402: Debt Collapse As Interest Rates Rise - Money Printing and Gold

11-17-2011

Debt Problem Only Just Started: Make no mistake, this European debt problem is not going to go away. It’s a slow collapse that is taking years. Essentially - for years there was fast GDP growth as the southern Mediterranean countries expanded rapidly during a period of low oil prices, benign inflation expectations and Eurozone integration – this is now being undone as the Germans have seized a competitive export lead and manufacturing advantage and these peripheral Eurozone countries can no longer afford high oil and other commodities import prices. It’s the effects of Peak Oil being felt – no, oil is not running out, it’s just becoming scarcer. Note that even though we are in a slow growth period, oil price s are above $100/bbl. This is all so predictable – regrettably we’ve been warning about this for the last 5 years. This is the key reason why we have advised not to invest in Spain, Italy, Greece, Portugal and Ireland for the last 5 years. The reasons are:

s are above $100/bbl. This is all so predictable – regrettably we’ve been warning about this for the last 5 years. This is the key reason why we have advised not to invest in Spain, Italy, Greece, Portugal and Ireland for the last 5 years. The reasons are:

· Declining and aging populations

· Gigantic oil, gas, energy, coal and commodities import bills

· Uncompetitive manufacturing

· Shackled by one Eurozone currency and interest rate

· Countries are not world leaders in financial services

· Large debts, large deficits, with increasing debt due to Peak Oil effects

For the investors, it’s pretty clear the only way the European Central Bank will be able to turn shortly is toward the money printing presses. To pro p the whole lot up and try and kick the can down the road.

p the whole lot up and try and kick the can down the road.

Is The Dollar A Safe Haven? Many investors will think they are wise to switch to the dollar as a so called safe haven, but they will be wrong. The reason is, the US debt issue is even worse than the European debt issue. And the political governance is so bi-partisan that things have ground to a halt. The Americans have been printing money for years. They claim to have inflation at 1% (CPI) but canny investors all know it’s more like 10%. That’s one reason why so few people are saving – rates are at 1%, whilst inflation is more like 10%. So if stock prices rise by 10%, at least it covers inflation, and one might get a dividend in return.

US Default = Gold Prices Rise: Our key messages is that, despite talk to the contrary, the US will default eventually as will many peripheral European countries – and/or they will just keep printing money until hyper-inflation starts. The dollar will get a massive hair cut one way or the other – there is little real difference for the investor. In the former scenario – it’s a slow default, and in the latter scenario, it’s a quick default. But in both scenarios, gold prices rise. The only sure way to protect your wealth during this crisis is to buy gold.

Silver Upside and Risk: For investor that like to take more risk, silver has the greater upside, but silver is susceptible to a severe manufacturing downturn, so it’s probably best not invest any more than half of your precious metals portfolio in silver, just in case manufacturing tanks in a global depression, and silver prices tank with it.

Governments Collapse As Interest Rates Skyrocket: As we know, firstly Greece’s interest rates rose well above 7%, then Ireland’s, and Italy’s and now Spain’s. Each country is having a new leader – intent on trying to stem the collapse. But the rot set in years ago – the message is – with giant government debt, any interest rates set by the market at 7% or more on short term borrowing sends the country into default (or bail-out mode). France is likely to be next. The only way to stop the rot is a gigantic bail-out using printed money. And this will cause inflation.

US Is Next: So we ask you – why don’t you think this will happen to the USA, since they have a similar percentage deficit to all these countries and their forward looking liabilities (healthcare, military, pensions) are far high per person. The official US debt is $15.1 Trillion but the debt including liabilities is $75 Trillion. The USA is already bankrupt and it’s only the printed money that is saving them from default as this props up the bond, stock and other markets. Whether there is a run on the US bond market and dollar later this year, in 2012 or 2013 we really don’t know, but we are almost certain it will happen. It could coincide with the US Election end 2012 or just be a contagion from the Eurozone collapse– although Bernacke will want to print as much money as possible just before the election to make it look as if the economy is performing well – his only chance of retaining his job is if President Obama gets back into power. Ben will definitely get the boot if the Republicans get into power – who in their right minds would want such a disaster to reside over the next 4-5 years of economic recovery. Greenspan did not exactly help the debt situation, but Bernacke has been an absolute disaster – he only knows how to print money and all his projections have been wrong.

Lots of Money: As this wave of printed money sweeps through the world – dollars, pounds and Euros – inflation will rise further and gold prices in our view will sky-rocket.

Correction Shakes A Few Investors Out: The gold price correction of today 17 Nov – from $1780/ounce to $1710/ounce is just a few investors selling their gold positions to pay for calls and short positions in the stock market. As the crisis develops further, gold prices will shoot well over $2000/ounce. As investors sell down stocks and reduce investments, they will shift more and more into gold as panic sets in.

Central Banks Buying gold: Developing countries with budget surpluses are now trying to buy as much gold as possible before it gets too expensive. China, Brazil, Mexico, Qatar, Saudi, Kuwait, India, Russia – they are all at it. They know the US strategy is to debase their currency. Italy and Spain may be forced to sell some of their gold – this would be a disaster of course – but poor financial management could lead them to this ultimate penalty – “hand over your gold you loser”. China’s strategy is to amass as much gold as possible – along with oil. One day – as the debt bomb explodes – there will be a gigantic transfer of wealth – through gold – to China, India and the Middle East. This is another reason why whenever gold drops to about $1700/ounce it sees strong support – the same for Silver at $30/ounce – central banks step in and start buying cheap precious metals – who can blame them. Our strategy is to not just sit back and watch this happen – it’s to get as much gold as possible before it all disappears at reasonable price for good. We think gold should really be trading at $6000/ounce simply because the dollar is pretty close to worthless according to our analysis and projections for 2012.

buy as much gold as possible before it gets too expensive. China, Brazil, Mexico, Qatar, Saudi, Kuwait, India, Russia – they are all at it. They know the US strategy is to debase their currency. Italy and Spain may be forced to sell some of their gold – this would be a disaster of course – but poor financial management could lead them to this ultimate penalty – “hand over your gold you loser”. China’s strategy is to amass as much gold as possible – along with oil. One day – as the debt bomb explodes – there will be a gigantic transfer of wealth – through gold – to China, India and the Middle East. This is another reason why whenever gold drops to about $1700/ounce it sees strong support – the same for Silver at $30/ounce – central banks step in and start buying cheap precious metals – who can blame them. Our strategy is to not just sit back and watch this happen – it’s to get as much gold as possible before it all disappears at reasonable price for good. We think gold should really be trading at $6000/ounce simply because the dollar is pretty close to worthless according to our analysis and projections for 2012.

Can You Retain Your Wealth? It will eventually be a case of those that lose everything and those that manage to retain their wealth – or lose the least. If you have made a lot of serious money in this dollar inflation bubble economy, why would you not take it all off the table in a panic-collapse and put it into something you know can never even come close to being worth zero – namely gold. Even if it dropped 30%, you’d still have 70% of your wealth left. But instead it’s likely to double in price as this western debt collapse takes hold.

Collapse Started in 2000: The routes of the collapse were in 2000 at the end of the last stock market bull run when the western stock markets crashed after the dotcom boom and bust. The Y2K and Internet bubble. Rather than re-adjust, Greenspan left interest rates at very low levels for years fuelling a gigantic private debt fuelled housing boom in the USA and Europe. The money bubble lead to inflation in the oil price as Peak Oil (crude oil) was reached in 2005. Tightening of the oil markets through to 2008 led to oil prices rising from $9/bbl in 1999 to $147/bbl in July 2008, before the private sector financial collapse. It was oh so obvious what would happen next – firstly public sector growth paid for by printed money. Then a realisation that the public sector had just got too big to pay for – more printed money then jobs loses and higher public sector or government debt. Interest rates could be held close to zero as money was printed – but this started to change in Greece, Spain, Italy and Ireland as higher import costs and small exports led to stubbornly high deficits. Governments collapsed, demonstrations became widespread as debt contagion crept through Europe.

Desperate Government - Tobin Tax: When the political elite start to get despar ate, they normally start shooting themselves in the foot. The classic recent example in the UK was raising North Sea taxes without even liaising with the Energy Minister never mind the oil industry - for a measly gain of $2 Billion per annum to offset a miniscule 2p per litre - something that evaporated within 2 weeks aft oil prices rose 10%. Within six months from the shock tax hike in March 2011, $20 Billion of investments had been cancelled or deferred. Drilling rates crashed to 60% of their former levels. Gas production crashed 8% and oil production 8% within 8 months. The Treasury is now on-track to extract less tax in 2012 than if it had not introduced this crazy oil tax. The other recent example is the likely introduction of the Tobin tax. All it means is hedge funds, investors and rich people will switch to Hong Kong - HSBC is looking to relocate from London to Hong Kong. It will drive business away and overall tax take will drop. Talk about shooting oneself in the foot. All for the sake of a few populist short term votes. With the introduction of such taxes, things look increasingly bleak for Europe. Another reason why gold is the best investment to switch to at present - and oil prices will continue to rise and supply and investment drops with increasing oil taxes.

ate, they normally start shooting themselves in the foot. The classic recent example in the UK was raising North Sea taxes without even liaising with the Energy Minister never mind the oil industry - for a measly gain of $2 Billion per annum to offset a miniscule 2p per litre - something that evaporated within 2 weeks aft oil prices rose 10%. Within six months from the shock tax hike in March 2011, $20 Billion of investments had been cancelled or deferred. Drilling rates crashed to 60% of their former levels. Gas production crashed 8% and oil production 8% within 8 months. The Treasury is now on-track to extract less tax in 2012 than if it had not introduced this crazy oil tax. The other recent example is the likely introduction of the Tobin tax. All it means is hedge funds, investors and rich people will switch to Hong Kong - HSBC is looking to relocate from London to Hong Kong. It will drive business away and overall tax take will drop. Talk about shooting oneself in the foot. All for the sake of a few populist short term votes. With the introduction of such taxes, things look increasingly bleak for Europe. Another reason why gold is the best investment to switch to at present - and oil prices will continue to rise and supply and investment drops with increasing oil taxes.

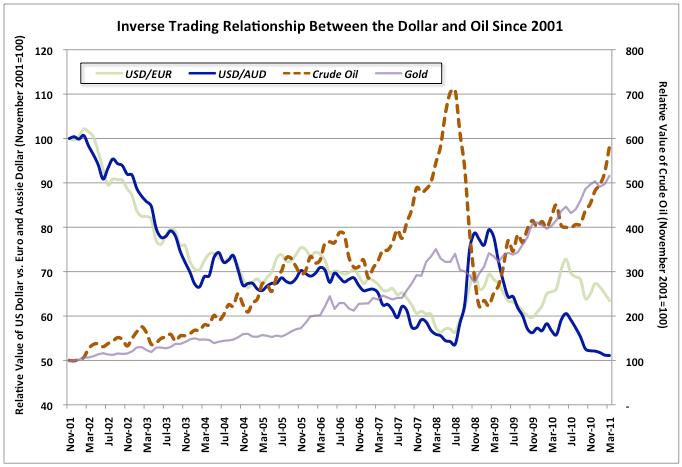

Continued Dollar Collapse: Just  to be very transparent, let's take a look at the US dollar value when compared to gold and the Australian dollar and oil in the last ten years. As one can see from the chart below, as the US dollar is continuously debased, it drops in value against real assets like oil and gold - along with the Australian Dollar (which is backed by its country's gold, coal, metals, oil and gas reserves and strong trading with China). There was a brief period of US dollar rise during the 2008 financial meltdown - only as a brief period of flight to the perceived safe haven - however, our view is that market next time will not view the US dollar as a safe haven, and the US dollar will continue to decline during the next financial crisis period - in part because the US now has an unsustainable $15.1 Trillion debt (and total $75 Trillion liabilities) - this will likely be the cause of this next big crisis. As one can see, the US dollar has halved in value compared with the Australian dollar in about ten years - that's frightening for the so called "reserve currency of the world". Meanwhile the value of gold has risen five-fold. Hardly surprizing as the Fed continues to print money with no foundation or gold standard measure.

to be very transparent, let's take a look at the US dollar value when compared to gold and the Australian dollar and oil in the last ten years. As one can see from the chart below, as the US dollar is continuously debased, it drops in value against real assets like oil and gold - along with the Australian Dollar (which is backed by its country's gold, coal, metals, oil and gas reserves and strong trading with China). There was a brief period of US dollar rise during the 2008 financial meltdown - only as a brief period of flight to the perceived safe haven - however, our view is that market next time will not view the US dollar as a safe haven, and the US dollar will continue to decline during the next financial crisis period - in part because the US now has an unsustainable $15.1 Trillion debt (and total $75 Trillion liabilities) - this will likely be the cause of this next big crisis. As one can see, the US dollar has halved in value compared with the Australian dollar in about ten years - that's frightening for the so called "reserve currency of the world". Meanwhile the value of gold has risen five-fold. Hardly surprizing as the Fed continues to print money with no foundation or gold standard measure.

Money Circulation Destroys Dollar: Since gold's last cyclic high of $850/ounce and silver's $50/ounce in 1980, the amount of dollars have increased ten-fold. So why wouldn't gold be $8500/ounce and silver $500/ounce at the end of this bull run? Also, at the end of the last cyclic high, gold was 7 times the Nasaq index (850 vs 153). Today the Nasdaq stands at 2575, therefore on  this ratio gold should be ~$8500/ounce at the end of this cycle if the Nasdaq crashes to 1500 at the end of the cyclic gold bull run. As more money is "produced" from thin air - as the Fed adds digits to their computer screen - then gold and silver will rise sharply from current levels. To believe different defies logic. And suggests currencies will gain in value against real assets - something almost impossible if fiat money is produced from thin air on an ongoing basis.

this ratio gold should be ~$8500/ounce at the end of this cycle if the Nasdaq crashes to 1500 at the end of the cyclic gold bull run. As more money is "produced" from thin air - as the Fed adds digits to their computer screen - then gold and silver will rise sharply from current levels. To believe different defies logic. And suggests currencies will gain in value against real assets - something almost impossible if fiat money is produced from thin air on an ongoing basis.

Real Crisis: The real crisis is now close. It will be when the market demands 7% for new US dollar debt rather than 2%. Realistically - the market will turn on the dollar eventually and when rates rise to 7%, the total tax receipts of the US will not be enough to pay for the interest payments on it's debt, and therefore the US will be to all intense and purpose bankrupt. This could happen in 6 months of 5 years - it's difficult to say. But most smart investors in their gut know or think this will happen - it's just they are not telling everyone. Because they want time to switch away from dollar assets to gold, silver, oil and safe haven assets. The hedge funds know this will happen - but don't expect them to go telling everyone!

Resource Nationalisation: When a commodities bull run starts, mining and oil companies become easy targets for governments who need cash - increases in tax - to pay for social programmes , attempts to reduce unemployment and debt payments. Many of the more socialist "popularist" governments will resort to siezing resource assets - or at least massively increasing taxes on them. Of course this just compounds the problem with high oil, gas and metals prices. Supply is even more constrained, prices rise even further and inflation rises still further. A vicious cycle is created with unintended consequences. Ultimately this normally leads to default or hyper-inflation. The table below summarizes this. And the picture below this is our diagramatic representation of the bull and bear markets - that normally last about 17 1/2 years. This is a key insight that all investors need to have instilled in their high end investment minds. Money is all in the mind - superior returns are in the mind - and this model will help you play the commodities bull run and avoid the stock bear run. Then time things perfectly to switch after commodities eventually crash - sometime in the next 4-8 years - into stocks again (and also out of gold and silver). But for now - its clearly inflation, oil, gold and silver all the way. With debt being deflated. Money and savings losing value. Real assets being the things to hold. Not currency.

, attempts to reduce unemployment and debt payments. Many of the more socialist "popularist" governments will resort to siezing resource assets - or at least massively increasing taxes on them. Of course this just compounds the problem with high oil, gas and metals prices. Supply is even more constrained, prices rise even further and inflation rises still further. A vicious cycle is created with unintended consequences. Ultimately this normally leads to default or hyper-inflation. The table below summarizes this. And the picture below this is our diagramatic representation of the bull and bear markets - that normally last about 17 1/2 years. This is a key insight that all investors need to have instilled in their high end investment minds. Money is all in the mind - superior returns are in the mind - and this model will help you play the commodities bull run and avoid the stock bear run. Then time things perfectly to switch after commodities eventually crash - sometime in the next 4-8 years - into stocks again (and also out of gold and silver). But for now - its clearly inflation, oil, gold and silver all the way. With debt being deflated. Money and savings losing value. Real assets being the things to hold. Not currency.

Resource Nationalisation and Commodities Bull Run

1980 to 1999

2000 to 2018

Low inflation

High inflation

Low interest rates

High interest rates

Low debt

High debt

Low commodities prices

High commodities prices

Low tax take

High tax take

Low investment in mining

High investment in mining

High supply of commodities

Low supply of commodities

No money printing

Massive money printing

Low unemployment

High unemployment

Liberal markets

Restricted markets

Globalization

Nationalisation

Low gold price

High gold price

Low oil price

High oil price

Stock market bull run 1980-1999

Stock market bear run 2000-2018

Strong growth in the west

Weak growth in the west

Public sector spending sprees

Public sector spending cuts-austerity

Surpluses and construction boom

Deficit and construction bust

Markets stable and steadily rising

Markets volatile and falling

Strong growth low inflation

Stagflation

17 1/2 Year Cycles In Commodities and Stock Markets Going Back To 1946

Gold: So where do you see all this leading. Can you see a bright future? Absolutely not at this time – because this is just the beginning unfortunately of the re-balancing if we can call it that. Essentially whilst governments stay intent on trying to print their way out of trouble, one can see hyperinflation on the horizon and the continued debasement of currencies. The ECB will not want to start printing money again, but we all know they will and will have to. This, along with the US printing, is sure to lead to higher gold prices.

Outlook: So you can look forward to the next five year and its going to be like the period 1975 to 1980, namely:

· Final 35% of the 17½ year commodities bull market

· Final 35% of the 17½ year stock bear market

· Runaway inflation to start in late 2011

· Unemployment continuing to rise

· Property prices staying in the doldrums

· Rental prices rising sharply

· Interest rates rising by end 2012 chasing the tail of high inflation

· Oil prices rising sharply

· Stock market staying range bound, erratic and declining in inflation adjusted terms by a further 40% in 5 years

· Gold and silver prices sky-rocketing

Property An Excellent Inflationary Hedge: Although on the face of it property investmen t looks a bit bleak, in fact debt levels will be severely eroded by inflation. House prices will almost keep pace with inflation and property equity will therefore rise sharply in most cases. Meanwhile rental rates will rise sharply because the average person will not be able to afford to borrow any money and/or will have no money for a deposit. Banks will stay tight with their lending. In five years, property prices could be 25% higher, with debt levels 40% lower in inflation adjusted terms whilst rental prices could by 30% higher. If you can survive this period of turmoil with small void periods, avoid rental defaults and manage costs well, you will come out of it with far higher equity and excellent yields as debt levels are lowered by inflation. No wonder so many wealthy people buy property – as a hedge against inflation – and as a safe haven asset class – let’s face it, property prices never decline to zero. They may halve in value, but they normally then go back up. As we all know, stock equity prices can drop 90% in a day, so it’s far riskier investing in the stock market.

t looks a bit bleak, in fact debt levels will be severely eroded by inflation. House prices will almost keep pace with inflation and property equity will therefore rise sharply in most cases. Meanwhile rental rates will rise sharply because the average person will not be able to afford to borrow any money and/or will have no money for a deposit. Banks will stay tight with their lending. In five years, property prices could be 25% higher, with debt levels 40% lower in inflation adjusted terms whilst rental prices could by 30% higher. If you can survive this period of turmoil with small void periods, avoid rental defaults and manage costs well, you will come out of it with far higher equity and excellent yields as debt levels are lowered by inflation. No wonder so many wealthy people buy property – as a hedge against inflation – and as a safe haven asset class – let’s face it, property prices never decline to zero. They may halve in value, but they normally then go back up. As we all know, stock equity prices can drop 90% in a day, so it’s far riskier investing in the stock market.

Focussed Portfolio: We thought we’d share what we think is a more or less ideal investme nt portfolio by category:

nt portfolio by category:

· Property 60%

· Oil 15%

· Gold 11%

· Cash 8%

· Agriculture 5%

· Silver 2%

As you can see, its property, oil, gold and silver all the way. It’s a portfolio heavily weighted to protect against inflation and debt crisis. Meanwhile one should look to increase gold and silver investments. If anything, shift further out of cash into gold and silver. As you can also see, no banking, no retail, cars, airlines or technology. We think this is a pretty good portfolio mix for the next five years – moving into the final bubble phase of the commodities bull run blow-off.

1975 All Over Again: You’ll also notice there is no investment in technology, retail, airlines, cars, banks, financial or any other thing that will be hit during the last five years of the commodities bull run. The strategy is simple – hold on for dear life to the property – meanwhile make as much money as possible from oil, gold and silver in the meantime. Then, as the commodities bubble finally pops – get out of commodities – probably sometime 2017 or thereabouts (quite possibly earlier) and into more cheap property – and the start of the secular stock market bull run. This plan is of course evergreen and fluid, evolving, but it’s a long term plan. And we are almost certain it will work, mainly because there is no option for western government any more but to print money. And when they print money, oil, silver and gold prices will rise sharply. Property prices will drift higher and inflati on will sky-rocket. So it will be like 1975 all over again – with the end of the bull run in 5 years time in 2017 (or 1980 equivalent). Also recall the US came off the gold standard in 1971. And we started printing money in 2008. So 9-10 years later, we will get the same as we did in 1980 – a gigantic gold price spike caused by huge waves of printed money and inflation.

on will sky-rocket. So it will be like 1975 all over again – with the end of the bull run in 5 years time in 2017 (or 1980 equivalent). Also recall the US came off the gold standard in 1971. And we started printing money in 2008. So 9-10 years later, we will get the same as we did in 1980 – a gigantic gold price spike caused by huge waves of printed money and inflation.

Get Real And Buy Gold: For those of you that remember, 1980 ended in war, massive inflation, riots, recession, gold prices crashing and the Iranian Revolution. Not pleasant. This time will be no different regrettably. Time to bunker down and make sure you own some gold!