404: UK stagflation - opportunities in property, gold, silver and oil

12-01-2011

UK Construction Decline: It’s hardly surprising the UK is barely growing at the moment. Just consider some of these construction points:

· North Sea oil investment levels are at an all time low in inflation adjusted terms

· No oil refinery has been built in the UK for 40 years

· No new nuclear power station has been built for about 40 years

· No new publicly funded motorway has been built for about 13 years

· House building is lower now than at any period since World War II

· Manufacturing has been moving overseas for decades and is in terminal decline

· It took ten years to build a two new 3m wide lanes on the M25 (the late Victorians built a whole railway network, cities and tubes in a similar period)

The only significant building project to be completed under the last government was Terminal 5

It now looks like no more nuclear reactors will be built. It’s possible a few small gas fired plants might be build fuelled by imported gas. The wind and solar renewables craze will probably subside through lack of public and private funding and low returns.

gas fired plants might be build fuelled by imported gas. The wind and solar renewables craze will probably subside through lack of public and private funding and low returns.

Next 25 Years – Almost No Projects: Take a guess what projects will have been built in the next 25 years – or in the next generation. Practically none. What we will have is:

· Olympics sites being finished – legacy buildings

· Crossrail (80% chance of completion)

· High Speed Rail link extension to Birmingham (40% chance) and Manchester-Leeds (25% chance)

Too Much Debt: That’s it. Expect no more motorways, no more airports, no more major railways. It’s pretty straight forward the reasons why:

· Too expensive

· UK cannot afford these projects anymore with its massive debts and lower tax revenues

· Environmentalist, Nimbys, NGOs and vested interest groups put a stop to new projects

· Lengthy planning process, over regulation, taxes and red-tape stifle development – adding too much cost and risk

Higher Unemployment: The net affect will be that unemployment will keep rising because the construction business employs so many semi-skilled workers – and these will be out of work. Most of these people will remain idle because most have no higher education hence it’s difficult to re-train these workers.

Growth In Overcrowding: Th e other net affect will be increased overcrowding of rail, tube, road and public transport systems, along with housing. Rental prices will keep rising as the poor and middle classes increasingly turn to renting because of higher taxes, difficulties getting loans, higher bank fees and lower disposable incomes. Inflation will keep rising and the basics in life like food, travel and energy will all get more expensive, making it even harder along with high tax burdens to fund mortgage payments. Some of the super rich will leave the UK because of very high taxes, and these revenues will be lost to places like Switzerland, Monaco, Hong Kong and Singapore.

e other net affect will be increased overcrowding of rail, tube, road and public transport systems, along with housing. Rental prices will keep rising as the poor and middle classes increasingly turn to renting because of higher taxes, difficulties getting loans, higher bank fees and lower disposable incomes. Inflation will keep rising and the basics in life like food, travel and energy will all get more expensive, making it even harder along with high tax burdens to fund mortgage payments. Some of the super rich will leave the UK because of very high taxes, and these revenues will be lost to places like Switzerland, Monaco, Hong Kong and Singapore.

Stagflation All The Way: As described in most of our Special Reports in the last four months, its stagflation all the way, just like in the 1970s.

Printing Money: Government tax receipts drop in recessions, and their social spending costs rise, so they will be desperate to try and create some form of GDP growth no matter what cost in the short term. Rather than re-balance the economies and government finances, taking a hit now, governments all across the western world will choose to try and “kick the can down the road” by printing more money. It’s that simple. They will print, give hand-outs directly an d indirectly to banks and the general public – and hope that people start spending in the shops, keep their jobs and keep paying their taxes. Because this process is so inefficient and socialist – e.g. it completely goes against a normal capitalist free market – what will happen is debt levels will rise further, inflation will rise strongly and eventually interest rates will start to rise sharply – as banks pass increasing costs to the debt laden consumer and mortgage owners.

d indirectly to banks and the general public – and hope that people start spending in the shops, keep their jobs and keep paying their taxes. Because this process is so inefficient and socialist – e.g. it completely goes against a normal capitalist free market – what will happen is debt levels will rise further, inflation will rise strongly and eventually interest rates will start to rise sharply – as banks pass increasing costs to the debt laden consumer and mortgage owners.

Strife and Social Disorder: As the momentum increases for public sector cuts, more demonstrations will take place, more civil strife, strikes and bitterness will ensue – just like in the 1970s – and inflation will then sky-rocket.

Commodities Super Cycle: It’s all part of a super cycle – just like the 1970s was. A 17½ year long stock bear market and 17½ year long commodities bull market – that started in 2000. 2012 is equivalent to 1975.

· 1971 was an oil crisis – 2008 was an oil crisis

· 1975 was a sovereign debt crisis – 2012 will be a sovereign debt crisis

· 1977 was a recession – 2014 will be a recession

· 1978 saw very high unemployment – 2015 will see very high unemployment

· 1980 saw gold and silver prices skyrocket – 2018 will see gold and silver prices skyrocket

· 1980 saw the Iranian revolution – 2018 will see another war with or in Iran

Yes – It’s Happening Again: Get the message, history does have a habit of repeating itself only because it’s all part of a super cycle in the stock market and commodities markets.

Peak Oil: This period of stagflation is likely to be long, drawn out and difficult because Peak Oil hit us back in 2005. This is when global conventional crude oil production started to decline. The expensive he avy oil, natural gas liquids and biofuels could not prevent oil prices sky-rocketting to $147/bbl in July 2008 - which helped trigger the western private sector financial meltdown that autumn. Its the end of cheap oil - period. Oil will likely never drop below $70/bbl again. The upside to oil prices is sky-high - no-one knows how high. It only needs a war to break out with or in Iran to double or triple from current price levels and lead to another oil crisis. Just to flag again, we are living through an "oil price shock" as we speak - and this will continue. It's just that no-one talks about it. We reiterate that Peak Oil (conventional crude) was now almost six years ago - it's history. And Peak Oil (all liquids) was either July 20008 or January 2011 depending on the details interpretation of the weekly production numbers. We are now on an undulating plateau - we've been predicting this since 2007. Its just possible overall oil liquids production could still head a little higher but to all intense and purposes, we are at an undulating plateau of all oil liquids production - and its the end of cheap oil. This is one of the key reasons why the Eurozone monetary union is unsustainable - because countries like Greece, Portugal, Ireland and Italy import gigantic quantities of oil compared with their GDPs - and this compounds their deficit problems leading to higher debts and borrowing costs. However, when some of these countries finally leave the Euro, their oil import costs will sky-rocket as will their inflation because they will be buying oil with weak local currencies - this will be their real Peak Oil shock - its just that no-one has warned them about this yet.

avy oil, natural gas liquids and biofuels could not prevent oil prices sky-rocketting to $147/bbl in July 2008 - which helped trigger the western private sector financial meltdown that autumn. Its the end of cheap oil - period. Oil will likely never drop below $70/bbl again. The upside to oil prices is sky-high - no-one knows how high. It only needs a war to break out with or in Iran to double or triple from current price levels and lead to another oil crisis. Just to flag again, we are living through an "oil price shock" as we speak - and this will continue. It's just that no-one talks about it. We reiterate that Peak Oil (conventional crude) was now almost six years ago - it's history. And Peak Oil (all liquids) was either July 20008 or January 2011 depending on the details interpretation of the weekly production numbers. We are now on an undulating plateau - we've been predicting this since 2007. Its just possible overall oil liquids production could still head a little higher but to all intense and purposes, we are at an undulating plateau of all oil liquids production - and its the end of cheap oil. This is one of the key reasons why the Eurozone monetary union is unsustainable - because countries like Greece, Portugal, Ireland and Italy import gigantic quantities of oil compared with their GDPs - and this compounds their deficit problems leading to higher debts and borrowing costs. However, when some of these countries finally leave the Euro, their oil import costs will sky-rocket as will their inflation because they will be buying oil with weak local currencies - this will be their real Peak Oil shock - its just that no-one has warned them about this yet.

Note: Predicted consumption growth is higher than forecast production - maxxed out - hence oil prices will keep rising so oil consumption drops - this will lead to lower GDP growth (or recession) in western developed nations and high inflation. This forecast adds all crude oil, oil sands and biofuels (total liquids). Crude oil is in decline, though heavy oil and biofuels is on the increase.

Massive Transfer of Wealth: Wealth is never destroyed – it’s just transferred from one place to another. In the next five years there will be a gigantic wealth transfer from all those people that have savings and investments in fiat currencies to owners of gold, silver, oil and commodities like food, forestry and farmland. It’s a transfer from paper an d fake assets to real physical assets (resources). Government have been conning you into thinking their currency is worth something – but it's value declines by 10% per annum. Meanwhile gold and silver languish way behind the curve. They are undervalued and so far unloved. But this will change very soon and very rapidly.

d fake assets to real physical assets (resources). Government have been conning you into thinking their currency is worth something – but it's value declines by 10% per annum. Meanwhile gold and silver languish way behind the curve. They are undervalued and so far unloved. But this will change very soon and very rapidly.

· If you own gold, silver, copper, oil, food – you will do well

· If you own cash in western currencies and stocks in consumer and financial companies – you will be destroyed

Ben The Printer: Ben Bernanke’s only opportunity to keep his job is to make sure President Obama keeps his job. Since there is only ten months to the US Election, the only way to get Obama back into power is to print money to keep everything "nicely" propped up with this printed money. Can you imagine any scenario that Ben will not try and print his way out of trouble and/or into his next term? He's just not going to stop printing. Period. This is a further reason over the pond in the UK that gold, silver, inflation and oil will all rise sharply along with unemployment. The US is exporting inflation, but most other countries are also printing in any case, so it's inflation all the way.

Property A Good Inflation Hedge: If you own property and can manage the high interest rates for the period 2012 to 2018, after this super cycle ends, you will do very well indeed. After 2018 – property prices in inflation adjusted terms might actually increase slowly after all the bad debt has been destroyed or written off. Just after the commodities crash around about that time.

Depressed Western Nations: During a commodities bull market, when energy and manufacturing input p rices skyrocket, most western nations (with the exception of Norway, Canada and Australia - all resources rich) will suffer very badly – because these high commodities prices lead to high inflation, higher borrowing costs, lower returns, depressed company earnings, lower tax receipts and higher unemployment. This wealth is also transferred to OPEC countries – in the 1970s and early 1980s much of the oil money was squandered on lavish palaces, luxury cars and riches for the upper elite. Now far more of this wealth will shift into equally inefficient social projects and food-energy subsidies for the masses to keep young people off the streets, as the populations in these desert countries have risen four fold since the 1970s and the huge young unemployed need to be looked after – otherwise there will be uprisings, civil disorder and ultimately kingdoms or autocracies would be overthrown.

rices skyrocket, most western nations (with the exception of Norway, Canada and Australia - all resources rich) will suffer very badly – because these high commodities prices lead to high inflation, higher borrowing costs, lower returns, depressed company earnings, lower tax receipts and higher unemployment. This wealth is also transferred to OPEC countries – in the 1970s and early 1980s much of the oil money was squandered on lavish palaces, luxury cars and riches for the upper elite. Now far more of this wealth will shift into equally inefficient social projects and food-energy subsidies for the masses to keep young people off the streets, as the populations in these desert countries have risen four fold since the 1970s and the huge young unemployed need to be looked after – otherwise there will be uprisings, civil disorder and ultimately kingdoms or autocracies would be overthrown.

That’s A Great Opportunity: So the scene is set for a very interesting five years. We at PropertyInvesting.net are not worried at all about this upcoming period. We see crises and mismanagement of economies as being part and parcel of this business environment - just like it was in the 1970s in the UK. The thing to do is to be positive about the scenery and make sure you are not caught out by the gigantic quantities of printed money about to rain down. Many of the smartest investors are taking this cheap money and shifting it into gold, silver and oil (also food and farmland). That's one reason why Trillions of dollars of printed money are not leading to any new jobs. The money is being exported abroad and put into commodities.

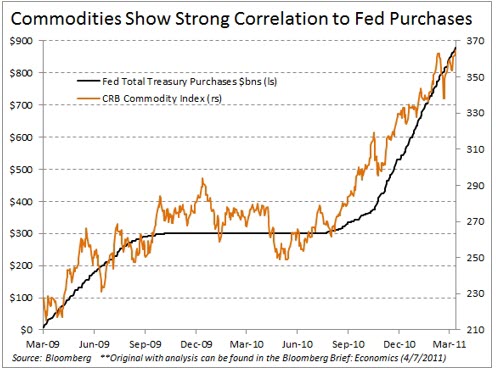

Printed Money – Crisis – Profits: Essentially every time more printed money is announced – then share prices and oil prices will rise. Stock and oil prices will follow the printed money - there is almost a perfect correlation between the commodities index and the degree of printing (see chart below). When the printing presses stop for a while, stocks and oil crash again – then further attempts are made to prop them up. This is government interference into what used to be a capitalist market economy – but capitalism in the true sense of the word disappeared around the year 2001 when the Fed kept rates dangerously low for 5 years and created a huge housing bubble in the USA – then home owners use their homes like ATM cash machines to spend in the malls. When more debt horror stories surface and panic sets in, share prices will tank. All the time, inflation is raging away – eating savings and destroying stock asset valuation in inflation adjusted terms.

Bull and Crash Model: Below is a model to describe what we think will happen in the next five years. Essentially all major western oil importing nations will start printing even more money to pay down debts and pay interest on these debts. Every time another bout of printed money hits the markets, it will cause stock markets to rally temporarily. It will rob savers of their cash value. The stock market will then drop back as the wisest investors take profits and buy gold, silver and oil. The Dow should drop a further 40% in inflation adjusted terms before the end of the stock bear market, sometime between 2014 and 2018. Meanwhile gold will keep rising as inflation takes hold - rising from the government claimed ~3.5% (actually more like 8%) to something like 18%. Interest rates will sky-rocket in the USA as there is a run on the bond market - and will also go higher in the UK and Europe. Panic will break out and there will be a final gold, sliver and oil blow-off rally - then a severe crash likely sometime between 2014 and 2018 - coinciding with an oil war of some form or another. The next stock 17 1/2 year bull run will then commence as bad debts are written down once and for all. Many companies, governments and entities will be bankrupt by this point. The real winners will be those that bought gold, silver and oil, then got out just before the final blow-off then crash. Cash savings will be wiped out. The only money worth anything meaningful by this point will be physical gold and silver, but even these two metals will drop once debts are finally written off at the end of this huge western debt bubble. At this point, the Chinese will have increased their gold and silver holdings by 10-20 fold as central banks are forced to transfer their gold to China to pay off bad debts. We hope this makes it clear the direction things are heading - in our opinion.

Protect Yourself: The way to mitigate against losing your wealth and also massively increasing your chance of making good returns is, in our view, fairly simple:

· Buy gold

· Buy silver

· Buy oil

· Buy the best gold-silver mining stocks and oil company stocks

· Hold property

Don’t touch anything else. If you think you can make good returns by gambling on banks, retail, consumer and technology – good for you – we doubt you will make serious returns as the printing presses gather momentum. The best way we see to safeguard and grow ones wealth is to shift cash and fiat currencies plus consumer stocks into physical gold, silver and oil (or oil and mining stocks).

Target Prices: To be specific, from our research we think there is a high chance in the next 2-5 years that:

· Gold prices will rise from $1730/Troy ounce to $6000/Troy ounce

· Silver prices will rise from $32/Troy ounce to $400/Troy ounce

· Oil prices will rise from $100/bbl to $150/bbl

· Gold and silver mining stocks will explode upwards

But be wary that this will be a parabolic shift upwards eventually into a final panic blow-off as every man and his dog starts buying gold and silver. But we are very far from this point at the moment and gold and silver are way undervalued - we think the top is years away – and we are only half way up the mountain (bubble) or less in this current 17 1/2 year commodity market bull run – albeit we are likely about 65% of the way through time–wise.

Size of Markets

$30 billion silver market

$100 billion Facebook valuation

$5000 billion gold market

$36000 billion stock market

$72000 billion bond market

$1000000 billion derivatives market

Gold: Consider this. There is only 0.5 ounces of gold per person in the world today. As the population has exploded from 3 billion 40 years ago to 7 billion today, and the amount of fiat currency has sky-rocketed, we make the case the gold is very good value indeed. Also consider that there is only 60% of the amount of silver compared to gold and hence there is only 0.35 ounces of silver per person on the earth's surface. That's a frighteningly small amount. Silver is almost non-existent.

Silver: We thought we'd describe the size of the different market - to give context as to why we are so convinced gold and silver prices will rise. Silver is now rarer than gold and is needed for electronic, military and many other uses. The size of the market is tiny, only $30 Billion. That's a third of the value of Facebook. That's ridiculous in our opinion. Silver is a screaming buy. Silver prices are going to go ballistic.

Gold and Silver Prices: Below is our latest research on gold and silver price scenarios as the end of the current commodities bull run based on the Dow Jones Index and UK Property prices. Its self explanatory, but as a point, the value of the Dow Jones will be linked to the degree of printing of money. The more money that is printed, the higher the Dow Jones will climb, albeit it will drop in inflation adjusted terms. That is to say, if severe inflation kicks in, the Dow will likely rise higher - but the gold price will go ballistic. The final ratio of Dow to Gold should be about 1:1, but it could overshoot to 1:0.66. Conservatively it will definitely drop to something like 2:1.

Silver: Then we look at silver compared to gold. Silver should drop from its current ratio of 1:40 to about 1:10 (conservatively 1:20, though it could overshoot to 1:6.66). Hence this is our target silver price.

UK Property: Then we calculate UK Property Prices in £ and convert to the gold price in US dollars. If stagnation continues, gold should reach $2933/Troy ounce, but if inflation gets high, then gold could easily reach $4622/Troy ounce.

Ballistic Investment: Any which way one looks at it, gold and silver will go ballistic. We have converted almost all our cash into gold and silver and shift stocks in oil, gold and silver mining. As the printing presses ramp up production of the US dollar, UK Sterling and likely Euro - gold and silver will go sky-rocketing. We see this like the property investment opportunity back in 1999 in the UK. A screaming buy as this bull run just started taking off. We should have 3-6 years left of this oil, gold and silver bull run. At the end, you will see prices like those described below!

London Property: For property investors in the UK, the only really good place to invest is London at the moment in our view. The reasons are fairly straight forward and tie into what we described above:

· London is the only UK city where large new infra-structure and housing projects are being built

· London’s population is forecast to rise by 10% in the next 10 years

· London Olympics 2012

· International finance, banking centre

· Private sector jobs growth still strong

· Almost no houses are being built in London – supply is low with demand high

· Communications with USA and Europe, Far East – through airports and telecommunications networks

· Best tube, road, rail, bus and airport transport links in UK

· Least proportion of public sector jobs as a proportion of the size of economy/city

· International tourism, visitors, universities and wealthy people visiting and having second homes

· Seat of government

· Tory policies normally help London and SE England whilst tending to hinder provincial areas

· London is the most energy efficient city – energy consumed per GDP created – in the UK

· Centre of international oil and mining companies during a commodities boom

· Centre for commodities trading and investment internationally

· As Sterling value decline, West London property starts to look cheap for w ealthy international buyers

ealthy international buyers

· There are so many foreign people renting in London that rental prices are rising and there is a massive shortage in rental property – this is not likely to change

· Most of the middle class and poorer foreigner cannot afford to own property – creating good rental demand

· Many of the wealthy foreigners are cash rich and target West London prime property driving asset prices higher

· Crossrail building will help London in zones from west through centre to east along station routes

· East London Rail to New Cross and Croydon has helped open up this area

· Olympics will help Stratford-Bow-Plaistow-Hackney area in the longer term

· Farringdon is a real hot-spot – a new transport hub in the making – can go any direction easily from this station once Crossrail is built ~2020, hence any flats close to this station will probably do well over time

Some London Risks:

· Higher taxes on banks and the financial industry driving London big business overseas to tax havens

· Greater disparity in wealth leads to London riots and crime

· Massive depression and further financial meltdown means that even London is badly affected compared to provincial regions

· Labour get into power in 3 years time and reverse current policy – suckin g wealth from London and feeding it into northern Labour strong-holds and public sector jobs, creating hyper-inflation

g wealth from London and feeding it into northern Labour strong-holds and public sector jobs, creating hyper-inflation

· Olympic legacy creates a white elephant – growth drops after the Olympics

· Severe overcrowding (tube, rail, airports)

Northern Depression: When you compare these positive aspects against places like Liverpool, Leeds, Nottingham and Bradford, you can understand why there is a two tier UK property market at the moment – and this is not likely to change any time soon. As oil prices rise, and inflation kicks in, London will outperform other areas as it is least exposed to the negative effects of Peak Oil. The only other serious contender in the UK for number one spot is Aberdeen – which will continue a mini-boom from high oil prices and robust employment internationally in the oil business, even though the UK North Sea oil production is in serious decline.

Watch That Bull Run: So we are going to keep building and clinging on to our gol d, silver, oil and property. Then watch this commodities super cycle bull run keep heading erratically rhigher – until we see a final parabolic curve developing. This will be the in the final bull market blow-off bubble – at which time we plan to sell-up close to the top without getting too greedy, then head for the hills into splendid very early retirement!

d, silver, oil and property. Then watch this commodities super cycle bull run keep heading erratically rhigher – until we see a final parabolic curve developing. This will be the in the final bull market blow-off bubble – at which time we plan to sell-up close to the top without getting too greedy, then head for the hills into splendid very early retirement!

Simple: Yes – we are confident about gold, silver, oil, property and our very early retirement – simply because we are so confident western governments will continue to mismanage economies, bail-out using social measures and print, print, print. It’s really not that difficult! Certainly not rocket science.

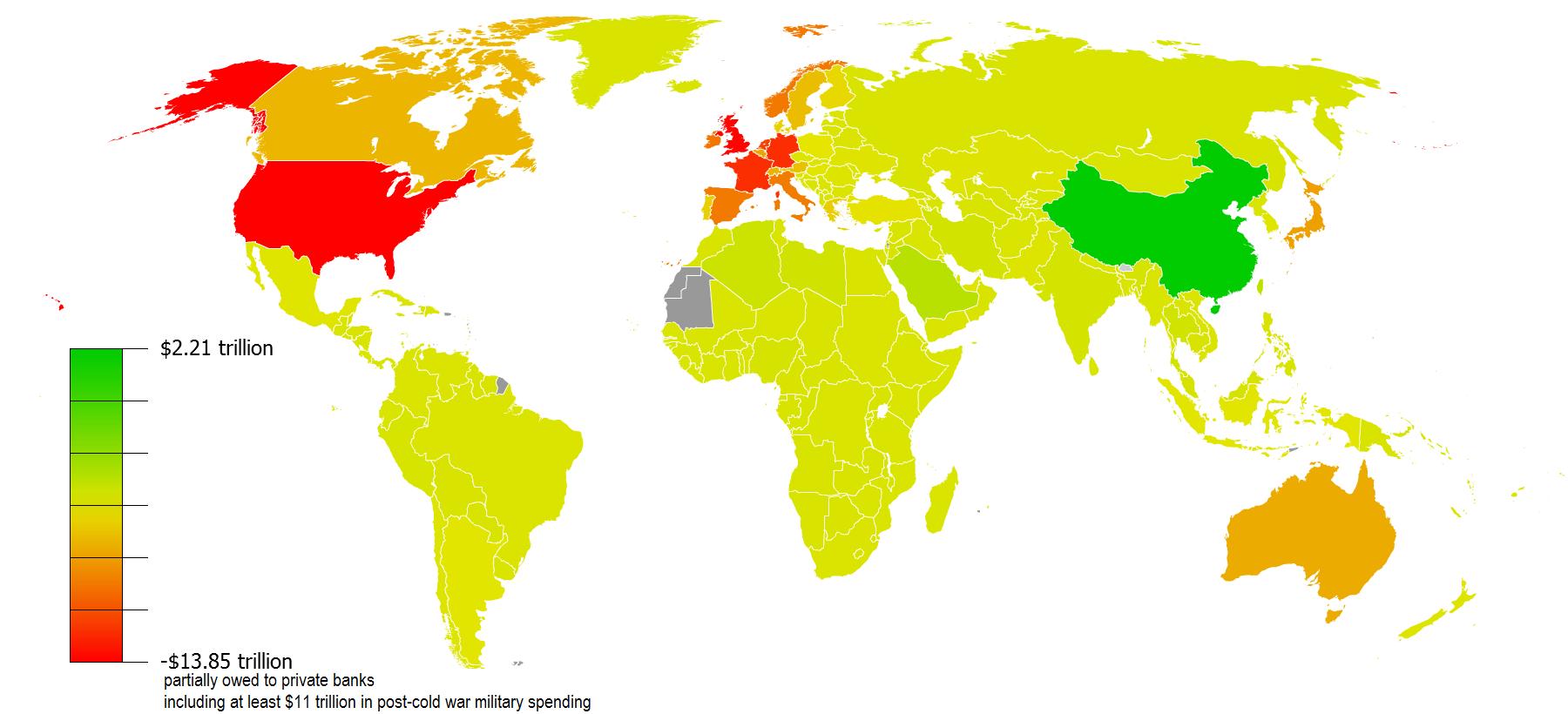

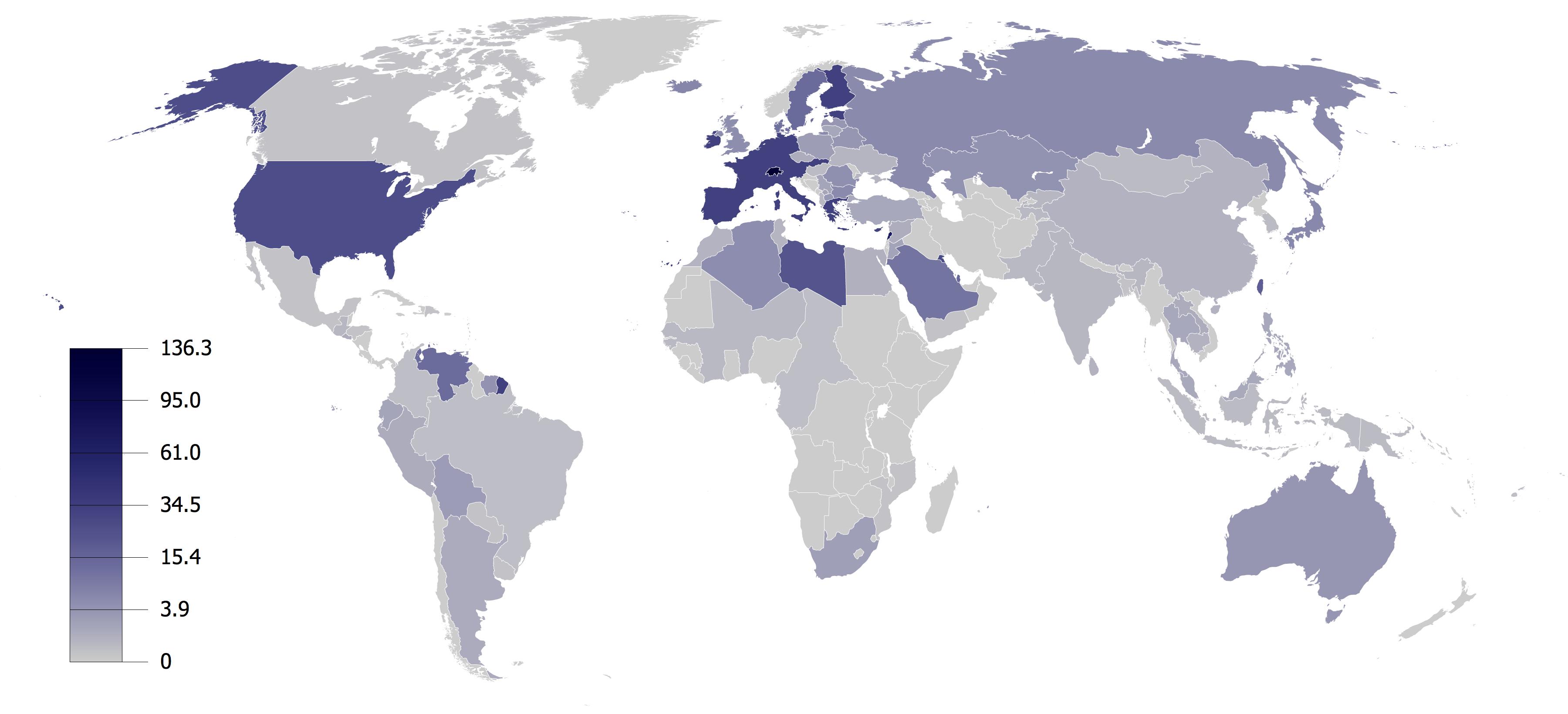

Gold Reserves per capita

Foreign currency reserves and gold minus external debt based on 2010 data from CIA Factbook