551: Property Investors Update - Interest Rates

10-10-2015

PropertyInvesting.net team

Oil price Re-Balance: As oil prices have dropped from $110/bbl Aug 2014 to $48/bbl April-Oct 2015, emerging economies such as Latin America, Africa, Middle East and Russia have all suffered from severe revenue losses that have reduced spending levels and consumer confidence. Their currencies have been hit hard which has made the US dollar comparatively strong. In addition, Chinas economy has slowed as the rate of infra-structure development and manufacturing growth has slowed and their oil demand has been weak which has also helped suppress oil prices. Overall we are hitting a deflationary period as commodities prices have dropped as emerging economies have slowed. This has been exacerbated by the US curtailing currency printing the end of QE for now.

Financial Services Boom During Low Oil Prices: Back in the UK, the low oil prices have stimulated business and financial asset performance in the financial services sector. This has positively impacted London in particular. The new Tory government has also boosted Sterlings value. This along with the low oil prices has led to a prolonged period of zero consumer inflation. The Bank of England (BoE) is reluctant to increase interest rates when Sterling is strong and depressing general inflation, whilst oil prices being low also counter inflation. If the BoE put up interest rates, they would probably cause significant deflation. To reduce Sterling strength they might be considering printing money instead of increasing interest rates. The chance of an interest rate rise in 2015 seems very small.

Impact on Interest Rates: Of course for mortgage holders, this is all very good news because the low interest rates make payments low and this then leads through to higher house prices. Because owning a property is normally cheaper than renting, people will scramble to save a deposit and purchase a property rather than rent. This keeps demand for sales high whilst supply remains low.

Housing Shortages: Of course as we all know there is a shortage of both rental properties and homes for purchase so prices for both will be higher when interest rates are low thence causing housing crunch. There seems to be no light at the end of the tunnel regarding housing suppl y since planning restrictions and lack of financing for building projects keeps a lid the amount of homes being built. The annualised rate of home building recently dropped to about 130,000 units a year way under the required 300,000 units per annum to just meet current demand. Realistically we cannot see the number of homes being built rising above say 180,000 units in the next five years and demand will remain at about 300,000 units hence prices in normal circumstances would have to go up to reduce demand. As people struggle to purchase properties and the governments tax raid on Landlord suppressed the amount of rental properties available, we expect rents to rise sharply in the next five years.

y since planning restrictions and lack of financing for building projects keeps a lid the amount of homes being built. The annualised rate of home building recently dropped to about 130,000 units a year way under the required 300,000 units per annum to just meet current demand. Realistically we cannot see the number of homes being built rising above say 180,000 units in the next five years and demand will remain at about 300,000 units hence prices in normal circumstances would have to go up to reduce demand. As people struggle to purchase properties and the governments tax raid on Landlord suppressed the amount of rental properties available, we expect rents to rise sharply in the next five years.

Tory Votes For Homeowners: The Tories longer term are keen for more home owners because these people tend to vote Tory. This is probably a key reason why they have hit buy-to-let Landlords with the tax hike from 2017 onwards they want to free up rental properties to make them available for purchase by first time buyers and know there is little chance of large scale building in the foreseeable future. They seem to be throwing the towel in. In doing so, they will overall get more Tory votes albeit they may lose a few Landlord votes in the process. The tax hikes will surely increase rents then there will be an even greater demand for purchased properties then these prices will need to rise accordingly. We see both house prices and rents both rising in the next few years at a fairly robust pace.

No Increase In Interest Rates: All the talk of interest rates ris ing we believe is way overblown. As European countries start to suffer economic woes Sterling will stay strong as the international markets see a well-run economy coordinated by a centre-right government and will buy Sterling ahead of the Euro and other weaker currencies from mismanaged nations. This will mean the UK inflation rate staying low for the next few years and interest rates will need to stay low also. After the financial crisis of 2008, its now 7 year on and we are due another global slowdown if not recession. This is exactly what we are seeing now as global GDP shifts down to 3.2% - close to the 3% rate which is widely regarded by the IMF as in recessionary territory. If oil prices rise inflation will rise but global GDP will slow down further. The global economy will not be helped by the Russians bombing Syria and Middle Eastern conflicts with ISIS etc. This reduces confidence and could increase oil prices neither of which helps most western developed nations.

ing we believe is way overblown. As European countries start to suffer economic woes Sterling will stay strong as the international markets see a well-run economy coordinated by a centre-right government and will buy Sterling ahead of the Euro and other weaker currencies from mismanaged nations. This will mean the UK inflation rate staying low for the next few years and interest rates will need to stay low also. After the financial crisis of 2008, its now 7 year on and we are due another global slowdown if not recession. This is exactly what we are seeing now as global GDP shifts down to 3.2% - close to the 3% rate which is widely regarded by the IMF as in recessionary territory. If oil prices rise inflation will rise but global GDP will slow down further. The global economy will not be helped by the Russians bombing Syria and Middle Eastern conflicts with ISIS etc. This reduces confidence and could increase oil prices neither of which helps most western developed nations.

Opposition Non Existent: Back in the UK after Jeremy Corbyn was elected Leader of the Opposition its now looking highly likely the Tories unless they mess up or self-implode will be elec ted in 2020 and onwards, simply because they dont have any strong opposition. This will allow the Tories to implement their policies that are likely to see in general the following outcomes compared with a socialist and/or mainland European economy:

ted in 2020 and onwards, simply because they dont have any strong opposition. This will allow the Tories to implement their policies that are likely to see in general the following outcomes compared with a socialist and/or mainland European economy:

· Pound Sterling staying strong

· Lower CPI and RPI inflation

· Lower borrowing costs

· Lower interest rates

· Higher GDP growth

· Higher employment

· Increasing private sector employment and spending

· Decreasing public sector employment and spending

· Lower unemployment

· Reducing debts and debt servicing costs

· Higher property prices

· Stronger rental demand

· Continued strong inward migration

· Increasing population and birth rates

· Continued fairly low levels of home building

· Continued housing crisis

· Increasing wealth in SE and southern England

· Increase in north-south wealth and house price divide

Free Markets: The Tories favour policies that encourage entrepreneurial behaviours and free markets these dynamics favour London since this is a private sector global financial and business centre that attracts the top global talent encouraging wealth generation and private sector employment growth. Labour policies tend to favour the distribution of wealth to northern heartlands and increasing public sector spending that pumps money into northern cities and rural areas. People have been amazed at the increase in property prices in London since the Tories came to power in 2010. However, we still believe with the 1) Tory government; and 2) London being a global city with massively increasing population of talented individuals property prices have still some way to go before they become truly unaffordable. London is after all a global property market and property prices compared to other global super cities dont look out of kilter yet.

Best Opportunities: For property investors, its best to consider areas that are showing overall improvement because of either:

· New jobs-business growth

· Infrastructure improvements transport, retail etc

· Gentrification by wealthy people

· Proximity to central wealthy city areas and job

London Areas: When we look at the UK, London scores highest on all these criteria. More specifically, we like the follow areas:

· Earls Court-West Brompton - new developments

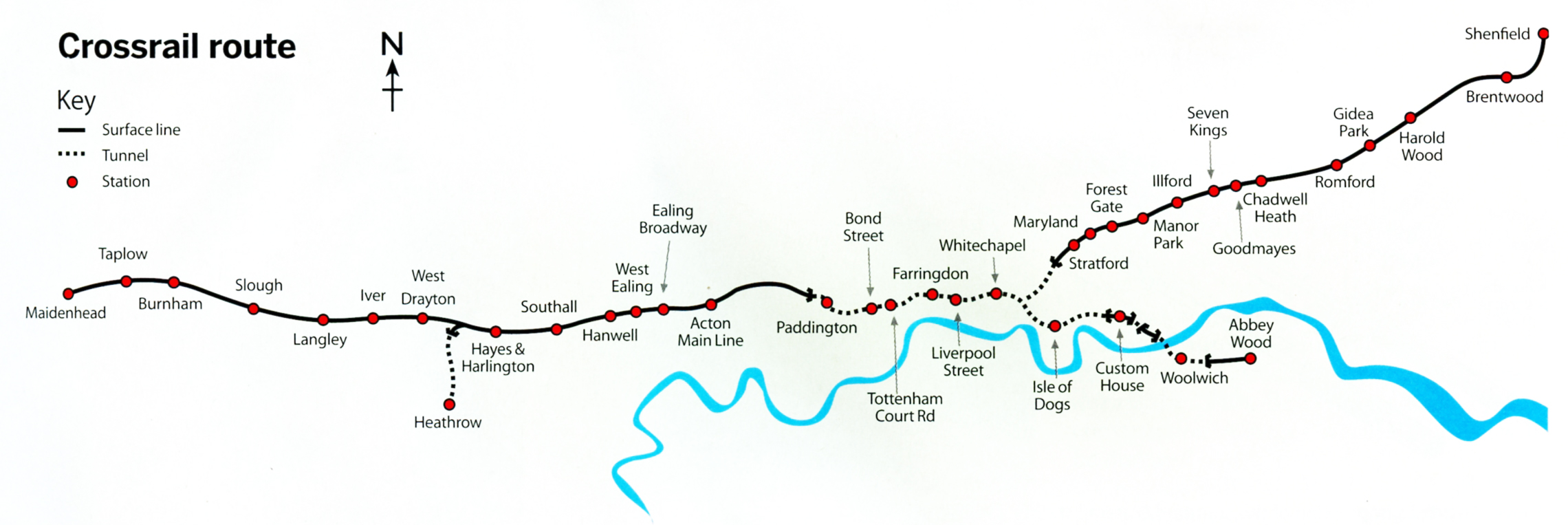

· Acton Crossrail (20 mins to City rather than 40 mins)

· Stratford Crossrail and other improvements

· Farringdon Crossrail and Thameslink junction

· Tottenham Court Road - Crossrail

· Woolwich Crossrail

· Maidenhead - Crossrail

· Abbey Wood - Crossrail

We think prime West End property looks set for a flat-lining break for a while as tax and stamp duty changes suppress this upper end of the market. However, properties in the £250,000 to £600,000 range further out from the West End in more affordable districts such as Peckham, Hackney, Leytonstone, Kennington, Elephant & Castle, Acton, New Cross and Willesdon will see prices rising sharply in the next few years.

Commuting Areas: Further out - in places within an hours commute to London will see prices rising sharply, particularly properties close to railway stations. Good examples are:

· Gravesend Ebbsfleet Southfleet - Bean- Dartford (18 mins to S t Pancras)

t Pancras)

· Ipswich Colchester

· Bedford

· Newbury

· Banbury

· Brentwood

· Slough

· Maidenhead

· Reading

· Letchworth

· Redhill

London Distance: Further afield, prices are likely to rise sharply in places like

· Kettering and Wellingborough affordable towns within 1 hour commute to London

· Corby low prices with 1 hour 10 min commute to London

· Northampton close to Cambridge booming area

· Cambridge booming high-tech business

· Crawley close to Gatwick

· Folkestone - Eurostar link

For the very brave, places like Newark (1 hr 13 min, the 7.37 hrs train), Leicester (1 hr 20 mins), Loughborough (1 hour 30 mins), Rugby (53 mins) and Retford (1 hr 30 mins) look like good value at this time. For those people that have a job in the City and want a large country pile with lots of land, a nice farmhouse near Newark could be just the ticket.

For the very brave, places like Newark (1 hr 13 min, the 7.37 hrs train), Leicester (1 hr 20 mins), Loughborough (1 hour 30 mins), Rugby (53 mins) and Retford (1 hr 30 mins) look like good value at this time. For those people that have a job in the City and want a large country pile with lots of land, a nice farmhouse near Newark could be just the ticket.

We hope this Special Report has been insightful for your property investment strategies. If you have any queries please contact us on enquiries@propertyinvesting.net