537: Crisis on Horizon If Labour Form New Government Propped Up By Unelected SNP First Minister

05-01-2015

PropertyInvesting.net team

There is a stark choice for UK voters in the next week. Either vote for Labour and have the SNP calling the shots in the rest of the UK, which will end in economic crisis, or vote Tory to continue a stable and viable economic recovery.

SNP Prop Up Labour: Labour will not have enough votes to win an overall majority and the most likely outcome would have them doing a deal with the far left Scottish Nationalists (SNP) in a desperate attempt to get Ed Milliband into Number 10. But it will end in tears for the whole of the UK and would likely see the UK splitting up amid economic and social chaos. We would see Scotland partitioning from the UK and severe financial instability. A constitutional mess.

The legitimacy of the government would also be severely called into question because one party is pro the UK keeping together (Labour) and the other is nationalist and wants Scotland to partition from the UK - despite Scotland having a referendum only six months ago where they voted to stay in the union.

Scottish Factor:  Scotland has its own Scottish Assembly that votes on its own country issues, but the SNP MPs will not be allowed to vote in this Assembly, instead would be voting in Westminister on England laws, spending, health and defence. The financial markets would spin into turmoil because of the lack of direction and clear leadership as Ed Miliband was bullied by Sturgeon at every turn and the whole political, constitutional and economic scene would become a complete mess.

Scotland has its own Scottish Assembly that votes on its own country issues, but the SNP MPs will not be allowed to vote in this Assembly, instead would be voting in Westminister on England laws, spending, health and defence. The financial markets would spin into turmoil because of the lack of direction and clear leadership as Ed Miliband was bullied by Sturgeon at every turn and the whole political, constitutional and economic scene would become a complete mess.

The UK would start to go the way of Greece as a run on the financial system ensued. Foreign investors would take flight. Wealth creators would leave in droves.

The only hope is that the Tories win more seats than Labour and then manage to get a Coalition together with someone like the LibDems. The other hope is there is a late swing from UKIP to Tory as these voters see their vote as a “wasted vote” whilst they realise that a vote for UKIP would result in Labour and SNP getting into power and destroying all the good work the Tory Coalition has done stabilizing the economy, lowering unemployment and boosting GDP growth in the last five years.

Demographic Choice? The choice belongs to the UK electorate, but with Ed Milliband odds on favourite to get into Number 10 with Ed Balls into Number 11 along with the Scottish Nationalist calling he shots – it’s a bleak outlook for property investors throughout the whole of the UK. No wander GDP growth has slowed and building levels have dropped of markedly as everyone puts investment on hold because of the fear of an anti-business high tax, high spending Labour government messing up the economy again like they did in 2008 – wasting ten years of tax receipts on useless spending projects that almost led to a UK financial meltdown. When we mention "democratic" - take this with a inch of salt because we would argue that having Scottish Nationalists calling the shots in Westminster is not exactly democratic. Considering Nicola Sturgeon is the First Minister with her party having 50 seats from 5 million people calling the shots over 60 million people in the UK seems a weird form of constitutional democracy with due respect to the Scottish - British citizens.

Nicola Surgeon Non Elected to Westminister (MP or Houses of Parliament): Also consider - if you were not already aware - that Nicola Surgeon is First Minister for Scotland, would not be an elected MP for Westminister. She would be calling he shots in Westminister over votes on English issues even though she was not elected. She said she plan to lead negotiations during a hung parliament. How can Labour or the UK allow this to happen? Well they will if the Tories do not win a majority, or quite as many seats as Labour it seems. In its desperation to win power, we believe Labour would do a deal with the SNP despite having diametrically opposing view of Defence (Trident) and the UK as a Union. It would surely lead to a constitutional crisis and financial ruin. Do the Scots want this? Only about 50% of Scots will vote SNP - so that's 2.5 million people within the UK of 60 million people that would be able to veto or stop/start any major policy decision in Westminster with an unelected Scottish Representative ruling over the UK - a Scottish Nationalist that lost the Scottish Nationalist referendum only 6 months ago. Frankly it would be a disgrace for democracy and make a joke out of the General Election. However, it seems the most likely outcome of the Election at this time.

Current Positive Forces: There are some very strong positive forces driving the UK economy at present – namely:

· Lowering unemployment (rising employee participation)

· Record low interest rates

· Record low Guilt-Yields driving down mortgage rates

· Improving mortgage availability

· Housing shortage

· Reduced building levels in the last five month

· Oil prices crashing from $110/bbl to $58/bbl – driving down fuel-food costs

· Higher disposable incomes with lower oil prices and reduced tax burden in the last year

· UK having the fastest growing economy in the developed world – at +2.6% GDP

These will absolutely reverse if Labour win power – we have no doubt at all.

Uncertainty: Despite all this, house prices increases have levelled off. The reason for this in our view is obvious. The market – the average person – is petrified to buy property just before the election – because if Labour get in, house prices and their investment will slide. They will lose money. They will be taxed more. Its nothing else but this. If SNP prop up Labour, it will be even worse. Taxes in England and Wales will be raised to fund Scottish spending projects.

Mansion Tax Threat: Many property investment projects are in a holding pattern waiting to see if Labour will implement their so called “Mansion Tax” on flats and small terrace homes in London. Ordinary people will be clobbered by insanely high tax levels on their private homes. This would drive wealthy international people and investors overseas to other countries and the economy will be far less dynamic because of this. The best talent will look for lower tax places to do business. This could also impact mid level properties as confidence drops and people start to think this stealth tax will affect them in years to come. The trickle down effects would obviously impact the bottom end of the market in London and all places across the UK.

Ed Balls wants a large slice of the pie for social spending projects and wealth re-distribution

Don’t Invest Right Now: We wouldn’t advise anyone to purchase property in the UK at this time – returns are highly dependent on who gets into power after the Election. If Ed Milliband and Ed Balls are running the country – we think property prices will drop very sharply. If they are being propped up by the SNP - there could well be a property price crash.

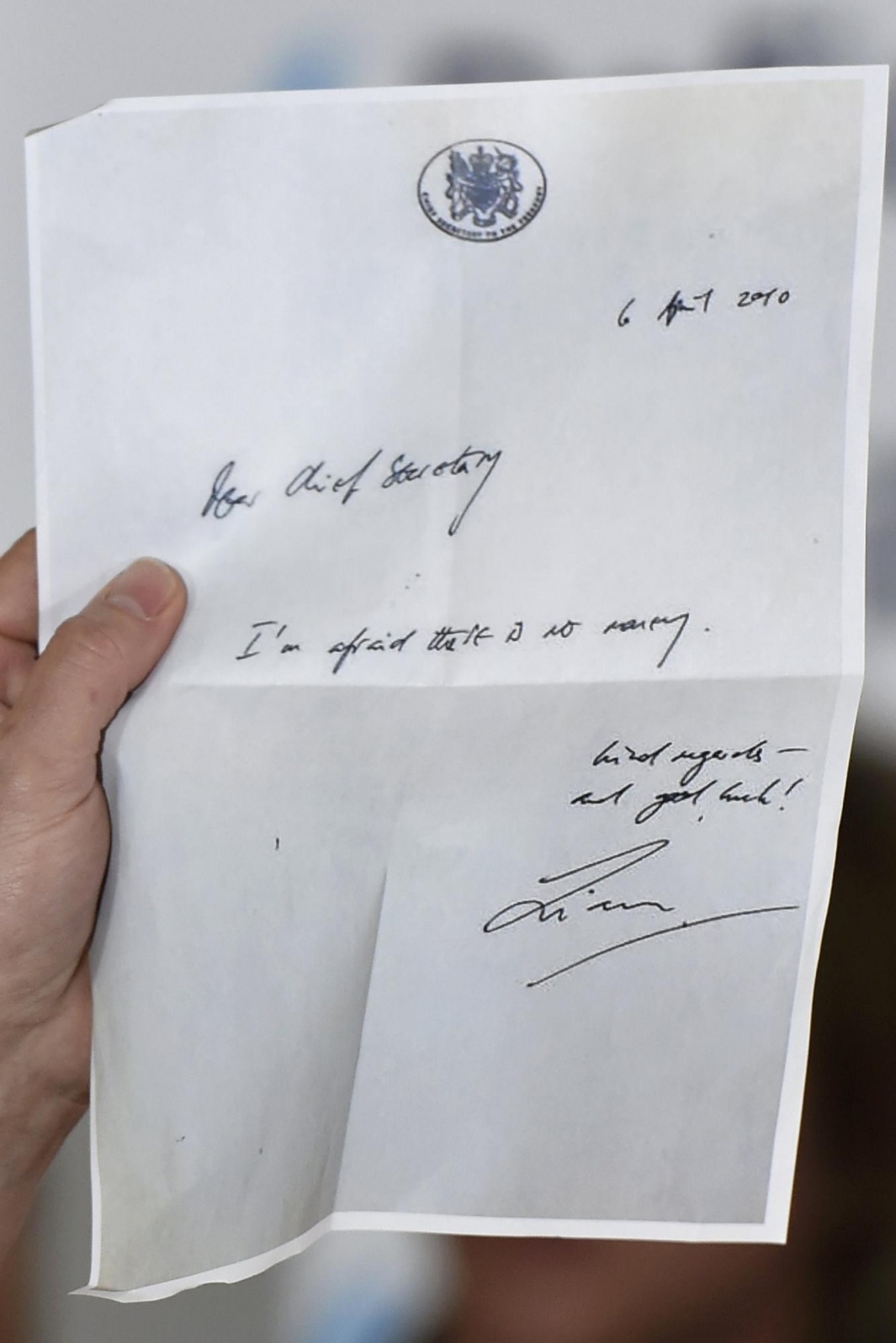

Labour Financial Mess Left 2010: Lets not forget the mess Labour left the UK finances in 2010 - which the Tory Coalition has spent the last 5 years trying to sort out and probably done about half the work to repair the damage. Hopefully this will not be lost on the UK electorate on polling day, surely they will realise the extent of the mess that was left and how much worse it could be this time if Labour work with SNP in an even more socialist planned spending frenzy. Enclose is the letter the Labour Treasury Secretary left his successor as a "handover" note.

"When I arrived at my desk on the very first day as chief secretary, I found a letter from the previous chief secretary to give me some advice, I assumed, on how I conduct myself over the months ahead.

"Unfortunately, when I opened it, it was a one-sentence letter which simply said 'Dear chief secretary, I'm afraid to tell you there's no money left,' which was honest but slightly less helpful advice than I had been expecting," - David Laws, May 2010

"Dear Chief of Secretary

I'm afraid there is no money. Kind regards - and good luck!

Liam Byrne" - May 2010

Labour: If Labour win power, our view is that the economy will tank because international financial institutions, wealthy individuals and businesses will shun the UK and invest in other countries instead - "in the global market place" since Labour will undoubtedly:

· increase taxation

· increase regulation

· increase deficits, public sector spending and government size

· implement anti-business policies

· increasing the size of government and public sector

· drive up the cost of borrowing as financial markets run scared

Unemployment will then rise, GDP growth will decline and house prices will drop sharply along with this. If Labour form a Coalition with the Liberal-Democrats or SNP, the outcome will be the same since all three parties have similar left wing policies. The socialist government will precipitate a similar outcome to the French socialists currently in power – namely economic decline/stagnation, low growth, high tax, lower confidence levels and higher unemployment. The bottom line is – Labour a clueless about how to run an economy – they are career politicians who have never been in business. They will absolutely mismanage the economy in our view and this will mean far higher borrowing costs for the ordinary person.

Tory: The converse will be true if the Tories win an outright majority or form a Coalition with UKIP, the Liberal Democrats again and/or the SNP. Namely:

· lowering taxation

· reducing regulation

· decreasing deficits and public sector spending with smaller government

· continued implementation of pro-business policies

· slightly reducing the size of government and public sector

· keep borrowing costs very low because of Sterling strength and financial market confidence is maintained

Unemployment will drop further, GDP growth increase and house prices will increase sharply along with this. The economy will boom >3% GDP growth helped by lower oil prices.

Simple Model: It’s really that simple. But the outcome of the Election is impossible to predict. It’s just too uncertain. Enclose a chart describing the two scenarios, we hope this helps. The bottom line is - by end 2015 property prices will be all about who won the election. It’s very difficult to see a scenarios where Labour win or form a Coalition and property prices continue to rise.

Financial Markets Fearful of Labour: Regardless of what a normal UK citizen thinks, because financial markets and large investors have so little confidence in Labour's ability to properly manage the economy - if Labour win power there would be following ramifications for all business investors and private citizens:

· Sterling would decline sharply against the Dollar and Euro

· Inflation would therefore rise since exports become more expensive (e.g. consumer goods, oil, gas, coal. food, service etc)

· Interest rates would need to rise to control inflation and try and support Sterling currency

· Mortgage rates would rise

· Property prices would drop

· Buy to let profitability would drop

· Home building would dry up

· Housing shortages of rental property would increase

· Rents would rise

Listen to the Words: This fear is not groundless since you only have to listen carefully to what Labour say – or are promising – to get very concerned about any private sector investment. Namely – they want to increase taxes, increase public sector and tax and regulate business far more. A good example is freezing energy prices – of course this now looks ridiculous since oil prices have crashed from $110/bbl in June 2014 to $50/bbl in Jan 2015.

Tipping Point: This chain of events is fairly predictable in an economy which is out of favour with international financial markets and investors. We have to remember the UK is an island, not part of the Euro, has very liquid markets and hence a run on Sterling would be an outcome of a Labour victory as the Treasury finances deteriorated and putting up taxes had the consequence of destroying businesses and eventually reducing overall tax take. The tax take moving from England to Scotland would increase dramatically if the SNP formed a pact with Labour and the financial markets would take a very dim view on this driving up borrowing costs.

Risks: This is the key risk for property investors in the next year or so - a Labour victory. It is about 50/50 that Ed Miliband will be the next prime minister in our view simple because there are so many people that seem to like his populist anti-business rhetoric. Despite Ed Miliband being completely out of touch with his mainstream Labour voters being a London based career politician (who's never had a non-political job) from a posh Oxbridge background and having socialist policies far to the left of New Labour - we still think there are enough supporters in urban areas to elect him as prime minster. UKIP have divided the centre-right vote and could let Labour in through the back door.

Drastic Drop in Building Levels: If Labour win – it’s likely the level of building will drop sharply since business confidence will drop and builders will be reluctant to take financial/business risk particularly in an environment or likely rising unemployment, taxes and greater government regulation and red tape. The outcome would probably lead to declining demand for the private purchase of property but increasing rental demand. The increasing regulation and political support for councils, licencing regimes and tenants would drive buy-to-let investors away from providing rental properties thence the rental demand would tighten and rents would then rise despite the depressed economic environment – particularly for mid-low priced rental properties in most parts of the UK. This has already started to happen since building levels have crash by 35% in the last 12 months in anticipation of a potential Labour win or the uncertainty of it.

Don’t Risk It Now: As you can see from all of the above, it’s not a good time to be risking hard earned cash – and taking big risks on property investment. If you fear a Labour win, its probably also too late to see – since the market has gone quiet. Most people are sitting on the side lines and keeping their fingers cross – not a good investment strategy since luck is also involved. We just wanted to be very clear that property returns in 2015 and 2016 will be highly dependent on the Election.

Finally if you want some form of stability and economic growth – then its time to vote Tory. Any Labour vote risks having the Scottish Nationalist running the UK.

We hope you have found this Special report helpful in framing your investment strategy for 2015. If you have any queries – please contact us on enquiries@propertyinvesting.net