445: Super-Crisis Getting Closer

09-20-2012

PropertyInvesting.net team

Super Crisis Is Close: It now feels like the super crisis is getting closer. Things are beginning to accelerate and our feeling is this crash is close. Let us explain.

US Fiscal Cliff: Firstly, the US fiscal cliff is fast approaching – the timing is 1st Jan 2013 – when legally binding spending cuts kick-in and taxes rise the US citizens. This is on the back of reduction in pre-election spending and the inevitable hang-over the Fed and Administrations vain attempt to create a mini-boom just before the election.

Euro Debt: The European debt issues is not and will not go away – ever since the private sector crash of 2007 five years ago, the debt was transferred to sovereign level as governments bailed out the private sector. Now government are struggling to pay off their debts – this issue is not going away any time soon. The threat of Euro break-up remains and Greece has looked like a basket case for the last two year – Spain, Italy and Portugal will all struggle to keep rates down.

China: China’s economy is slowing down – and they will put their foot on the accelerator soon to print more money and lower interest rates – this will drive global inflation higher and make commodities more expensive. China’s demand is what is causing the west to suffer so much – because there is now enough cheap oil, metals and commodities to go around. Just imagine 1.5 billion people living like the Americans in giant houses – all driving 5 litre sports utility vehicles. It doesn’t bear thinking about – but this is what they aspire towards. The resource need to come from somewhere so expect to see US oil demand keep dropping as Chinese demand rises. The oil and commodities will be sucked from west to east.

west to east.

Peak Oil: We are stumbling along a Peak Oil (or Peak cheap oil) plateau as we have been describing for four years now. Just as the oil prices rises, its enough to stall economic growth in western oil importing nations. All costs are being driven up and we are in a prolonged period of stagflation. Recall from our previous special reports –conventional crude oil production peaked in 2005. Its only because of oil sands, ethanol, gas-to-liquids and natural gas liquids increases that have meant an overall liquids production has not declined. It continues to edge higher as demand rises – but the whole energy business has to fight harder and harder to keep this up - every new barrel that is added now will cost more than $90/bbl – the marginal new oil barrel is very expensive indeed. Gone are the days of $10/bbl oil, $50/bbl oil – the floor is likely to be $80/bbl even in a recession.

Bubbles: Rather than let the bubbles deflate, the Fed and other Central Banks are int ent on printing money like there is no tomorrow. Shortly, we believe it will start to get difficult to price things simply because inflation is running to high. At this time, people will panic and want to spend all their cash driving prices even higher as demand for goods and services looks up.

ent on printing money like there is no tomorrow. Shortly, we believe it will start to get difficult to price things simply because inflation is running to high. At this time, people will panic and want to spend all their cash driving prices even higher as demand for goods and services looks up.

Follow The Bubbles: Now that smart investors know what the Fed will do – it’s very predictable – they can then make serious money. They buy oil and equities before the Fed announced more printing. They sell just before printing ends. When they see a bubble develop, they jump in, but get out before it deflates. It’s that simple. Follow the bubble – get out before it pops. All assets and paper develop bubbles. They then crash and spend years in the doldrums. The bond market is the latest obvious bubble that is just about to go pop. Gold is in the early stages of a bubble – no-where near the top. It will pop one day after a parabolic rise, but you need to see the skyrocketing first and every man and his dog is talking about gold. It’s not even begun yet. Just before the bubble pops, gold should more or less equal the Dow – so if the Dow Jones is 10000, gold will be $10000/ounce, if the Dow is 5000, gold will be $5000/ ounce. We are way off the top of the bubble. Ditto for silver – which is set to go absolutely ballistic sometime in the next 3 years – the bargain of the century.

ounce. We are way off the top of the bubble. Ditto for silver – which is set to go absolutely ballistic sometime in the next 3 years – the bargain of the century.

QE3: The Fed announced recently "open ended" money printing to the tune of $40 Billion a month. That's $0.480 Trillion a year. Meanwhile Europe has just agreed to $0.645 Trillion of money printing (the so called stability pact). This is making money from thin air - debasing the currency. In theory, if they add 10% to the money supply, prices should rise by 10%. This is sure to happen plus more. Regrettably - there will be a little boost - a short term feel good fatcor - but then if and when the US bond market bubble pops - everyone with dollars will dump them into hard assets, then prices will sky-rocket across the board. It will be difficult to know what a good price is for a while. Ever get that feeling - when you buy a cup of Kosta Coffee for £5 and think back to 1990 when coffee cost 25p a cup - but think "what the hell - this stuffs worth nothing anyway". That's the point that inflation really starts to kick-off big time - its just been reached. Why should a cup of coffee cost five times more than petrol? That means oil and petrol prices are low! Watch out as all prices rise sharply into 2013 - oil prices must rise - even wages will start to rise faster.

Inflation Destroys Supply: Because savings rates have been far too low for far too long, this has created a gigantic distortion in the market. It’s is difficult to borrow money for investment - economic growth rates are low and depressed – businesses do not want to risk borrowing more capital. Because of this, capacity is coming down, particularly in the gold and silver mining and oil/gas businesses despite high prices – along with housing. As government get more desperate, they tax oil and mining companies further depressing supplies.

Inflation Destroys Supply: Because savings rates have been far too low for far too long, this has created a gigantic distortion in the market. It’s is difficult to borrow money for investment - economic growth rates are low and depressed – businesses do not want to risk borrowing more capital. Because of this, capacity is coming down, particularly in the gold and silver mining and oil/gas businesses despite high prices – along with housing. As government get more desperate, they tax oil and mining companies further depressing supplies.

Property Distortion: This also happens in the housing market – stamp duty being a good example and the possible mansion tax. For instance in London there is a housing crisis with 170,000 stalled homes – because risks are too high for developers with regulations, delays, lack of funding and poor terms for borrowing. This means rental prices are rising sharply as demand outstrips supply. The population is booming yet property building is almost non-existent. It’s a classic case of stagflation. Lack of investment – and distortion of the market by government interference and money printing with savings rates far too low to encourage investment. For property investors, grabbing some low cost flats in London and renting them has to be one of the safest investment around – because borrowing costs remain low, rental demand is rising, inflation is ra ging, rents are rising, and supply of homes is non-existent. Of course first-time buyer find it hard to raise a mortgage partly because of high rates, high deposits, high taxes and also because of student loans – which are set to rise 300% next month. That’s what we call inflation. Then housing crisis has been ever present for the last 15 years and its getting worse as huge numbers of overseas workers flood into London swelling the population by 1 million every 8 years.

ging, rents are rising, and supply of homes is non-existent. Of course first-time buyer find it hard to raise a mortgage partly because of high rates, high deposits, high taxes and also because of student loans – which are set to rise 300% next month. That’s what we call inflation. Then housing crisis has been ever present for the last 15 years and its getting worse as huge numbers of overseas workers flood into London swelling the population by 1 million every 8 years.

North Sea Production Crash: In the North Sea, taxes for both oil and gas rose sharply in March 2011 and then oil and gas production crashed 25% in the subsequence 12 months as investment dried up. Despite record oil and gas prices, the UK North Sea continues its relentless decline as the government tax take has risen and costs have risen – stifling supply and leading to record oil and gas imports. This has cause huge harm to the balance of payments and triggered a sharp drop in manufacturing output as oil-gas production has crashed. The Treasury now gets less tax revenue than before it put up taxes just 18 months ago – the rule of unintended consequences – but surely any knowledgeable person at the Treasury could have predicted this – especially within a Tory government. Shooting the goose that lay the golden eye springs to mind. What a disaster.

Petrocurrency Decline: As the UK Sterling’s status as a petrocurrency has declined, so has the value of Sterling – this has then stimulated large capital inflows by wealthy international families into West London property as a fairly low cost (good value) safe haven - as global economic turmoil continues. Any property not requiring a mortgage – read super rich property bought in case – has risen sharply. The super-rich have been fighting to get this real estate secured before the next meltdown and hyper-inflation.

Inflation: Food prices continue to climb along with fuel prices and rental prices – these are the key prices the poor get hit by. The socialist Keynesian policy of printing more money actually harms the poor the most because these prices rise so sharply and they disproportionally hit the poor of course. Very little sustainable employment is created by waves of money printing – it just jacks prices up and makes people feel initially like they are better off – but after paying all the bills – they realise they are worse off. This money printing benefits the rich the most because they use the cheap money to speculate in the equity and commodities markets – leverage up – and ride the bubbles – and get out before the bubbles go pop. Every time the Fed prints money, equities rise, inflation rises, commodities prices rise – then they drop when money printing ends. The poor get poorer and the rich get richer. It’s pretty simple really. The super-rich make sure they buy West London property, gold, silver and play at spotting short term equities bubbles. The governments play games by buying each other’s debts. The Chinese buy US Treasuries so the US can buy cheap Chinese “stuff”. The money machine goes around. But who will pay back this debt and when will it be paid back? It will not. It is impossible for the US to pay back its debts. The reasons:

· The US direct debt is $16 Trillion

· The US indirect debt is $75 Trillion (including unfunded liabilities)

· US GDP is $15 Trillion and not growing

· US government debt is growing at $1 Trillion per annum

· The US government borrows 50% of its spending requirement each year and rising

· Even if the US taxed everyone at 100%, it would not be able to pay interest on its debts if rates rose to 5% (from current 0.5% levels) – recall rates rose to 15% in 1980

· The US only survives because it can print money to pay interest charges – how many more months or years can it keep doing this before the bond market pops and interest rates rise?

Crisis Timing: It feels a little earlier than we thought – but the end is getting closer now. We expect gold prices to sky-rocket in 2013 and 2014 as the US Fed finally loses control of the situation as inflation rises sharply and interest rates are forced up – meaning any amount of money printing will not help.

Assets: The only thing to be invested in at this stage is physical assets. Just mak e sure you have;

e sure you have;

· Gold

· Silver

· Property

· Oil

· Land, farmland-forestry

Governments will either inflate their debt to oblivion or give huge “haircuts” to bond and treasuries holders. Stay well out of government debt and make sure you own physical gold and silver.

Whatever happens –it will end in massive inflation. There could be a short deflation then massive inflation, or straight to massive inflation.

Massive Inflation: Just think back to 1990 when oil prices were $14/bbl, a West London flat was £75,000, a bus fare was 25p, a pint of beer was £1, cigarettes were £1, and a good wage was £15,000 a year. Oil is now $110/bbl, a West London flat is £400,000, bus fare is £3, a pint £4, cigarettes £8, and a good wages is £70,000. This is during a period of so called low inflationary times. When we look back in five years time, gold at $1750/ounce will look like a steal, silver at $34/ounce the bargain of the century,  oil at $110/bbl will look cheap and house prices will be far higher as all prices rise because everyone is printing money in all corners of the globe. The GDP will be lower in proper inflation adjusted terms in western economies, but all prices will be higher. Standards of living will have slipped in almost all western developed nations. The Far East and South Asia will have expanded its economy. It’s the very first time we have had truly global money printing on a gigantic scale. It’s the first time all countries have been able to buy gold and silver – even using a mobile phone over the internet. At some time soon, when real panic sets in, gold and silver will go ballistic. We are convinced. Cash value will decline rapidly. Gold will retain its value. There will be a gigantic transfer of wealth from fiat currency into gold and silver.

oil at $110/bbl will look cheap and house prices will be far higher as all prices rise because everyone is printing money in all corners of the globe. The GDP will be lower in proper inflation adjusted terms in western economies, but all prices will be higher. Standards of living will have slipped in almost all western developed nations. The Far East and South Asia will have expanded its economy. It’s the very first time we have had truly global money printing on a gigantic scale. It’s the first time all countries have been able to buy gold and silver – even using a mobile phone over the internet. At some time soon, when real panic sets in, gold and silver will go ballistic. We are convinced. Cash value will decline rapidly. Gold will retain its value. There will be a gigantic transfer of wealth from fiat currency into gold and silver.

2034 Prices: Just to get you warmed up, assuming we have low inflation and we take the same inflationary trends, then all prices in 22 year time should be about 6 times higher. So by 2034 a flat in London would cost £2.4 million, a good salary £450,000 per annum, cigarettes £48/packet, and oil price $600/bbl. But this is likely to be a gross under-estimation because high inflation is very likely in the next few years - even hyper-inflation is possible. So the only way to protect ones wealth is to buy gold, silver, oil, land and property as a hedge against inflation. Expect rapidly rising prices globally.

Get Into Physical Assets Fast: Make sure you get out of paper and into physical assets. This will be the key to protecting ones wealth as taxes, money printing, inflation, low savings rates and high  unemployment – make things feel more like the 1970s than the 2010s.

unemployment – make things feel more like the 1970s than the 2010s.

Bull Run Continues: This commodities bull run started in 2000 – and we think its due to end around 2018 – but the way things are going, this could accelerate into 2014 because of the size and severity of the Fed and other Central Banks printing of money. In small part this is so they can compete to drive their currency values down to try and create keep export high and imports lower – a currency/trade war. As everyone has started doing it now – this fiat currency mirage will explode in rampant inflation sometime soon.

Bear market: The bear market in equities started 2000 – in inflation adjusted terms the Dow Jones is now 50% of 1999 levels and is set to decline further – each waves of printed money propping it up – then it declines again. But as the years go by, the real value drops. Its should reach an inflation adjusted low some time around 2018 after the baby-boomers have tried to sell their equities late in the hope of securing retirement – only to be dashed by inflation.

Riots and Turmoil: This will lead to greater turmoil in the Middle East, Africa and Asia. Food rio ts in hot countries – exacerbated by water shortages, power shortages, heat and internet-mobile-communication will further strain oil production-supply and investment. These riots will manifest themselves in different forms – but essentially some of the key underlying reasons will be – Peak Oil, printed money, inflation, food prices, booming desert populations and water shortages. The world has created deserts with billions of people living in them relying on water, cooling, imported food and organisation. Its largely unsustainable when oil production declines then oil imports are required. Is it a coincidence that the largest problems have been in Yemen, Bahrain, Syria, Egypt and Tunisia – all countries that used to produce far more oil – but regrettably exports have dried up and imports have begun in most of these affected countries. When the state government can no longer subsides food and fuel – riots and tensions break out. Saudi, Kuwait, Iran, Qatar and UAE have been able to hold things together because of high oil exports-revenue.

ts in hot countries – exacerbated by water shortages, power shortages, heat and internet-mobile-communication will further strain oil production-supply and investment. These riots will manifest themselves in different forms – but essentially some of the key underlying reasons will be – Peak Oil, printed money, inflation, food prices, booming desert populations and water shortages. The world has created deserts with billions of people living in them relying on water, cooling, imported food and organisation. Its largely unsustainable when oil production declines then oil imports are required. Is it a coincidence that the largest problems have been in Yemen, Bahrain, Syria, Egypt and Tunisia – all countries that used to produce far more oil – but regrettably exports have dried up and imports have begun in most of these affected countries. When the state government can no longer subsides food and fuel – riots and tensions break out. Saudi, Kuwait, Iran, Qatar and UAE have been able to hold things together because of high oil exports-revenue.

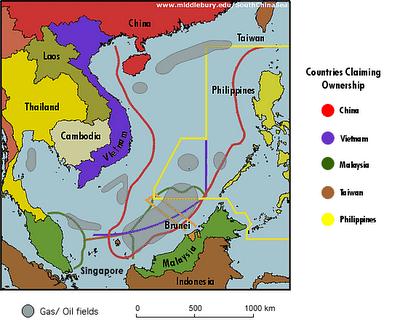

South China Sea: One area to watch out for is the South China Sea. About 11 countries claim parts of this sea as their own maritime area – meanwhile China claims the whole area. This has been a festering issue for years and as China’s economic and military-naval force increases, more conflict in this area is almost inevitable. The strength of feeling is intense. There is no agreements in place. Any naval conflict in this area could rapidly escalate – so watch out for the economic impact of any such resource conflicts. The Spratly Islands are at the centre of this area. The recent spat with Japan be believe is just a pre-curser to wider conflict in this sea – particularly if a recession commences and governments wish to deflect blame overseas and/or get desperate for resources in these seas . It’s worth flagging as a trouble spot moving into 2013 – don’t be surprized if things go rapidly pear in Asia over the South China Sea.

South China Sea: One area to watch out for is the South China Sea. About 11 countries claim parts of this sea as their own maritime area – meanwhile China claims the whole area. This has been a festering issue for years and as China’s economic and military-naval force increases, more conflict in this area is almost inevitable. The strength of feeling is intense. There is no agreements in place. Any naval conflict in this area could rapidly escalate – so watch out for the economic impact of any such resource conflicts. The Spratly Islands are at the centre of this area. The recent spat with Japan be believe is just a pre-curser to wider conflict in this sea – particularly if a recession commences and governments wish to deflect blame overseas and/or get desperate for resources in these seas . It’s worth flagging as a trouble spot moving into 2013 – don’t be surprized if things go rapidly pear in Asia over the South China Sea.

Super-Rich Bail Out: When you look at the wider picture of the super-rich bailing out of risky countries – cash rich – wanting to find a safe haven for their riches – then it’s easy to see why West London property prices continue to boom. It’s becoming increasingly difficult for these people to hide from the tax man or their own governments – and probably the safest place to be is in UK prime real estate in a good quiet neighbourhood in London. Cash buyers coming from all parts of the globe as economic turmoil spreads. Calling these people super rich economic refugees is going too far – some of them are from toppled governments or have or had big business interests in countries in turmoil. Others are just sensibly diversifying their portfolio – they are probably buying gold and silver as well.

Global Directions: We hope this Special Report has given you insights into the direction the global and national economies will be heading. As they say, whenever there is a problem there is an opportunity. The problem is that the opportunities are getting fewer and more difficult to locate – but shifting to assets is clearly the way forward and out of fiat paper in these high inflationary declining times – with gold and silver being the real prize as this bull rerun gathers momentum – and eventually develops into a bubble as panic sets in 2013 to 2014.