452: Prospective’s on Gold

12-01-2012

China and Gold: In 2011 China was the world’s biggest gold buyer. China is also the biggest gold producer (or gold miner) in the world. By law, all Chinese gold has to stay in China – it cannot be exported. Meanwhile China continues to import vast quantities of gold albeit no-one really knows how much. China pegs its currency to the dollar. The Chinese strategy we believe is to amass as much gold as possible – then dump its currency linkage with the dollar and go it alone by backing their currency with gold. A new gold standard.

Mad On Gold: The Chinese are mad about gold – the government encourage all citizens to own gold. It has even set up vending machines where Chinese can buy gold. Not only is the central bank buying as much gold as it can quietly do, so are the citizens. They use their export revenue t o buy gold. Some people would describe this as cornering the gold market, but others would say it’s a sensible approach to global money printing and the flood of dollars hitting the markets. And it looks increasingly likely the Chinese are indeed positioning to peg the Renminbi RMB to the weight of gold – rather than the weakening US dollar. In doing so, the Chinese would claim to be the new economic super-power – rising above the US in economic prowess. Their commissioning of an aircraft carrier and increasing postures on South China Sea resources could be part of this play.

o buy gold. Some people would describe this as cornering the gold market, but others would say it’s a sensible approach to global money printing and the flood of dollars hitting the markets. And it looks increasingly likely the Chinese are indeed positioning to peg the Renminbi RMB to the weight of gold – rather than the weakening US dollar. In doing so, the Chinese would claim to be the new economic super-power – rising above the US in economic prowess. Their commissioning of an aircraft carrier and increasing postures on South China Sea resources could be part of this play.

Increasing Gold Reserves Required: The Chinese currently only have 10% of their foreign currency reserves in gold – a meagre amount considering their size and global economic importance. They will surely be addressing this in the next ten years. Meanwhile a historically prudent Portugal has 90% of its foreign reserves in gold – may be this is why despite it's deficits, Portugal remains out of the news. It's economy is nicely backed by physical gold. Imagine if China converted 90% of it's foreign reserves into gold, moving away from the dollar into gold – they look to be starting on this path.

Gold Suppression: The US government and Fed almost certainly try and suppress the price of gold to make the dollar look attractive – for bond and international investors. This indirectly helps the Chinese amass as much gold as possible at a cheap price. We think the Chinese are lying low – not announcing how much gold they really own – because they want to buy as much gold as possible at a low price – until the cat finally gets out of the bag – then of course the gold price in dollar terms will go ballistic. Most Gold reserves are held and are owned by Europe and the USA. The Chinese are trying to buy as much as possible using different hidden entities – with the strategy of shifting as much cheap gold as possible back to the “mothership”.

gold to make the dollar look attractive – for bond and international investors. This indirectly helps the Chinese amass as much gold as possible at a cheap price. We think the Chinese are lying low – not announcing how much gold they really own – because they want to buy as much gold as possible at a low price – until the cat finally gets out of the bag – then of course the gold price in dollar terms will go ballistic. Most Gold reserves are held and are owned by Europe and the USA. The Chinese are trying to buy as much as possible using different hidden entities – with the strategy of shifting as much cheap gold as possible back to the “mothership”.

Chinese Gold Production: The Chinese produce 300 tons of gold a year from their own mines. That’s as much gold as the UK has amassed in thousands of years. They then import an unknown quantity of gold on top. The Chinese are buying gold from the IMF. Since 2009 their gold holdings had risen by 75%. The Chinese only have 1.8% of their foreign reserves in gold. They report only 1054 Tons of gold as their reserves. However, we think they probably own about 3000 Tons by now - almost as much as Germany. But unlike Germany, 100% of their gold is stored safely on their own sovereign soil - unlike German gold. That’s very small compared with Germany and the USA at 73% and 76% respectively. They will need to keep buying huge quantities of gold to catch up.

Chinese Gold Miners: The Chinese own many largely concealed stakes in gold companies. China bought 111 Tons of gold from Hong Kong in 2011 for example – an entre-port for the mother-ship. Chinese gold reserves have not been disclosed since 2009. Expect something in the next few years to slip out about how much gold China owns. They might not actually divulge this, or even under-state what they own – so as not to raise attention. This is opposite to many countries that would probably like to over-state gold and reserves, to bolster their books and currency.

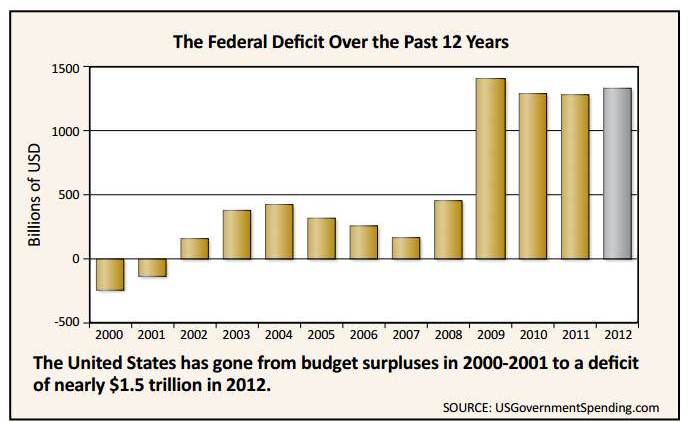

German Gold: It’s fascinating to see the Germans getting nervous about where their gold is stored. Years ago, before electronic money, central banks chose to store their gold in safe vaults in large banking areas – because bars were shifted around underground between vaults when currencies backed by gold were traded. Germany also housed its gold in the USA (New York), UK (London) and France (Paris) partly because they were forced to after WWII. The USA and UK would have wanted some way of constraining the Germans after the previous two world wars started in close succession in 1917 and 1939. Now the Germans are (quite rightly) very worried about where all their gold is – and whether it actually still exists – it might have been lent out or even shifted somewhere else – it might be rolled into an ETF. To say this is a thorny issue is an understatement. After all, the USA in 2002 sold gold bars to China and they were found to be made of Tungsten (gold plated) – note Tungsten is about 99% of the weight of gold (gold is four times heavier than iron), the Chinese had to drill holes in the bars to find this out – unfortunately grey matter came back from the drill-bit. 62% of German gold is housed in the UK and USA - though the UK sold a lot of their own gold to the Germans back in 2002 at record low prices, and have handed some back. But if the global economy  melts down and governments get disparate or a corrupt government seized power, the fear the Germans probably have is that their gold will be either confiscated, sold on, not be there or not be available for them anymore - be stolen. After all, it was back in 1956 when the US last audited their gold reserves – and they refuse to audit the German gold reserves it seems, or even their own gold. The Germans are putting on a very respectable politeness that they are not particularly concerned, but surely they must be petrified of losing their gold – particularly as they see the US deficit running at 8% of GDP, direct debts of $16 Trillion, unfunded liabilities of $75 Trillion and increasing indebtedness of the USA every year. Add to that the collapse of MF Global in New York when allocated gold accounts were used against all regulations. Clearly they want their gold back – and quickly. They seem to have struck a deal with the USA that the USA will send back a total of 150 Tons “for inspection” - 50 Tons a year for 3 years, but compared to their 3400 Tons total German gold reserves, this is not a meaningful amount given how close to a financial meltdown the US and Europe could be. Also, the Fed can of course send back the good gold, and continue to house what might be gold plated tungsten or non-existent gold. They can buy 50 Tons on the open market and send this to the Germans. Anyway, watch this space, because where everyone’s gold is – will likely become a bigger issue moving forwards when the paper financial debt bubble pops.

melts down and governments get disparate or a corrupt government seized power, the fear the Germans probably have is that their gold will be either confiscated, sold on, not be there or not be available for them anymore - be stolen. After all, it was back in 1956 when the US last audited their gold reserves – and they refuse to audit the German gold reserves it seems, or even their own gold. The Germans are putting on a very respectable politeness that they are not particularly concerned, but surely they must be petrified of losing their gold – particularly as they see the US deficit running at 8% of GDP, direct debts of $16 Trillion, unfunded liabilities of $75 Trillion and increasing indebtedness of the USA every year. Add to that the collapse of MF Global in New York when allocated gold accounts were used against all regulations. Clearly they want their gold back – and quickly. They seem to have struck a deal with the USA that the USA will send back a total of 150 Tons “for inspection” - 50 Tons a year for 3 years, but compared to their 3400 Tons total German gold reserves, this is not a meaningful amount given how close to a financial meltdown the US and Europe could be. Also, the Fed can of course send back the good gold, and continue to house what might be gold plated tungsten or non-existent gold. They can buy 50 Tons on the open market and send this to the Germans. Anyway, watch this space, because where everyone’s gold is – will likely become a bigger issue moving forwards when the paper financial debt bubble pops.

UK Gold or Lack Of It: Let’s switch to the UK. Our gold situation is as miserable as one can get in a western developed nation. Gordon Brown, when he was Chancellor, chose to sell 60% of the UK gold between 1999 and 2002 at record inflation adjusted low prices of $280/ounce (the price is now $1730/ounce). He lost the UK more than £30 Billion of value in the process and flooded the gold market at the peak of currency interest and lack of gold interest - driving prices down even lower during this time. Some people called it "Brown's Bottom". There is even speculation Brown was forced to sell the gold when Germany asked for their gold back - and he did not have it - so he dumped the gold into the market so they could pick it up cheaply. The UK gold reserves are now only 310 Tons, about ten times less than Germany’s with an economy 60% of the size. But worse still, the UK private and public sector debts run to about five times GDP, so it has little to back the banking system up with. It’s too late and costly to amass large gold reserves now – particularly as the UK deficit is so high and government borrowing continues to rise. The Bank of England (BoE) can always print money to buy gold – something that could be a good idea if the markets did not get wind of this – causing gold prices to move sharply higher. But the BoE show no signed of doing this. The UK economy is in a pretty grave state – and is very dependent on the financial wellbeing of the city if London. Regrettably, if the UK government is not able to kick the can down the road and keep the confidence of the international markets any longer, there could be a big run on the London UK Sterling currency markets and banks. British Gilts rates could rise sharply and interest rates for borrowers along with this.

60% of the UK gold between 1999 and 2002 at record inflation adjusted low prices of $280/ounce (the price is now $1730/ounce). He lost the UK more than £30 Billion of value in the process and flooded the gold market at the peak of currency interest and lack of gold interest - driving prices down even lower during this time. Some people called it "Brown's Bottom". There is even speculation Brown was forced to sell the gold when Germany asked for their gold back - and he did not have it - so he dumped the gold into the market so they could pick it up cheaply. The UK gold reserves are now only 310 Tons, about ten times less than Germany’s with an economy 60% of the size. But worse still, the UK private and public sector debts run to about five times GDP, so it has little to back the banking system up with. It’s too late and costly to amass large gold reserves now – particularly as the UK deficit is so high and government borrowing continues to rise. The Bank of England (BoE) can always print money to buy gold – something that could be a good idea if the markets did not get wind of this – causing gold prices to move sharply higher. But the BoE show no signed of doing this. The UK economy is in a pretty grave state – and is very dependent on the financial wellbeing of the city if London. Regrettably, if the UK government is not able to kick the can down the road and keep the confidence of the international markets any longer, there could be a big run on the London UK Sterling currency markets and banks. British Gilts rates could rise sharply and interest rates for borrowers along with this.

London and A Financial Crisis: The BoE has so far been able to convince markets that it has a reasonably credible plan to keep borrowing and deficits under control. It has been able to print money, feed this into the UK banking system to help prop banks up and suppress interest rates to near zero for the banks. The banks have then lent out at gig antic mark-ups – say 5% to mortgage borrowers, 8% to businesses and 25% to credit card holders (poorer people with debt problems – higher risk borrowers). The BoE’s ability to print money is dependent on the strength of Sterling and gilt rates. If Sterling declines sharply, imported goods prices rise and inflation rises and this would likely force the BoE to put up interest rates. Gilt rates would also rise. This would then put pressure on borrowers – who have got used to lower interest rates (some would say addicted) and many people would default – thence banks would go under quite rapidly. These infusions of printed money are only possible because Sterling remains fairly robust compared with other currencies. This is also because so many other countries are printing money – USA, Japan, China and European mainland countries are all printing. Over time, its a question of which country trips up first – which country is deemed by the markets to be the weakest – and thence their currency would come under pressure, rates rise and no amount of austerity measures would be enough to stop the country tipping into either a mild or a serious financial meltdown. The risks to the UK and London are quite high we believe. Though one point to make it that, if Sterling does decline sharply – because London is a play-ground of the super-rich, one might still find West London prime property prices keep rising because the super rich pile their cash into these lower priced assets. The UK is also in control of its monetary policy – so has reasonable control over tax, money printing, and interest rates. This helps the BoE steer the UK economy better than countries like Spain and Greece.

antic mark-ups – say 5% to mortgage borrowers, 8% to businesses and 25% to credit card holders (poorer people with debt problems – higher risk borrowers). The BoE’s ability to print money is dependent on the strength of Sterling and gilt rates. If Sterling declines sharply, imported goods prices rise and inflation rises and this would likely force the BoE to put up interest rates. Gilt rates would also rise. This would then put pressure on borrowers – who have got used to lower interest rates (some would say addicted) and many people would default – thence banks would go under quite rapidly. These infusions of printed money are only possible because Sterling remains fairly robust compared with other currencies. This is also because so many other countries are printing money – USA, Japan, China and European mainland countries are all printing. Over time, its a question of which country trips up first – which country is deemed by the markets to be the weakest – and thence their currency would come under pressure, rates rise and no amount of austerity measures would be enough to stop the country tipping into either a mild or a serious financial meltdown. The risks to the UK and London are quite high we believe. Though one point to make it that, if Sterling does decline sharply – because London is a play-ground of the super-rich, one might still find West London prime property prices keep rising because the super rich pile their cash into these lower priced assets. The UK is also in control of its monetary policy – so has reasonable control over tax, money printing, and interest rates. This helps the BoE steer the UK economy better than countries like Spain and Greece.

Japan: For many years, because Japan has exported such huge quantities of manufactured goods, the Yen has remained high and interest rates low. But with the tsunami, nuclear power plant closures, recession in car manufacturing, aging population, and recently budget deficits - the yen could take a severe knock in the next few months. The new government is threatening to print 3 Trillion Yen. This could cause the currency to crash and trigger a more general global crisis in the next six months. Watch out for Japan. The resource wars with it's neighbour China hardly make matters any better. These two economic powers tlook set to clash further as regional tensions rise over the South China Sea.

Bubbles: Throughout history, there have been bubbles and crashes, to name but a few in the last 30 years:

· Technology – Y2K bubble 1997 to 2000

· Credit bubble 1990 to 2008

· Oil price bubble 2005 to 2008

· House price bubble 2002 to 2007

· Private sector debt bubble 1990 to 2007

· Bond market bubble 1980 to ?

Smart investors: The super rich elite take cheap money, put their money into these bubbles – ride them up – then get out before the maximum mania-euphoria, then shift assets to the class that are in the doldrums, then ride this new bubble up. Financial paper assets look like a bubble – especially the bond market. Gold seems to be in the very early stages of a bubble, but it’s likely years away from the top in our opinion. The same is true of farmland and agriculture – they are in the early bull run stages of a bubble – but have many years left to run. One could argue that West London property prices look rather “bubblish” but we are not sure about this – if inflation hits hard, then these property prices will continue to rise – though the price might not keep up with underlying inflation.

Follow The Bubble: The bottom line is – to be a pure disciplined successful investor, you have to buy low and sell high. Buy in the doldrums and sell close to peak euphoria. It’s as simple as that. It’s just that not many people are skilled in spotting the bubbles then predicting when they will burst. It’s probably why you are reading this Special Report – to get some insights for yourself into this. Anyone that claims they are not looking for a bubble is probably not being realistic – because all people seek higher asset prices (and capital returns) in every investment they purchase, and every investment eventually forms some sort of moderate to severe bubble over time. The US Fed more than any entity has created huge bubbles all around the world by flooding the world with cheap dollars. This is why art work has seen gigantic gains. Rare wine prices have shot up. Why some houses in London cost £20 million. Why a new key for a Volvo costs £200 (the same price as a car in 1965). And a Starbucks coffee cost £5.

Investments and the Bond Market Bubble: Our steer is – try and amass physical gold and silver, avoid government bonds, make sure you have access to some cash if interest rates rise, and hold property. Eventually – as more money is printed – bubbles will appear in lots more different assets as central banks try and stop deflation. Stagflation is the order if the day. So over time, property prices should still rise, but on an inflation adjusted basis, continue a steady decline in most regions of Europe and USA. Cities and high end localities frequented by the super-rich will likely see prices continue to rise, off the back of the cheap money. But the mortgage debt in property will be devalued as currencies are devalued so your net worth will actually rise over time hold property. Taken in the long term, especially if central banks continue to keep a lid on interest rates, rental yields will remain strong. Rental demand should be reasonable as long as there is not a major recession and far higher unemployment – simply because the average person will not be able to raise money from banks for mortgages. They will be renting instead. Banks will only lend to the safest borrowers – many people rent, also because deposits are so large. Not a nice thing for society as a whole. However, it will encourage landlords to put their time into providing more rental accommodation, despite all the hassles with tenants, higher maintenance costs and fees, regulations, capital gains tax increases, and pressures from authorities. It might still be worth buying more rental properties despite these burdens. But the shear weight of burden will put many buy-to-let investors off and hence rental prices will rise further as more rental shortages occur. But the big risk will be a bond market collapse, then rapidly rising interest rates, then rental yields would be rapidly suppressed – go negative and many landlords could go bankrupt. That is why it is so important to watch the bond markets and interest rate movements. Central banks have continued to keep the lid on interest rates in all countries but Greece and Spain. But this might not continue for much longer as central banks lose credibility, and markets take the view that the sovereign capacity to pay off debts has reduced. The UK is exposed to this, just like France, Italy, USA, Japan and Spain.

in the long term, especially if central banks continue to keep a lid on interest rates, rental yields will remain strong. Rental demand should be reasonable as long as there is not a major recession and far higher unemployment – simply because the average person will not be able to raise money from banks for mortgages. They will be renting instead. Banks will only lend to the safest borrowers – many people rent, also because deposits are so large. Not a nice thing for society as a whole. However, it will encourage landlords to put their time into providing more rental accommodation, despite all the hassles with tenants, higher maintenance costs and fees, regulations, capital gains tax increases, and pressures from authorities. It might still be worth buying more rental properties despite these burdens. But the shear weight of burden will put many buy-to-let investors off and hence rental prices will rise further as more rental shortages occur. But the big risk will be a bond market collapse, then rapidly rising interest rates, then rental yields would be rapidly suppressed – go negative and many landlords could go bankrupt. That is why it is so important to watch the bond markets and interest rate movements. Central banks have continued to keep the lid on interest rates in all countries but Greece and Spain. But this might not continue for much longer as central banks lose credibility, and markets take the view that the sovereign capacity to pay off debts has reduced. The UK is exposed to this, just like France, Italy, USA, Japan and Spain.