528: Dollar Decline Through 2015 – Reasons and Impact for Property Investors

01-25-2015

Dollar Decline: From around March 2015 we expect the dollar to start a (likely gradual) decline in value against a basket of global currencies that will:

· Increase the price of oil in dollar terms

· Increase the price of gold and silver in dollar terms

· Increase the US global manufacturing competitiveness for exports

· Give a boost to the US inflation rate and employment levels after six months.

Reasons: The reason why we think this, is that the US dollar has had a particularly good run because of:

· Other region’s rather miserable economic performance

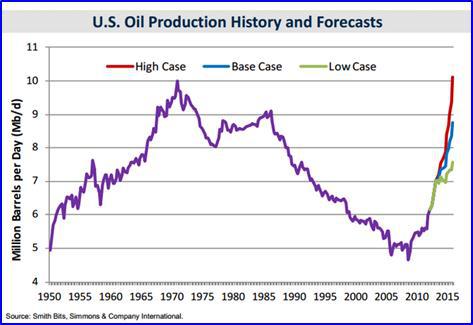

· Five years of shale-oil production and discoveries that have boosted the dollar as a petro-currency

· The anticipation of higher interest rates, the mirage of real gro wth and Fed announcements have lulled the market into this expectation

wth and Fed announcements have lulled the market into this expectation

· Tensions and security in Russia-Ukraine and the Middle East that have boosted the US dollar as a so called “safe haven”

Partly trigged by gigantic programmes of Euro printing and Yen printing, we expect the Fed to see the US economy slowing and stock markets looking turbulent in the next few months. The Fed will then respond with its own dollar currency printing scheme – to increase its balance sheet and flood the world with more dollars. This will then create further asset bubbles in the course of the next few years around the world.

Interest Rate Expectation: The key message for US and UK property investors is – interest rates will not go any higher in the next year and expect to see further currency printing programmes that will prop the economies up. The US is able to print as many dollars as it wishes as long as people believe in the dollar – and they seem to at present only because there are no good alternatives (read continued European economic woes and Japanese woes) – and also because the USA has found billions of barrels of oil in shale in the last seven years that have changed the game on the oil-energy scene.

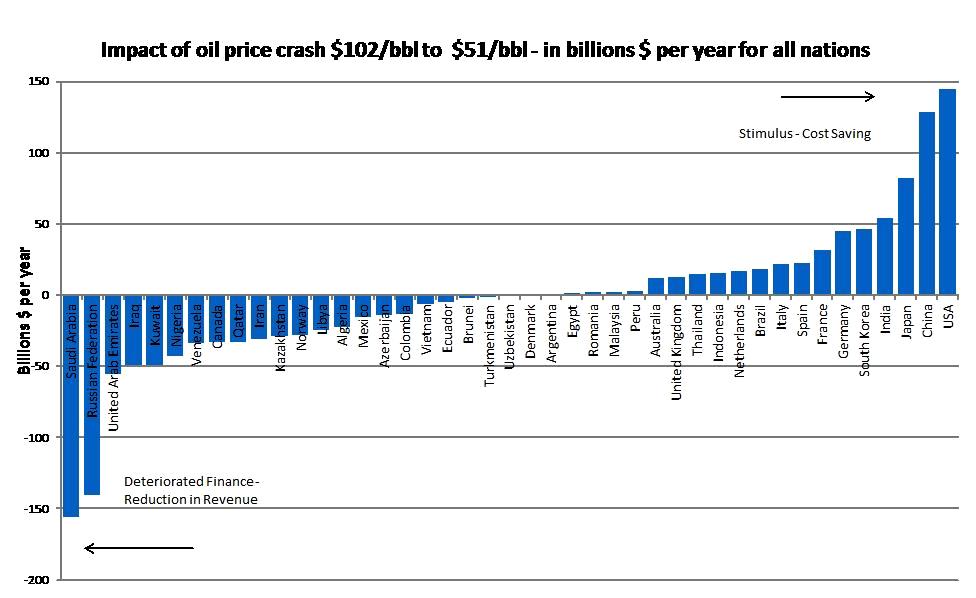

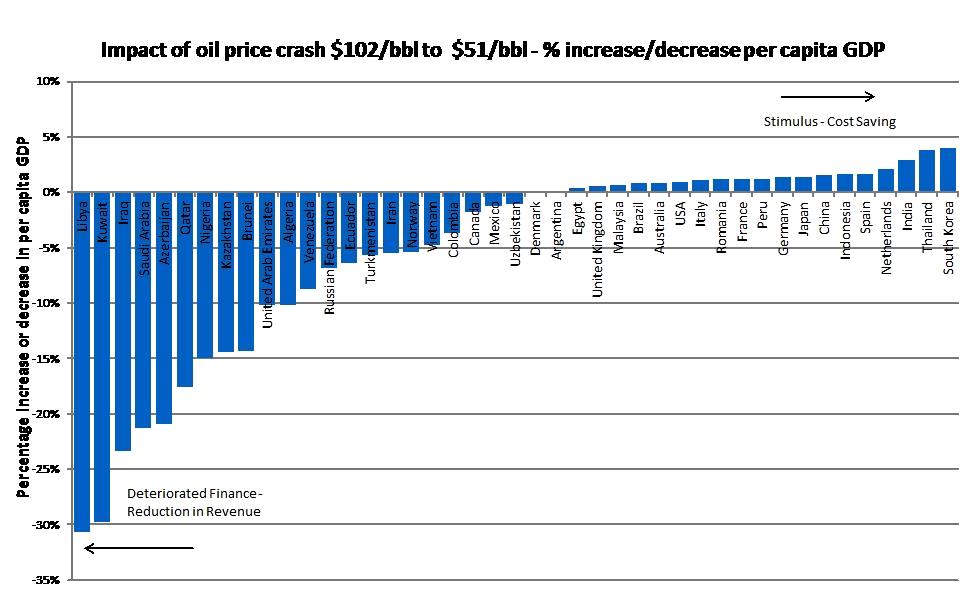

Oil Price Boost: The low priced oil – having crashed from $110/bbl in June 2014 to $48/bbl today, will certainly help all oil importing economies like the UK, US, China, Japan and most of western European nations, but markets are genuinely concerned the reason for the oil price drop is because the world is entering a global recession. This massive price drop – worth $1.2 Trillion dollars in oil revenue a year – is likely to be enough to stimulate oil importing economies along with the currency printing to keep them out of recession. This is like a giant tax cut for oil importing nations (see the table at the end of this Special Report).

Currency is not Money: It’s worth noting we refer to the Dollar, Pound and Euro as a currency – not “money”. The reason is that any notes or currency that can be “printed” either on paper or electronically from “thin air” is fiat, a fiat currency. Money is something that holds its value and is tangible. Hence gold is money but the dollar is not – it is a currency – very different albeit still it has value of course. This value fluctuates with other fiat currencies – not least the Yen, Euro and Pound.

Pound Sterling Between Dollar and Euro: For UK property investors, one normally sees the Pound Sterling fluctuating between the fortunes of the Dollar and Euro – partly be cause the Bank of England is able to set interest rates, regulate currency printing, guide export-import growth, deficits and inflation to hedge between these two currencies as the UK’s big two trading blocks. The Bank of England likes to see a fairly strong Sterling to prevent inflation and keep interest rates down whilst keeping it low enough to stimulate exports, manufacturing and financial-services competitiveness. It’s a balance – albeit control can be lost easily if the market take a disliking to the currency like they did at the end of the last Labour government and ensuing financial crisis caused by high spending and taxation and rising unemployment in 2009. At least the Bank of England retains power over interest rates since the UK is of course, not part of the Euro currency.

cause the Bank of England is able to set interest rates, regulate currency printing, guide export-import growth, deficits and inflation to hedge between these two currencies as the UK’s big two trading blocks. The Bank of England likes to see a fairly strong Sterling to prevent inflation and keep interest rates down whilst keeping it low enough to stimulate exports, manufacturing and financial-services competitiveness. It’s a balance – albeit control can be lost easily if the market take a disliking to the currency like they did at the end of the last Labour government and ensuing financial crisis caused by high spending and taxation and rising unemployment in 2009. At least the Bank of England retains power over interest rates since the UK is of course, not part of the Euro currency.

More of the Same Printing: The whole global debt fuelled economy is precarious, volatile and unpredictable, but what we now see is:

· No interest rate rises in the strong developed economies because of stagnation – and partly because of demographics – an aging and often stagnant or declining population (e.g. Japan, Spain, Italy)

· Global markets preferring the debt of western developed nations despite this lack of growth – thinking at least they will get their “money back” through central bank bail-outs and bond purchases etc

· Massive stimulus to keep the show on the road in the form of three pillars: 1) abnormally low interest rates; 2) currency printing; 3) lower oil prices. Frankly – it’s almost impossible to get any more stimulus than this to keep the debt fuelled economies afloat and thence giving the impression of real growth. It’s like having a patient in life support but the patient is stable with massive infusions of drugs. The drug in this case is printed currency.

Property Investors: The impact for property investors is:

· Continued low interest and mortgage lending rates

· Continued low wage growth

· Increasing price/earnings ratios for wages/house prices

· The poor getting poorer – many only being able to afford rental property

· The rich – people with “real assets” like property, gold, silver and artwork – getting richer

· A continuation of the cycle started in 2008 when central banks began to bail out their “rich buddies” – and hence creating an elite cadre of super-rich private business people – where 1% of the population owns 50% of the assets. In another ten year’s time this is likely to be more like 0.5% of the global population own 50% of the asset.

Taxes and Super Rich Elite: Whilst Central Bankers and Politicians from both the left-labour-social-democrat and right-conservative-republican sides – give the impression that currency printing is helping the lower and middle classes, in fact far from it, it helps the super-rich and takes from everyone else. This is because savings rates for the “normal person” and pensioners are destroyed, employee wages remain under pressure, taxes on the middle class increase and food-fuel and rental prices rise sharply.

Taxes On Printed Currency: Furthermore, when deficits rise, governments then “take back much of the printed currency” in the form of higher taxes on the middle classes. For property investors, it’s a fairly  tough world, but at least property investors own real assets and the asset prices rise sharply. Despite added tax burdens – people with large portfolios in such a low interest rate currency printing environment should do quite well in the long term. Objectively, despite all the complaints, that’s probably the reality.

tough world, but at least property investors own real assets and the asset prices rise sharply. Despite added tax burdens – people with large portfolios in such a low interest rate currency printing environment should do quite well in the long term. Objectively, despite all the complaints, that’s probably the reality.

It’s important though to avoid investing in countries and regions that have:

· Low population growth – stagnating micro-economies (poor property and rental demand)

· Countries that might suffer from a very sharp currency decline (e.g. Russia in mid-2014, Greece if they exit the Euro, Spain if they suffer economically or the Euro breaks up, Italy because of poor demographics, Japan because of poor demographics)

More Printing – Strategy For Property Investors: The continued currency printing escapades point to this strategic direction for property inventors – please take note because this is key – as long as the whole dollar based financial system does not crash into oblivion (and even if it did, there might be hyperinf lation and that might not be so bad for property investors with real assets) - it’s important to:

lation and that might not be so bad for property investors with real assets) - it’s important to:

· Invest in cities-regions with high population growth with a high proportion of the super-rich living in the areas – benefit from some of the “tickle down”

· Invest in cities with expanding business and small public sectors

· Invest in safe cities in secure (non-war torn) areas – far from security issues-troubles

· Invest in cities that attract highly educated international migrants that want to set up business, are highly motivated and want to prosper in the private sector

· Invest in cities with low building levels and high demand for property and rentals

· Invest in cities that attract the super-rich with currency printing (zero cost currency for the super-rich) and fairly low taxes and regulation

· Invest in cities that are not currently exposed to high oil prices – that are likely to boom because of the lower oil prices

Super Cities: Some of these cities that seem to fit this bill are:

· London (as long as the Tories form the next government, not Labour)

· New York

· Munich

· Geneva

· San Francisco

· Luxembourg

· Monaco

· Shanghai (as long as the Chinese economy and real estate bubble do not implode)

· Mumbai (Indian economy should perform well in 2015-2016)

Cities to Avoid

Cities to Avoid

· Houston, New Orleans

· Aberdeen

· Olso

· Calgary

· Moscow

· Tehran

· Dubai

· Cape Town

· Any rural area or city exposed to security issues and low oil prices

Upside Opportunities: For high risk but potentially massive upside real estate areas – for the global investors – two cities spring to mind – both in their infancy but could potentially see ten-fold increases in property values:

· Havana (Cuba)

· Rangoon (Burma)

Both these cities are opening up for the first time to dollar/US based investors as sanctions end and more normalised relationships develop. Of course very risky, but with low oil prices (these countries do not produce oil) and flooding in of dollars – the property prices are likely to shoot up in the next five years – like they did in Vietnam and China around 2001.

Middle East Risk: We would avoid any property investment in the Middle East that looks likely to see their regional economy suffer from $1 Trillion per annum less oil revenue due to the decline in the oil prices – that looks set to continue for the next few years. Furthermore the ISI S and factious security issues have increased risks over the last few years.

S and factious security issues have increased risks over the last few years.

Eastern Europe: We would also avoid investment in Russia, eastern European “fringe” countries and southern European countries. We would definitely avoid investment in North and West African countries due to the massive increase in security concerns in the last few years and lower oil prices.

US Economy: For the time being, despite the US economy being built on sand – at least the Americans are highly innovative, hardworking, employment participation is very high (both men and women of all ages work) and they have gas-oil-coal reserves and massive agricultural businesses – plus high-tech, strong manufacturing, low energy prices and strong dollar financing of course. The population is also expanding. For 2015 its definitely best to avoid property investment in oil producing regions like Texas, Louisiana and North Dakota - that will see their economies decline by about 5% in the next 1-2 years as drilling activities wanes due to low oil prices and a slowdown in the oil-shale-fraccing businesses.

Russia: For investors that are considering Russia, it’s hard to see an economy that is so heavily reliant on oil and gas prices with a declining population doing well over time. The economy seems to be controlled by a few oligarchs – in a very opaque manner. Many western companies have tried but fai led to make good returns in Russia. Our view is that to make a profits in Russia, you have to be Russian. If you are not, best go somewhere else. Things are not likely to change any time soon. The ongoing war in SE Ukraine looks likely to continue for years and the stand-off between the “West” and Russia is very unhealthy – counterproductive and rekindles many of the aspects of the Cold War pre-1986 times before the Soviet Union collapsed – partly triggers by Saudi Arabia flooding the oil markets and driving oil prices to $8/bbl (when Soviet export costs were $10/bbl). We expect Russia to strengthen ties with China and Iran and select other trading partners – moving away from the US and western Europe.

led to make good returns in Russia. Our view is that to make a profits in Russia, you have to be Russian. If you are not, best go somewhere else. Things are not likely to change any time soon. The ongoing war in SE Ukraine looks likely to continue for years and the stand-off between the “West” and Russia is very unhealthy – counterproductive and rekindles many of the aspects of the Cold War pre-1986 times before the Soviet Union collapsed – partly triggers by Saudi Arabia flooding the oil markets and driving oil prices to $8/bbl (when Soviet export costs were $10/bbl). We expect Russia to strengthen ties with China and Iran and select other trading partners – moving away from the US and western Europe.

Dollar King Status: Its worth noting finally the sad truth that all countries that try and use a different currency than the dollar – e.g. attempt to trade oil or other commodities in other currencies, are either frozen out of the global economy by the US or are out-right invaded. Examples are Libya and Iraq that were invaded after Col. Gaddafi and President Sadam Hussain respectively challenging the dollar, and Iran and Russia that have sanctions against them – in many people’s view in part because they have challenged the mighty dollar. Without the dollar as a global reserve currency – to finance the US economy – the US living standards would be about 30% lower than they are currently. Most governments around the world understand this dynamic – and oil is priced in dollars as are other commodities – and this status quo position is rarely challenged because it has consequences. Hence for property investors, as a general principle or rule – one should “avoid investing in any country that looks to be seriously challenging the dollar as a reserve currency”. If you want to hedge or bet against the dollar or US government, the better way of doing it at lower risk is to invest in gold and silver.

We hope this Special Report has given you some key insights into the global economic world we now live in – and some healthy and objective pointers for property investors with the aim of lowering your risk and improving your financial return on investment. If you have any queries, please contact us on enquiries@propertyinvesting.net

Appendix:

At $51/bbl average in a year instead of $102/bbl (halving of oil price)

| Country |

Loss/Gain $ Bln/year at $51/bbl |

| Saudi Arabia | -155.59 |

| Russian Federation | -140.23 |

| United Arab Emirates | -54.96 |

| Iraq | -48.96 |

| Kuwait | -48.90 |

| Nigeria | -42.35 |

| Venezuela | -33.10 |

| Canada | -32.78 |

| Qatar | -32.61 |

| Iran | -30.85 |

| Kazakhstan | -28.73 |

| Norway | -27.62 |

| Libya | -24.26 |

| Algeria | -21.99 |

| Mexico | -15.91 |

| Azerbaijan | -14.37 |

| Colombia | -13.75 |

| Vietnam | -6.51 |

| Ecuador | -5.31 |

| Brunei | -2.34 |

| Turkmenistan | -1.80 |

| Uzbekistan | -0.56 |

| Denmark | -0.01 |

| Argentina | 0.11 |

| Egypt | 0.95 |

| Romania | 1.84 |

| Malaysia | 2.02 |

| Peru | 2.36 |

| Australia | 11.74 |

| United Kingdom | 12.59 |

| Thailand | 14.23 |

| Indonesia | 14.91 |

| Netherlands | 16.22 |

| Brazil | 17.64 |

| Italy | 21.64 |

| Spain | 22.34 |

| France | 31.02 |

| Germany | 44.78 |

| South Korea | 45.79 |

| India | 53.76 |

| Japan | 82.17 |

| China | 127.97 |

| USA | 144.68 |

| Country |

Proportional Gain/Loss per person % |

| Libya | -30.6% |

| Kuwait | -29.8% |

| Iraq | -23.3% |

| Saudi Arabia | -21.2% |

| Azerbaijan | -20.9% |

| Qatar | -17.5% |

| Nigeria | -15.0% |

| Kazakhstan | -14.3% |

| Brunei | -14.3% |

| United Arab Emirates | -10.3% |

| Algeria | -10.2% |

| Venezuela | -8.8% |

| Russian Federation | -6.9% |

| Ecuador | -6.4% |

| Turkmenistan | -5.7% |

| Iran | -5.6% |

| Norway | -5.5% |

| Vietnam | -4.8% |

| Colombia | -3.7% |

| Canada | -1.8% |

| Mexico | -1.3% |

| Uzbekistan | -1.1% |

| Denmark | 0.0% |

| Argentina | 0.0% |

| Egypt | 0.4% |

| United Kingdom | 0.5% |

| Malaysia | 0.7% |

| Brazil | 0.8% |

| Australia | 0.8% |

| USA | 0.9% |

| Italy | 1.1% |

| Romania | 1.2% |

| France | 1.2% |

| Peru | 1.2% |

| Germany | 1.3% |

| Japan | 1.4% |

| China | 1.6% |

| Indonesia | 1.6% |

| Spain | 1.6% |

| Netherlands | 2.1% |

| India | 2.9% |

| Thailand | 3.8% |

| South Korea | 3.9% |

The chart below shows the actual dollar increase or decrease in cost or revenues in different countries - in billions of dollars a year. What this chart clearly shows is that - for example:

- Japan has a stimulus of $82 billion

- USA has a stimulus of $145 billion

- China has a stimulus of $128 billion

- Saudi Arabia has a reduction in revenue of -$156 billion

- Russia has a reduction in revenue of -$140 billion

It doesn't take a rocket scientist to deduce that property prices in Japan and USA should rise along with economic stimulus-growth - whilst Russia and Saudi Arabia will see large drops and a recession.

Venezuela will see a drop of $33 billion in revenue in a small struggling economy highly dependant on oil revenues with a gigantic state public sector. Frankly Venezuela is predicted to have a collapsing economy in 2015 - default and strife if oil prices stay at $50-$60/bbl. Property investors should steer well clear of Venezuela. Iran will also see a $31 billion drop in revenues which should put further pressure on inflation as the currency declines and lead to far lower standard of living in Iran.

The UK should see a stimulus of a fairly meagre £12 billion. Oil companies will be hard hit in Aberdeen and London. The Treasury tax receipts will drop, but the economy should be boosted overall. Aberdeen should see property prices dropping sharply by about 10% in 2015, meanwhile house prices in England should be stimulated by lower general inflation, lower mortgage lending costs and improving employment prospects - as long as Labour win power in May 2015.