examples are the banker bashing after the 2008 financial crisis and BP bashing after the Gulf of Mexico oil spill. Regarding the financial crisis, they like to give the impression that there was some group of people or some system to blame, that lessons have now been learnt and that it cannot happen again. In a way, its classic defensive behaviour from people in denial. Old fashioned and not exactly totally honest.

t and blame for previous crises. Classic examples are the banker bashing after the 2008 financial crisis and BP bashing after the Gulf of Mexico oil spill. Regarding the financial crisis, they like to give the impression that there was some group of people or some system to blame, that lessons have now been learnt and that it cannot happen again. In a way, its classic defensive behaviour from people in denial. Old fashioned and not exactly totally honest.

Objectivity: What we are now going to do is give our objective frank analysis of what we thing is going on behind the scenes – that the politicians either don’t know about, or know about but are ignoring and in any case certainly not telling investors and the general public. And that ultimately will lead to another recession and financial meltdown.

Complexity: It’s a complex web of opaque data, crisis through stealth and lack of realization of unintended consequences. Let us explain.

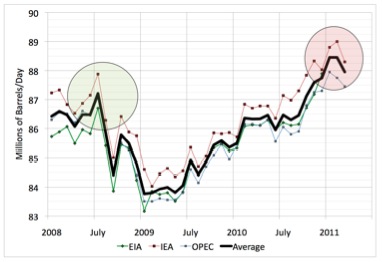

Peak Oil: Firstly, no-one in the government has acknowledged the elephant in the room – namely – that we reached Peak Oil back in 2008 (all oil liquids0 or 2005 (crude oil) albeit there appears to have been a short spike higher for all liquids in January 2011.

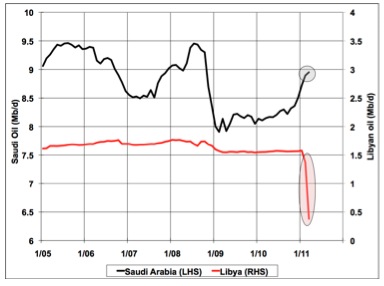

We’ve been on an undulating plateau since 2005 despite oil prices rising from $50/bbl to $147/bbl. Everyone always claims Saudi Arabia has 3 million bbls/day spare capacity, but we do not believe this and never have. We think after the 2008 oil shock, Saudi Arabia got a shock because it failed to respond to the oil prices rocketing – it had no spare capacity. So it increased it doubled its rig count and has spent the last three years desperately trying to boost capacity. But what happened when Libyan oil production was shut-down – they did not increase production at all (take a very close look at the chart below - Saudi did increased production from Dec 2010 though). Last month, their exports dropped by 0.3 million bbls/day. Does this make you worry – it sure should! What no-one knows is why Saudi reduced exports – was it because:

· There was no market for their crude at $120/bbl (unlikely)

· They were burning more crude for power generation as temperatures rose (possible)

· They were holding back production to boost prices (possible)

· They could not boost production because they were at maximum capacity, possible first signs of a natural decline (probable)

Saudi Arabian oil production and Libyan oil production from Oildrum.com

Saudi Arabia: When Saudi Arabia blame the oil speculators for driving up oil prices and say that the market is well supplied – it’s just possible that they are correct (see later dialogue). But our intuition would advise that Saudi is at maximum reasonable production rate at this time and again are unable to respond to oil prices sky-rocketting due to insufficient supply (tightening between supply and demand).

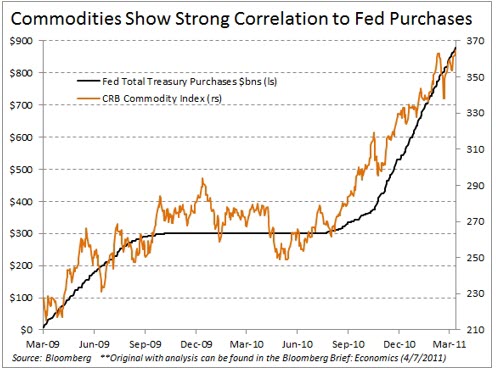

Printed US Money: Secondly, President Obama and Ben Bernanke have done the following:

· Printed $2 Trillion of money and driven up money supply

· The money has not been used for inward US private sector investment – instead it has been used by speculators (or investors) to buy commodities as the most obvious commodities bull run stares experienced investors in the face. Banks have maximised returns by trading oil and commodities.

· The printed money and ultra-loose fiscal policy has driven down the value of the dollar which has made investments on oil more attractive as a hedge against inflations. Meanwhile, OPEC are furious that their oil is traded in the weak dollar and because of this, some have been holding back oil production to keep prices high to get more income in local currency terms.

Quantitative Easing and Oil Bubble: The below chart shows the almost perfect correlation between the printed US money (QE2) and the commodities price index rising. Please note that Quantitative Easing (or printing money) is planned to end 30th June 2011. If this happens, we expect US interest rates to skyrocket, stock markets to crash and oil prices to crash. Please also note the US Fed will announce confirmation on 27 April of when it intends to stop QE2 (and even a possible further QE3 programme). If QE3 commences, expect oil prices to continue to rise, but the crash to be more severe when QE3 ends. Simple isn't it!

Vicious Circle: As one can see, its like a vicious circle – OPEC, currency, printed money, commodities speculation – these have all acted in one direction to drive oil prices higher. The conventional wisdom would suggest th is would continue – because people from governments, IMF, publically quoted companies and media see the global economy coming out of the recession. We think this vicious circle is the unpredicted unintended consequence of the US monetary policy. It seems the lessons from 2008 have not been learnt because a very similar thing happen then as well – namely lose money, commodities bubble, then crash and banking crisis. The only difference this time will be the crisis will be at the top level sovereign debt default in many western oil importing countries.

is would continue – because people from governments, IMF, publically quoted companies and media see the global economy coming out of the recession. We think this vicious circle is the unpredicted unintended consequence of the US monetary policy. It seems the lessons from 2008 have not been learnt because a very similar thing happen then as well – namely lose money, commodities bubble, then crash and banking crisis. The only difference this time will be the crisis will be at the top level sovereign debt default in many western oil importing countries.

Recession When Oil Over $120/bbl: This is also where was differ from the conventional view. You see, any oil price above $120/bbls leads to recession. This is when oil imports as a percentage of GDP reach about 5% in oil importing nations. Just remember – in 2008, the oil prices spiked quickly to $147/bbl during a long stable economic growth period and we think this was the key reason for the recession as inflation took hold and interest rates rose beyond people’s means. In the UK, the oil price at $122/bbl is now higher than in mid 2008 in UK Sterling terms (because Sterling is worth less). And oil prices have risen less sharply hence having a greater longer term economic impact. Why do people think Europe and the USA will escape recession this time when public sector spending is being cut, private business is far more fragile and government debts are gigantic. It’s very scary stuff.

Paradigm Shift: Just like in 2 008 between May and October, almost precisely three years later there will be another massive shift in thinking. Let's be frank and admit the only reason why the global economy got out of the 2008 recession was because trillions of dollars were printed and ten years worth of debt was raised in 2 years - another bubble was created out of thin air - whilst the Chinese economy continued motoring onwards. China's massive draw of all commodities has created resources constraints for the West - there's not enough oil, gas, coal, wood and food to go around - hence prices have sky-rocketted. Something has to give. Businesses are only "doing well" because of low interest rates and the easy printed money. What happen to the private sector when the printing presses stop and interest rates sky-rocket off the back of inflation that is out of control caused in part by this "Chinese demand pull". Surely - logically - there will be a period of realization that company and personal incomes will drop, a stock market and oil price crash?

008 between May and October, almost precisely three years later there will be another massive shift in thinking. Let's be frank and admit the only reason why the global economy got out of the 2008 recession was because trillions of dollars were printed and ten years worth of debt was raised in 2 years - another bubble was created out of thin air - whilst the Chinese economy continued motoring onwards. China's massive draw of all commodities has created resources constraints for the West - there's not enough oil, gas, coal, wood and food to go around - hence prices have sky-rocketted. Something has to give. Businesses are only "doing well" because of low interest rates and the easy printed money. What happen to the private sector when the printing presses stop and interest rates sky-rocket off the back of inflation that is out of control caused in part by this "Chinese demand pull". Surely - logically - there will be a period of realization that company and personal incomes will drop, a stock market and oil price crash?

Only After The Event: Normally, its not possible to see a country has dipped into recession until after its happened – about 4 months after or more. We think the UK, US and other European countries from May onwards will be in recession. But the cat will not get out of the bag until August. At this time or before, the stock market will crash - it's likely to start dipping in May - in 2-3 weeks. There is so much tax revenue and stock market equity vested in future company profits growing that there will be a gigantic correction when people realise another recession in western oil importing nations has started. At this time, either shortly before or after, the oil prices will crash as well. Probably back down within 3 month to $70/bbl.

Stock Massive Correction – The Bubble Pops: This will all happen someti me within the next 3 weeks to 5 months – that is our prediction. Realistically the FTS100 should drop from 6000 to 3800 sometime before the end of year in three big stages. And the Dow from 12000 to 9000 or lower.

me within the next 3 weeks to 5 months – that is our prediction. Realistically the FTS100 should drop from 6000 to 3800 sometime before the end of year in three big stages. And the Dow from 12000 to 9000 or lower.

Property Prices: Property prices will continue to slowly drop in all UK areas apart from London. In London, there could be a brief dip caused by the stock market crash, but lots of international money flooding in will likely provide a fairly good floor for mid to upper end properties. Lower end would likely suffer the most and be most exposed to house price drops.

Summer Blues Again: Anyway, we’ve set out our rational for a major stock market drop or crash this summer. This being regardless of the troubles in North Africa and the Middle East, which could make matters even worse.

Liquidate: We think investors should liquidate as much as possible as soon as possible into cash. And make sure you put your cash into a safe bank – one that will not fold after the crash. Norway and Switzerland spring to mind.

possible into cash. And make sure you put your cash into a safe bank – one that will not fold after the crash. Norway and Switzerland spring to mind.

Default: Just consider this – when the governments default on debt, what happens? Who pays? Will you be able to get your money out? It’s possible everyone’s savings will be cut in half, wages will drop, jobs will be lost and a major re-structuring could happen. It’s just a good job the UK government has started the cuts already and have a reasonably credible plan, and the UK does not import much oil and gas. Our hearts go out to Greece, Portugal, Ireland, Spain and possibly Italy (in that order) that have no oil or gas production to speak of, no manufacturing power, no nuclear power, no financial services global acumen and aging populations with massive budget deficits. Most had building booms up to 2007 that went bust.

US Deficit Projections - "assuming not further recession and GDP growth ~3% per annum"

As oil prices have risen, these countries have got to a point where they cannot afford the oil and gas imports anymore – and debt default is almost certain with oil prices over $120/bbl. The bottom line for most of these countries is – their tax receipts don’t pay for more than 65% of their spending – an accident waiting to happen. They should double tax in consumer petrol because their massive oil usage is what's doing the most damage - they cannot afford to keep so many cars burning around. Surely this will eventually lead to the break-up of the Euro as a common currency, and at this point mainland European stock markets will drop at least 30%.

Help! We hope you have found this Special Report helpful – in flagging the risks in the coming months. If you disagree with our synopsis or have any different view, please contact us on enquiries@PropertyInvesting.net . We like to calibrate ourselves – in case we have missed something important.