485: Tightening of oil supplies leading to dangerous inflation - could trigger recession - property investor notes

09-08-2013

PropertyInvesting.net team

Oil Prices: Oil prices are now back at danger levels of $115/bbl. As we have previously advised, any oil price over about $110/bbl starts to close down the OECD economies because:

-

Oil prices feed rapidly into general inflation

-

Inflation puts upward pressure on interest rates

-

Borrowing costs rise

-

House prices fall

-

Disposable income drops

-

Currencies of net oil importing nations declines – further increasing inflation

-

Ensuing stagflation and economic slowdown puts pressure on unemployment

-

Borrowing costs rise further as tax revenues drop and deficits increase

The global economic growth is always strongly impacted by oil price – particularly in the net oil importing nations with high deficits.

US Economy Slowing: We expect the US economy to slow down further later in 2013. When economies start to suffer and hardship rises, countries often go to war, in part to deflect blame and attention from the economic hardships back home. They can also blame the slowdown on some external influences, giving out messages about needing to “do the right thing for humanity” by going to war. We see this manifested today in the US’s desperation to go to war against Syria – or the Syrian government. It will likely fan the flames of atrocities and lead to further knock-on conflicts within the region. I very dangerous strategy.

Oil Supply Disruptions: Despite the shale oil boom in the US driven by technology advances with fraccing in combination with horizontal drilling, the world oil suppliers are struggling to keep pace with demand. In China alone, another 70 million people each year start using oil of transport and home use.

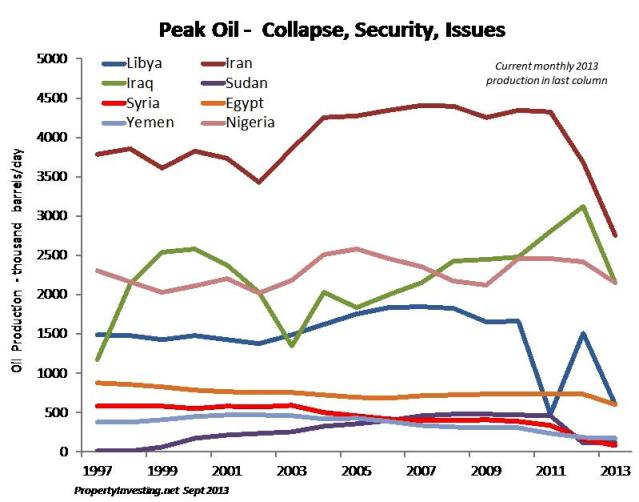

Let’s take a look at some countries with production issues:

Yemen – oil production started a steep decline in 2006 and the country has suffered severe economic and security problems ever since with sporadic production outages

Syria - oil production started a steep decline in 2006 and the country has suffered severe economic and security problems since 2011, oil production has crashed from 0.6 million bbls/day to a tenth of these levels.

Egypt - oil production started a steep decline in 2009 and the country has suffered severe economic and security problems since 2011 which have worsened as oil and gas production has been effected – a vicious circle of decline

Libya – just before Col. Gaddafi was deposed, the country was producing 1.6 million bbls/day at a steady rate – Libya now produces 0.25 million bbl/day after oil port strikes, security problems and insurgents shutting pipeline demanding payments etc. The economy has spiralled into a miserable depression as oil revenues have dried up and civil wars have started.

Nigeria – oil production is about 1.5 million bb/day, well under capacity of ~2.5 million bb/day – security issue, lawlessness and oil leaks are rife, with investment dwindling.

Sudan – production is on-off depending on negotiation between North and South Sudan after a bitter war led to break-up.

Iraq – oil production has plateaued at this time at around 2.3 million/day – back in 2010 production was projected to recover to 5.5 million/day as security improved. However, insurgency, car bombs and sectarianism has kept back oil production growth. Oil production is no higher than before the 2003 military intervention.

Iran – sanctions over nuclear enrichment have cause oil production to drop from 3 million bbl/day to around 1.8 million bbl/day with no end in sight

Supply Crunch on Horizon: These are only some of the lowlights. OPEC production is dropping and OECD countries are using up oil in storage at a rate of 2.2 million bbls/day – compared to demand at around 85 million bbl/day. A supply crunch is now well and truly on the horizon – it only needs one big producer to get into difficulties and the oil prices to sky-rocket/spike to $150/bbl. The situation is becoming grave. Especially as a US led war looks likely in Syria now that could or would likely fan out across the region.

The following key trends are taking place:

-

Increasing US light oil production and reducing oil imports

-

Decreasing European oil production and high oil imports

-

Increasing oil demand from China and most developing nations

-

Declining OPEC oil exports because of rising populations, rising consumption and security issues/wars stifling oil production rates

Overall – demand continues to increase at a higher rate than supply, leading to tightening of supply-demand and increasing oil prices.

Security – Production Interruptions: We are seeing Peak Oil for the time being in OPEC countries not because oil is running out, but because of wars, security issues, civil disorder and supply disruptions. If oil production rates cannot be kept up for any reason, then this can cause Peak Oil in a particular country or overall around the global if several countries have the same problems.

Cost of Extraction New Oil $80/bbl: Talk of oil demand dropping is rather overdone – indeed, it would at very high oil prices as this leads to recession and factories closing with higher unemployment and lower oil demand. So in a way, the world is struggling to supply low priced oil – new oil now needs a prices of at least $80/bbl to make it economic to develop because unconventional oil costs so much to produce – either oil shale, deepwater oil or ethanol from sugar/corn. Hence the oil prices is directly controlling the rate of global economic growth – this has always been the case and nothing has changed.

The war in Syria will not help of course, and the US response is likely to make matters far worse as Iran and other countries and sects get involved.

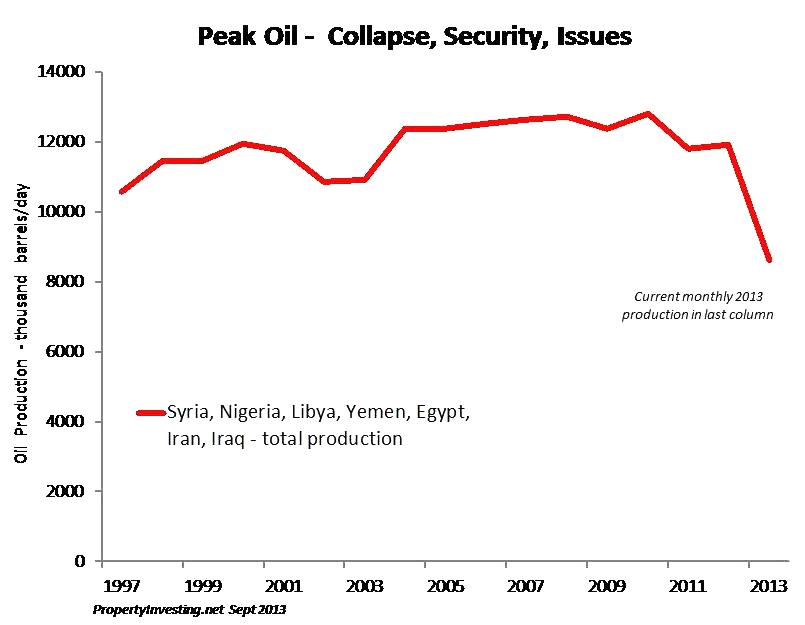

Security, sanctions and civil disorder have led to production disruptions that have caused on overall collapse in oil production in most of these countries. In summer 2013 this has led to a tightening of supply and increasing oil prices that will drive up inflation and could trigger another OECD recession.

Summation of all the countries showing overall collapse in oil production in summer 2013

Cost of Oil Exploration-Development-Production (full life cycle) - ranges

Conventional $1 - $40

Heavy Oil $50 - $100

Deepwater $20 - $80

Oil Shale $70+

Ethanol-Sugar $70

Key Points on Peak Oil

There is plenty of producible globally – it’s a question of how much it costs to produce and how fast this oil will flow

-

“Peak ‘Conventional’ Oil” was 2005 – since then, conventional oil production has been on a undulating plateau

-

Total liquids oil production has continued to rise – but only because of unconventional oil sources such as Heavy Oil, Deepwater Oil, Oil Shale, Ethanol and Natural Gas Liquids (a bi-product of expanding gas production)

-

As oil price rises, consumption drops as people cut back on driving and the economy goes into stagnation or recession

-

If oil prices stay high – this encourages new oil supplies to come on-stream

-

The system is self-levelling to s certain extent though with an overall increase price trend as extraction costs rise

-

OPEC would certainly be capable of increasing oil production rates considerably – but about 4-5 million barrels/day of oil production capacity is currently offline because of civil wars, security issues, sectarianism and worker strikes.

-

We have hit “Peak Cheap Oil” – liquid oil from now onwards will cost considerably more than the cost range of conventional oil – new oil supplies will cost >$80/bbl to make development economic – so it is very unlikely oil prices will drop below $80/bbl (at least not for any more time than a few months, unless there is a financial meltdown-crash and massive deflation)

-

Trillions of dollars-worth of printed currencies by the US Fed, BoE and BoJ have done their bit in driving oil prices from $10/bbl in 1999 to $110/bbl in 2013. This eleven fold increase in oil prices in 14 years has been caused by high cost marginal oil extraction costs, printed money and tightening of oil supplies along with strong demand from developing industrialising nations

-

The world is losing control of total oil production as some key oil exports struggle or collapse (e.g. Libya, Syria, Yemen, Egypt, Sudan, Iraq). With rising food costs, water shortages, massively increasing desert populations and the USA withdrawing from its role as “policeman of the world” – these security issues in this region are likely to intensify not improve and hence OPEC production and exports are likely to decline rather than rise in years to come.

-

A tightening of the oil market will create economic recessions as oil prices spike – this tends to control the pace of overall global economic growth. As oil prices drop, activity will pick up – then oil prices will rise, then economic activity will stall out once more.

-

Big net oil exporters like Kuwait, Saudi Arabia, UAE and Qatar will be able to afford subsidies for their expanding populations for the next few years – though pressures will eventually build even for these big producers as declining oil exports cause by high indigenous use and populations threatens their stability

-

Middle East countries that have hit national “Peak Oil” like Syria, Egypt, Yemen and Tunisia – that were used to oil revenues that then dried up – will come under increasing economic pressure and with this, more in-fighting will ensue. Countries that used to export oil then end up importing oil whilst having expanding populations usually collapse. The mixture of desert, water shortage, poor agriculture, and oil exports turning to imports is a particularly toxic economic mixture

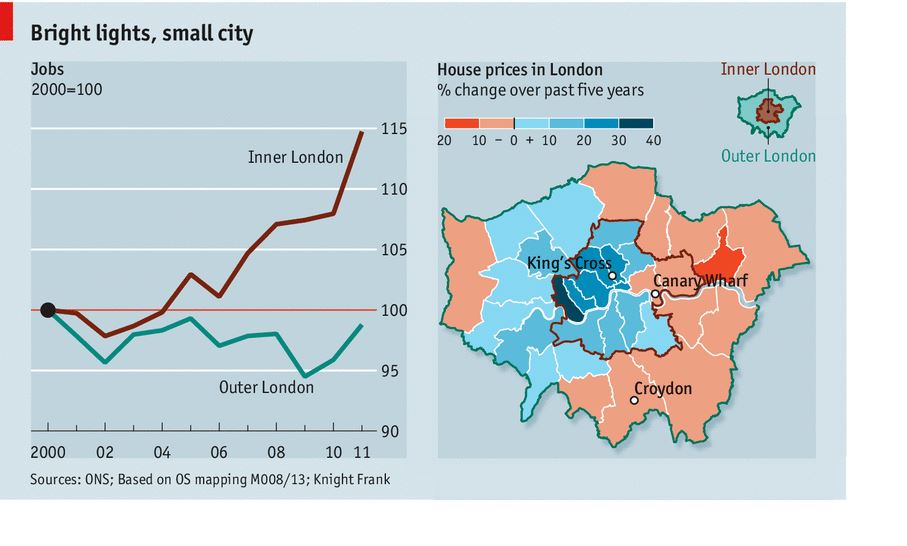

Property Investors: For property investors, uncertainty will increase towards the end of 2013. The perceived housing mini-boom in the UK is only really impacting London and SE England. The rest of the UK is largely unaffected. Since the Tories and Coalition will want to do well at the next General Election they likely have the following strategy:

-

As inflation rises, they will want Mark Carney and the Bank of England to keep rates low for as long as possible to boost growth

-

As oil prices rise, inflation rises, the BoE will do all it can to keep growth going – by printing currency, attempting to control interest rates downwards and stimulating the housing market

-

As the property market slows toward year end, the new Help to Buy Scheme will be a key part of a strategy to keep the housing market propped up

Uncertainty Increasing: The chance this all pans out nicely for the government moving into 2014 is most uncertain. There is a limit to how the BoE and Government can control the economy – and if markets get the upper hand and the bond market bubble pops – another crisis could break out by end 2013 leading to rapidly rising UK bond rates – this then effecting mortgage rates and house prices.

Property Price Gains: If the UK house prices continue to rise, the largest gains in the next year are likely to be in area peripheral Prime Central London – a first phase ripple effect. There would also be a ripple effect into low priced areas – nice towns and villages - between 30-70 miles from London as they start to look very cheap compared with Prime Central London prices. It’s unlikely this ripple will spread far and fast any time soon – places like NE England and central Wales are likely to stay stuck in recession for the next year. Overall since Labour lost power, these areas that were boosted by Labour and Gordon Brown’s public sector debt fuelled socialist spending, will stay in a depression. This is part of a rebalancing of public and private sector – but demographics in these more rural areas with close to zero population growth are also affecting housing demand. Despite all the talk of austerity, the UK public spending continues to rise at 3% a year – even more than inflation. The UK has not really cut spending – it may have cut services, but public sector employees have been getting pay rises of ~2.4% - well above private sector wage growth of 1.6%. Without this public sector spending, northern and rural areas would have suffered an even bigger recession/ depression. What we are saying here is that it could get a lot worse if big cuts were actually implemented rather than just talked about.

Courtesy the Economist and ONS. Shows how only the prime London property prices have risen in the last five years - other poorer areas are still languishing.

Help to Buy: A mainstay to the Coalition strategy to keep house prices propped up before the next election is the January introduction of the Help to Buy scheme targeting used properties this time – making it far easier for younger people to purchase properties under-written by government subsidies. Without this by end 2013, property price could start to slide again.

Area Improvements: For property investors, a few key trends to follow to gauge the faster capital growth areas:

-

Infra-structure developments – e.g. Crossrail, London Overground, Football Stadiums, new roads-rail

-

Jobs Growth – e.g. M4 corridor, Tech City in Shoreditch London, Chiswick Park, Canary Wharf, City of London, West End.

-

Gentrification – e.g. Hackney, Lambeth, Wandsworth, Shoreditch-Whitechapel.

-

Crossrail hotspots – e.g. Ealing, Tottenham Court Road, Farringdon, Acton

-

New projects – e.g. Earls Court, Nine Elms, South Bank, Tech City, Battersea Power Station, Chiswick Park

-

Regenerating Northern Cities – e.g. Salford, Leeds, Birmingham Jewelry Quarter

Areas to avoid are probably those with planning issues hanging over the area – for instance Heathrow and along the HS2 proposed rail line.

Northern Stress: It’s worth pointing out that when the next down-leg in the economy comes, it’s likely to be the north again that is more severely hit because manufacturing would suffer and the demographics are far less strong. In higher oil price inflationary times, the rich tend to get richer because they own assets that inflate and their debts are destroyed rapidly. The poor tend to suffer from the effects or low savings rates, high food and fuel costs, public sector cut-backs, low income growth compared to price inflation. It’s now been six years since the last recession in London, so we are due for another one – and by hook and by crook – the government will try and prop things up until the next Election in ~May 2015.

Migration: As the UK has become an increasingly global country – with huge numbers of migrants into the country, this has kept a lid on wage inflation for the lower end of the employment market. This has helped the Bank of England to keep rates lower than they normally would be able to – but it has had the negative effect of driving inefficiencies in public and private sector capital allocation whilst seeing the average-lower wage growth being severely suppressed in the UK. Wage growth is running at about 1.6% in the private sector – whilst inflation has been running at a claimed 2.6 to 3.5% for many years. Real inflation is actually about double these levels – because the inflation basket is skewed and changed regularly and does not really reflect the average basket for a normal person. So real disposable incomes has been in decline for many years now – at least six since the crash of 2008 – and this is set to continue as inflation runs at well above wage growth and negative savings rates continue.

had the negative effect of driving inefficiencies in public and private sector capital allocation whilst seeing the average-lower wage growth being severely suppressed in the UK. Wage growth is running at about 1.6% in the private sector – whilst inflation has been running at a claimed 2.6 to 3.5% for many years. Real inflation is actually about double these levels – because the inflation basket is skewed and changed regularly and does not really reflect the average basket for a normal person. So real disposable incomes has been in decline for many years now – at least six since the crash of 2008 – and this is set to continue as inflation runs at well above wage growth and negative savings rates continue.

Planning System Failing: So crudely speaking, migrates into the UK tend to keep a lid on inflation, create lower interest rates, lower mortgage rates and this feeds through to higher house prices and asset prices. The added housing demand will also drive up rental prices and house prices. The planning system has failed to keep pace with inflation for decades now. The UK should be building about 250,000 homes a year just to stand still, but in the last 6 years, net new UK homes built have been in range 60,000-100,000 a year – a miserable number that helps drive property prices higher, particularly in London and the SE which are experiencing a population boom. Just to remind you that London’s population as risen by 800,000 in the last 8 years, and we project the population to increase a further 800,000 in the next 8 years. This is partly to do with net migration, less people leaving and the cosmopolitan population having a far higher fertility rate compared with 25 years ago. There is both a housing crisis and a primary schooling cris is that shows no signs of easing with the current policies in place.

is that shows no signs of easing with the current policies in place.

Shoe-Box Homes: Let’s also remember the size of homes in the UK are about 60% of the size in other crowded nations like Denmark and Holland. UK citizens have to put up with being crammed into shoe-boxes despite only 6% of the area being urban. This hardly helps lead to healthy lifestyles, social coherence and happiness. Homes continue to get smaller, gardens smaller, and transportation systems more crowded. But we cannot really see any improvement in the standard of living for the vast majority of individuals. The elderly savers are wiped out by inflation. The young have high unemployment, weak jobs prospects, huge student debts and need struggle to raise deposits to buy shoe-box homes. Any new development is shut-down by Nimbyism – examples are the HS2 Rail, Heathrow expansion, other airport expansion, road building, home building. A classic example is the referral of the Shell Centre redevelopment of the desperately ugly South Bank complex by the housing Minister despite all other approvals going through. These reason being – it might be seen behind County Hall building far off down-river from the Westminster Parliament building.

Preventing a Slowdown: So for London and SE England, because the Tory Coalition will do everything in their powers to keep the UK economy from tipping back into recession, the net beneficiary will be London – partly because if London is allowed to sink into stagnation, the rest of the country will be in a depression. It’s only by creating strong growth in London that this will ripple out into the provinces into moderate growth or at least preventing recession – particularly as manufacturing and public sector growth is either weak or in decline.

We hope you have found this Special report helpful to frame your investment decisions and give some insights into how tightening of oil supplies, policies, inflation and economic growth impact UK property investment. If you have any queries, please contact us on enquiries@propertyinvesting.net