609: Follow Your Passion To Develop Your Property Investing Skills

11-04-2017

PropertyInvesting.net team

In life for yourself and your family you really need to follow your passion but be pragmatic with it.

What is Your Passion?: The first thing to consider is that in every person - there is a passion for something and that something can make serious money if it is channelled correctly. Lets take a few examples:

· Flowers if your passion is flowers, you might grow them, sell them, display them, photograph them there are many successful businesses based on flowers.

· Property if your passion is property then its probably the single easiest way of making money for the average person. If you research things well, buy at a low prices, like doing places up at low cost and are good at managing and renting properties and/or building and extending them you have a very high chance of making very good money from this passion. Its probably about the most easily lucrative passion to have.

· Music if you love playing guitar, then you can become incredibly wealthy and famous doing this like Keith Richards, Ed Sheeran or Eric Clapton. But competition is fierce and chances of success probably quite low most guitarists scrape a living, not many make serious money but the most successful make huge amounts. Its has to be highlighted though that if you are a guitarist, the chances of becoming a drug taking alcoholic are regrettably higher than average.

· Golf or Tennis similar to being a musician or actor there are small numbers of top people and the rest are normally part time passionate about it but cannot make a living out of it competition is fierce since its such a nice popular thing to do.

· Engineer this is totally different if you are a passionate engineer, then competition is a lot lower, there are many high paid jobs but you are not likely to become famous.  If you start your own engineering business this is probably a high chance of becoming super-rich.

If you start your own engineering business this is probably a high chance of becoming super-rich.

Passionate: If you are interested in property investment, you have to ask yourself are you passionate about it, because it really does help if you have passion or obsession with property. You like working on it, always looking to grow, improve and have high standards. You aspire to live in a gigantic house it helps drive you having this dream. If you are only interested in making money from property you probably wont be very successful. You really need to put a lot of effort and soul into property investment. It might mean decorating properties in the evening in your spare time, coordinating contractors and doing reams of paperwork and tax returns the books. If you dont dread this in fact if you like it or love it you will probably do very well in property investing.

Brilliance: In any walk of life the very brilliant people have a combination of:

· Skill, knowledge and experience

· Passion (or obsession)

· Hard work

Re-enforcing: One thing normally leads to the rest they are self re-enforcing. Fo r instance, if you have a reasonable artistic skill, and start to paint, your knowledge and skill will develop with passion (obsession) and hard work. You will then through practice get a lot better and could then become famous. If you have the skills, but dont work hard and/or are not passionate (or obsessed) then you will never be a famous brilliant artist.

r instance, if you have a reasonable artistic skill, and start to paint, your knowledge and skill will develop with passion (obsession) and hard work. You will then through practice get a lot better and could then become famous. If you have the skills, but dont work hard and/or are not passionate (or obsessed) then you will never be a famous brilliant artist.

The More You Practice the Luckier You Get: This also goes for property investing if you are passionate and obsessed about property investing you will research, read, analyse, then with hard work and some reasonable levels of skill-knowledge you will get better and better at property investing then end up making serious money. But if you think you can make serious money by not working hard at it forget it its not going to happen. We hate to disappoint you, but you might as well stop. Very few property investors made serious money by not putting some focussed effort and/or hard working into their portfolios. As Greg Norman, the world famous golfer once said, the more he practiced, the luckier he got. If you practice through hard work you will become a better (or luckier) property investor.

Natural Traits: Obviously some people have a knack in business and property in vestment they are particularly savvy at unearthing bargains and doing excellent deals, but if you research, practice, focus and try hard yourself, you will probably find you also get good at it if you follow certain methodologies. It does not matter what gender, race, colour, age, background you are from if you can work nicely with people, and have a good reputation with banks, then you can make serious money. Dont hold back whatever you do.

vestment they are particularly savvy at unearthing bargains and doing excellent deals, but if you research, practice, focus and try hard yourself, you will probably find you also get good at it if you follow certain methodologies. It does not matter what gender, race, colour, age, background you are from if you can work nicely with people, and have a good reputation with banks, then you can make serious money. Dont hold back whatever you do.

Low Ball Offers a Must: One example of a methodology is finding the most central flat in a large city with lowest prices and putting in low ball offers on 5 properties in a rotating time-sequence until someone accepts. Making sure all the properties are structurally sound but need simple renovation and/or repair to make them look good again and add value. And not being wedded to one particularly property as long as the price is right on your chosen picks then you should go with it even if its not the one you would necessarily want to live in.

Superficial Grottiness: For instance, properties with heavy smokers, graffiti, awfu l decorative colours, old bathrooms and kitchens, un-kept gardens they all go for massively below normal market value. The trick is to keep you eye on such bargains then see through the superficial eye-sores and make low-ball offers for such properties then simply fix them up by decorating, tidying, cleaning, repairing, cutting the grass. It means some hard work, but you can make tens of thousands of pounds in value added and rapidly by using this simple strategy.

l decorative colours, old bathrooms and kitchens, un-kept gardens they all go for massively below normal market value. The trick is to keep you eye on such bargains then see through the superficial eye-sores and make low-ball offers for such properties then simply fix them up by decorating, tidying, cleaning, repairing, cutting the grass. It means some hard work, but you can make tens of thousands of pounds in value added and rapidly by using this simple strategy.

Victorian Property in Central Leafy Areas: Remember in large UK cities, professional high earning people and families like to live in leafy areas that are close to the city centre and good schools, where the houses are spacious but older. So its best to try and focus on Victorian or older housing in nice areas, but in need of re-decoration and some simple upgrades. Victorian and Edwardian properties normally sell fo r a premium versus 1950s or 1970s properties but we arent building any Victorian properties anymore they are normally central and in more prosperous areas and people love the terraces as long as they are fairly specious (not back-to-back in the north). The closer they are to high paid professional jobs the better and longer term these are the properties that will continue to climb particularly if the Tories stay in power. This is particularly true in major cities like Leeds, London, Edinburgh, Manchester, Birmingham, Cambridge, Oxford, Bristol and Southampton. Wealthy young professional families also like to be in areas with large prestigious Universities and you will find money follows education so properties around top Universities and Schools will see prices rising faster than areas with poor education or no major colleges (like Barrow-on-Furness, Redcar, Morecambe Bay, Bodmin). But if you look at Lincoln, York, Warwick, Falmouth, Exeter, Lancaster, Bath you will find towns and small cities with good universities that have property prices rising sharply.

r a premium versus 1950s or 1970s properties but we arent building any Victorian properties anymore they are normally central and in more prosperous areas and people love the terraces as long as they are fairly specious (not back-to-back in the north). The closer they are to high paid professional jobs the better and longer term these are the properties that will continue to climb particularly if the Tories stay in power. This is particularly true in major cities like Leeds, London, Edinburgh, Manchester, Birmingham, Cambridge, Oxford, Bristol and Southampton. Wealthy young professional families also like to be in areas with large prestigious Universities and you will find money follows education so properties around top Universities and Schools will see prices rising faster than areas with poor education or no major colleges (like Barrow-on-Furness, Redcar, Morecambe Bay, Bodmin). But if you look at Lincoln, York, Warwick, Falmouth, Exeter, Lancaster, Bath you will find towns and small cities with good universities that have property prices rising sharply.

· If you are not convinced that property investing is for you that you dont like hard work and are not passionate enough about it thats fine and a good call you just need to find something whatever it is that you are truly passionate about and see it through.

· If you love taking care of babies, why not start a creche?

· If you love fashion then what about being a fashion designer or making beautiful dresses or suites?

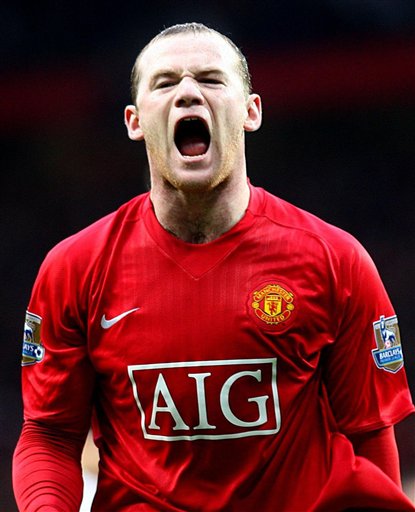

· If you love sports then be a sportsperson teach sports coach set up a fitness school any passion can make money.

Obsession: The good news for people at propertyinvesting.net net is that we are passionate to the point of obsession with property investment and this sees us into making serious money. But you cant do it without property research and building up your knowledge-skill base which is why we set up this website to help fellow investors for free.

do it without property research and building up your knowledge-skill base which is why we set up this website to help fellow investors for free.

Enjoy and Make Serious Money: There is nothing more enjoyable than immersing oneself in a passion that also makes serious money and you can see it in front of your eyes every time you do an upgrade, improvement and spend not much money to add a lot of value, whatever you do to your properties.

Other Traits: A few other key traits to consider:

· You have to be positive but realistic when you property invest.

· You have to identify and retain good service provides like builders, letting agents, maintenance people and dump any underperforming people rapidly. You should not accept poor performance, you should have high standards always pay on time as quickly as you can to builders and maintenance people then they will always want to work for you as long as you are fair and reasonable.

· You have to stay healthy not drink lots or take drugs to be objective, hard-working and respected by your suppliers and customers. Dont think you can drink lots and make serious money alcoholism (and also drugs) are about the fastest way to poverty a nd early death, make no mistake.

nd early death, make no mistake.

Open Minded No Snobbery: In property investment, one needs to be very open minded about where to invest in. You need to be very objective. For example, if you firmly believe from your research that the rich will keep getting richer, and the poor will tread water then you should focus on investing in the wealthy areas like Kensington and Chelsea in London. But if you firmly believe there will be a big re-distribution of wealth to the lower middle classes and working classes then you might choose to invest in places like Rotherham, Bury, Middlesbrough, Bradford, Swansea and Barrow-in-Furness. Its not good to be either snobby or an inverted snob. You should try and leave your political views out of it but instead understand what the political parties will do if they are in power.

Labour in Power: Beyond any doubt, if Labour get into power then property prices will drop across the board but particularly in the expensive southern areas and London. There would be more public sector spending, more public sector jobs and this would benefit northern and western plus rural areas that are deprived. Inflation would rise, borrowing costs would rise, Sterling would crash and unemployment would eventually rise as the country dipped into stagflation.

Tories in Power: If the Tories keep in power, property prices are likely to keep rising, particularly in the more expensive southern areas and London where private sector will do fair ly well and the public sector will continue to get hammered with jobs losses as the re-balancing from the high spending days of Labour continues. Inflation would stay more subdued, interest rates would stay lower, unemployment would stay low and Sterling stronger than under Labour.

ly well and the public sector will continue to get hammered with jobs losses as the re-balancing from the high spending days of Labour continues. Inflation would stay more subdued, interest rates would stay lower, unemployment would stay low and Sterling stronger than under Labour.

Draconian Taxes: Now regardless of who you vote for if you really think Labour are about to get into power its probably best to divest your property portfolio rapidly. Regardless of the political party in power, the building levels will definitely in our view stay very low particularly with all the Brexit uncertainties and meanwhile the population continues to expanding dramatically. Also the draconian taxes on buy-to-let landlords will almost certainly not be reverses, so a rental crisis will start breaking out shortly a really big shortage of rental accommodation particularly in London and SE England where businesses are expanding no building is taking place, property prices and borrowing levels are highest and hence the taxes hit buy to let landlords the most and drive them ot of the market. Just where the most rental accommodation is required, its where there is the biggest tax deterrent for property landlords. Crazy. Anywat, expect rents to rise as inflation keeps rising as oil prices rise and interest rates rise a massive triple bad whammy for SE buy-to-let landlords many of whom will start to sell up shortly because of the giant tax bills leading to an even greater rental crisis.

We hope you have found this Newsletter insightful. If you have any comments or queries, please contact us on enquiries@propertyinvesting.net . All the best for your property investing.