491: Technology Revolution - quietly changing the world

10-31-2013

Technology Revolution: There is a technology revolution happening in the USA that is completely changing the global dynamics of the energy industry, and with it shaping geo-politics and security pressure points. Only in the next 1-2 years will enough information be collected to see if this tre nd will continue or whether it’s been a short term change only.

nd will continue or whether it’s been a short term change only.

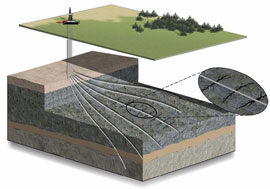

Fraccing and Horizontals: The technology in question oil production from shale deposits using horizontal wells with multiple hydraulic fracs. Ten years ago, a typical shale-gas well would have a horizontal section of 1000m and three fracs. But some of the recent shale-oil wells drilled have 2500m horizontal sections with 30 fracs – with 6-8 wells drilled from one location in a star shaped pattern. The efficiency gains and lowering of units costs has changed the break-even cost of oil-shale from about $80/bbl to lower than $30/bbl in some instances. These costs are often lower than Deepwater oil production and mot much higher than Russian oil production costs. It might surprize you that fraccing is not a new technology – the Americans were fraccing wells back in the 1950s. Horizontal wells are exactly new either – the first horizontal wells were in the 1980s. But the combination of long deep horizontal wells with say 10-30 fracces placed per well is new, as is the production of light sweet crude from low permeability sand and carbonate streaks within shale using these fracs as conduits for oil production.

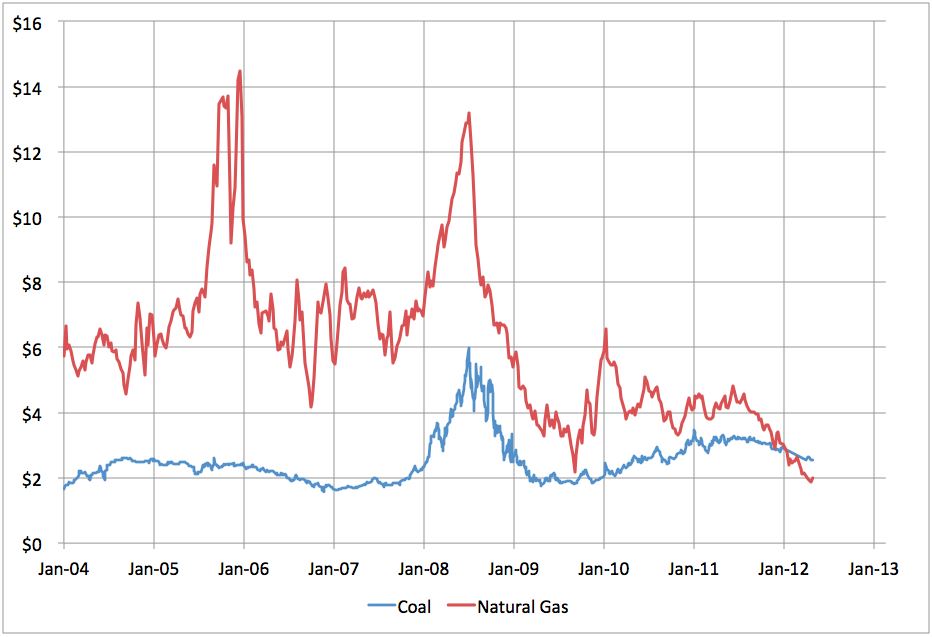

US coal and gas prices dramatically lower as shale-gas and shale-oil boom improves economics and drives overall prosperity - lowering costs for consumers and industry. Wholesale gas prices are now 3 1/2 times lower than those in the UK.

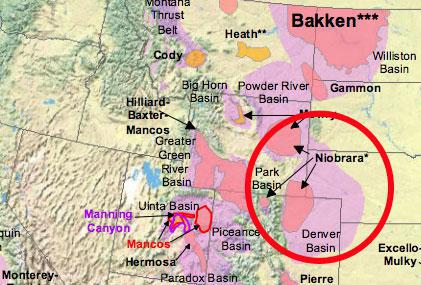

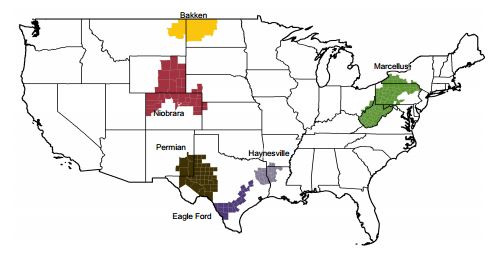

How Long Before The Decline?: New oil production is coming on stream at about 70,000 bbls/day whilst existing oil wells are declining at about 50,000 bbls/day in two key growth areas – North Dakota “Bakkan” and Texas “Eagle Ford”. The big question no-one knows yet is whether the 2.5 million bbls/day of extra oil that the USA is now producing compared with 2007 will continue to rise, plateau off or go into decline in the next few years. It all depends on the combined decline rate of thousands of new wells – how long they continue to produce at reasonable rates or not. Not enough data has yet been collected and analysed to show a conclusive trend.

Possible Oil Price Drop: If oil production continues to increase and then this drives global oil prices down, the sceptics would say this will slow shale-oil drilling as it becomes sub-economic. But if the whole process gets very efficient, as is possible in the USA - which is the birthplace of the oil industry – then these wells could still be drilled if prices dropped below $60 or $50/bbl. But don’t be surprized if when oil prices drop to $50/bbl, a war or some major security issue will break out – causing the price to go up again.

Other Basins: Other large shale-oil basins have hardly been explored up until now, so the upside is huge – the Marcellous formation has massive potential, but we wont know how productive this formation is until more drilling and fraccing have tested it. But many people think the best well locations and parts of the US oil shale basins have already been drilled up. We sit on the fence – we don’t have an answer yet. But the upside for the USA is that it continues to grow its oil production so high, it actually starts exporting oil around 2022. The chances of this are small, but it’s certainly possible. It’s quite likely though that by 2020 the USA will be close to energy independent in combined oil/gas/coal/nuclear. Only time will tell if this upside scenario plays out.

Other Basins: Other large shale-oil basins have hardly been explored up until now, so the upside is huge – the Marcellous formation has massive potential, but we wont know how productive this formation is until more drilling and fraccing have tested it. But many people think the best well locations and parts of the US oil shale basins have already been drilled up. We sit on the fence – we don’t have an answer yet. But the upside for the USA is that it continues to grow its oil production so high, it actually starts exporting oil around 2022. The chances of this are small, but it’s certainly possible. It’s quite likely though that by 2020 the USA will be close to energy independent in combined oil/gas/coal/nuclear. Only time will tell if this upside scenario plays out.

Property Investment Impact: So why is this so important for the property investor, global economics and social aspects?

-

If the USA is able to produce enough oil to make itself self-sufficient and also drive the oil price down in the process it will have huge ramifications all around the world:

-

First its balance of payments deficit will drop dramatically – by $500 billion a year

-

The value of the US dollar would likely strength as it became a true petro-currency once more

-

The requirement or need for the USA to mount global military excursions would diminish – particularly in Middle Eastern areas

-

The USA could re-trench from being the policeman of the world – this is most likely to make the world a more dangerous place outside the USA

-

The USA could become far less confrontational – and leave the Middle East to its own devices

Disaster: Low oil prices would spell disaster for many oil exporting nations in the Middle East – for instance, Saudi Arabia now has a break-even budget of about $125/bbl – less than this they have to go into budget deficit. The country’s population is exploding and higher unemployment and less subsidies would probably lead to social unrest and potentially the family run oligarchic autocracy ending in some shape or form.

Iran-Iraq: Iran could further destabilize as could Iraq – both countries strongly dependant  on oil exports for revenues for social programmes. Sectarian strife across populations in the Middle East from Syrian, Levant, Saudi, Iraq and Iran would likely worsen as subsidies were pulled because of low oil prices. There are so many tribes and sects that only the local populations understand the dynamics amongst these groups.

on oil exports for revenues for social programmes. Sectarian strife across populations in the Middle East from Syrian, Levant, Saudi, Iraq and Iran would likely worsen as subsidies were pulled because of low oil prices. There are so many tribes and sects that only the local populations understand the dynamics amongst these groups.

USA Hands Off Approach: A hands off approach by the USA would probably worsen turbulence – as regimes changed – in a similar way to what happened in Egypt when the USA announced that their 20 year ally Mubarak “should leave as soon as possible” after some early riots during the Arab Spring.

Self Sufficiency: Back in the USA, if the country truly became self-sufficient again in oil (as well as starting to export gas) then it would create millions of jobs, boost the economy and certainly help boost house prices. This technology revolution started around 2005, and has been expanding for 8 years now – some people believe this shale-oil boom is a bubble that will bust. But at this time, it shows no signs of slowing – its remarkable the speed of oil production growth from onshore oil shale and shale-gas deposits.

Obama Saved By Flood of Oil: Just as the financial crisis hit the USA in 2008 and Obama has struggled ever since with a money-printing binge, high deficits and political intransience, quietly his government have been saved by this innovative private sector growth splurge. It demonstrates o nce more the ingenuity of the US average private sector people in times of hardship – they really “get after it” if they see an opportunity. No less so than in Texas – where the mere sniff of oil will bring out the drilling rigs. Hat’s off to those people for creating wealth, jobs, reducing the USA’s reliance on oil imports from unfriendly nations and reducing the deficits.

nce more the ingenuity of the US average private sector people in times of hardship – they really “get after it” if they see an opportunity. No less so than in Texas – where the mere sniff of oil will bring out the drilling rigs. Hat’s off to those people for creating wealth, jobs, reducing the USA’s reliance on oil imports from unfriendly nations and reducing the deficits.

Changing Dynamics: Quietly Russia must be worried, along with Saudi Arabia. They have been overtaken by the USA in oil production and gas production. Russia needs $115/bbl to balance its books, so if the oil price is driven down to $50/bbl it would spell economic turbulence for Russia – just like it did in 1986 when a sudden drop in oil prices caused by Saudi turning on the taps drove oil prices down from $35/bbl to $7/bbl and precipitate the collapse of the Soviet Empire – a Ronald Reagan orchestrated strategy in concert with the Saudis that is thought to have ended widespread communism at the time (because oil pumping-pipeline costs were $10/bbl).

High Oil Prices Needed By Big Oil Exporter: One of the problems we see is that the big oil exporting nations like to have high oil prices – they need them high. One of the ways of driving oil prices up it to create insecurity, uncertainty and conflict, even if this is just rhetoric, talk. Regrettably a nice stable secure world with high growth in oil importing nations and low oil prices spells disaster for their economies – it’s probably a sub-conscious vested interest, but the more negative rhetoric they can produce and scare stories, the higher oil prices will be and the less likely their governments will be turfed out by social unrest – in countries like Iran, Iraq, Saudi, Venezuela, Kuwait, Libya, Russia, UAE and Qatar – the big exporters. Many of these countries – like Qatar, Saudi. Kuwait and UAE are wealthy – only through high oil prices. But their Achilles heal is their gigantic population growth, lack of water and reliance on high oil prices for social spending and civil servant jobs to keep people of the streets. Low oil prices may help Syria, Tunisia, Egypt and Jordan that have oil imports and declining oil production, but interference from the big exporters probably will not help.

up it to create insecurity, uncertainty and conflict, even if this is just rhetoric, talk. Regrettably a nice stable secure world with high growth in oil importing nations and low oil prices spells disaster for their economies – it’s probably a sub-conscious vested interest, but the more negative rhetoric they can produce and scare stories, the higher oil prices will be and the less likely their governments will be turfed out by social unrest – in countries like Iran, Iraq, Saudi, Venezuela, Kuwait, Libya, Russia, UAE and Qatar – the big exporters. Many of these countries – like Qatar, Saudi. Kuwait and UAE are wealthy – only through high oil prices. But their Achilles heal is their gigantic population growth, lack of water and reliance on high oil prices for social spending and civil servant jobs to keep people of the streets. Low oil prices may help Syria, Tunisia, Egypt and Jordan that have oil imports and declining oil production, but interference from the big exporters probably will not help.

Shale-Oil Progress: We will continue to report on progress on shale oil in the USA since it has potential to completely change the energy game and with it strength the USA dollar, increase real estate prices and stabilise the US finances in years to come – if this growth trend continues. US manufacturing will also get a big boost from low energy prices as industry converts to cheap gas – at $3/mmbtu – that’s 3˝ times cheap the UK gas. This will drive growth in petrochemicals, fertilizer, plastics and associated industries – whilst supplying cheap power for auto and other industries. It will allow Obama to continue to fund his social programmes and support low interest rates – because the oil and gas production should provide some support to the US dollar despite the gross abuse of the currency from the Fed’s gigantic money printing policy.

Emissions: For all those people that are concerned about the global warming aspects of this US shale-gas and shale-oil boom , the simple fact is that – since it started in 2007, the USA has quietly dropped it’s CO2 emissions 35 times more than Germany in that time. Even though Germany has spent huge amounts on renewable energy, its CO2 emissions have gone up – because they are burning more coal (after shutting nuclear plants). Meanwhile the US has switched away from coal to clean gas – supplemented by some wind and also dropped its oil consumption significantly. What we are saying is – shale-gas (switching away from coal) is very beneficial both economically and environmentally.

, the simple fact is that – since it started in 2007, the USA has quietly dropped it’s CO2 emissions 35 times more than Germany in that time. Even though Germany has spent huge amounts on renewable energy, its CO2 emissions have gone up – because they are burning more coal (after shutting nuclear plants). Meanwhile the US has switched away from coal to clean gas – supplemented by some wind and also dropped its oil consumption significantly. What we are saying is – shale-gas (switching away from coal) is very beneficial both economically and environmentally.

Hugh Benefits: The low priced oil and gas I the USA will keep a lid on inflation, keep the pressure off interest rates and with it – real estate prices should rise. Employment would be stronger and manufacturing would benefit.

Peak Oil Decline Disaster: Of course, if the oil and gas production peaks and goes into reverse rapidly, the opposite is likely to happen. The dollar would crash, interest rates would rise, unemployment would rise, deficits would rise and social disorder would increase. End 2013, its now looking increasingly like shale oil and shale gas will save the day for the US economy and finances – a gigantic turnaround only possible from the innovative technological developments of horizontal multiple fracced wells in the Bakken and Eagle Ford shale deposits. Hat’s off for the US ingenuity and dynamic entrepreneurialism once more!

Property Investment Opportunities: For the property investors in the USA, where are the places most likely to see real estate prices rise – if this shale-oil and shale-gas boom continues? Th ey are the regions that currently have to growth in the oil production and drilling activity – where economic wealth and activity are highest - these areas offer some excellent investment opportunities for both asset price rises and rental price rises in cities like:

ey are the regions that currently have to growth in the oil production and drilling activity – where economic wealth and activity are highest - these areas offer some excellent investment opportunities for both asset price rises and rental price rises in cities like:

* Midland – Texas*

* San Antonio – Texas

* Austin - Texas

* Dallas-Fort Worth - Texas

* Houston - Texas

* Williston– North Dakota*

* Bismark – North Dakota

* Operational town-city – excellent rental demand for high paid rig crews and oil service workers, requiring good quality accommodation for rotational working.

Property Investors Oil Shale Boom - can use this map to determine the areas where property prices will boom as the shale-oil and shale-gas revolution continues. West Virginia has the whole state underlain by the Marcellus Shale - we prediction property prices to rise robustly in West Virginia in the next few years. It's really simple to predict property prices rising with this geological map....follow the horizontal shale fraccing boom is our steer.

Booming US Oil Provinces: As the US economy struggles to stay out of recession, these areas are set to boom as high oil prices and the huge levels of drilling and oil services related activities drive these economies. Texas has not seen such a boom since the mid-1980s – it’s taken 30 years and the good times are finally back. It’s been even longer for North Dakota. This desperately remote state had the lowest property prices of any state back in 2003 – ten years later the NW part of the state is booming – all rooms sold out – there just in not enough accommodation for all the rig crews operating in the area. Of course there has been a building boom trying to cater for the influx of workers – drilling horizontal fracced shale oil wells. Take a look at the oil production profiles.

We hope this Special Report has given you some insights into how the shale-gas and shale-oil boom is charging world geopolitics, and is likely to have a big impact on real estate prices in places like Texas and North Dakota. If you have any questions or queries, please contact us on enquiries@propertyinvesting.net