623: Property Investing Update - EU at a Tipping Point

06-23-2018

PropertyInvesting.net team

Europe is becoming more divided by the day – its reach a tipping point.

Italy: Italy has got Europe’s first truly Populist government of far left socialist and far right nationalist working off the back of an anti-immigration and anti liberal EU card. Meanwhile the socialist have just got into power in Spain after the right-centre government was toppled in a corruption scandal.

Migration Issue: Europe still hasn’t solved in any way the migration problem – boat loads of mainly African migrants heading north for a better way of life and more opportunities. The  bulk of them are likely economic migrants although the area is always grey and many will be claiming asylum and have been persecuted in some shape or form in their country of origin – some will have had to move because of wars or famine. This issue is not going away. In fact its likely to get worse over the years because:

bulk of them are likely economic migrants although the area is always grey and many will be claiming asylum and have been persecuted in some shape or form in their country of origin – some will have had to move because of wars or famine. This issue is not going away. In fact its likely to get worse over the years because:

Massively expanding population in desert and semi-arid areas – pressure or resources – water-farming-land

- Ethnic, national and religious strife

- Poverty

- Wars

- Persecution by extremist groups

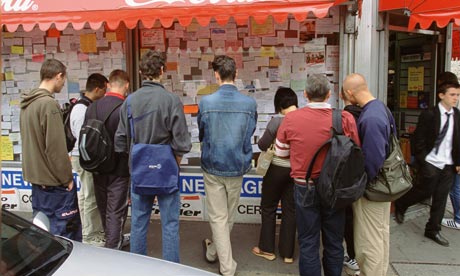

Migrants Mainly Young Men: The fact is that most of the migrants are young men – fit and able to attempt to survive and risk the crossing to Europe. Not many women or elderly people attempt it. Many are simply looking for more opportunity, better climate and an better way of lif e. Unless Europe tackles this issue, its likely to lead to more countries voting extreme left or right nationalist parties into power and this would then lead to the destruction of the European Union – because such extreme political parties will never agree to EU budgets, policies and closer integration. They will always search for hand-outs but won’t want to take in migrants. This process has just started in Italy and its likely to spread – contagion effect – through much of Europe in some shape or form. The free movement of African nationals into Europe and then across the borders is something most people don’t either want or agree with – because they rightly or wrongly feel like their national culture is being threatened and also their jobs and economic well-being and housing will also be threatened.

e. Unless Europe tackles this issue, its likely to lead to more countries voting extreme left or right nationalist parties into power and this would then lead to the destruction of the European Union – because such extreme political parties will never agree to EU budgets, policies and closer integration. They will always search for hand-outs but won’t want to take in migrants. This process has just started in Italy and its likely to spread – contagion effect – through much of Europe in some shape or form. The free movement of African nationals into Europe and then across the borders is something most people don’t either want or agree with – because they rightly or wrongly feel like their national culture is being threatened and also their jobs and economic well-being and housing will also be threatened.

Liberal UK: The UK is one of the more liberal thinking countries when it comes to migration – after all the UK is head of the Commonwealth – a hugely diverse group of nations and we have had much migration through the decades since WWII ended. But what Brexit showed was that this was a key issue that caused 52% of the people that voted to vote Brexit. Of course a key further concern was B russels telling the UK what laws we needed to adopt, the EU parliament and a bunch of non elected burocrats starting to have greater power than our elected parliament.

russels telling the UK what laws we needed to adopt, the EU parliament and a bunch of non elected burocrats starting to have greater power than our elected parliament.

Brexit: Much of the centrist liberal elite of the UK seem to think the migration and powers arguments are not important and that the UK will economically go down a hole once Brexit happens. So far however despite all the uncertainty – the economy had continued to expand, there is record low unemployment and recently Sterling has recovered a lot of the losses from immediately after the Referendum result. The liberal papers like the Independent and Guardian are full of headlines with doomsday forecasts – they seem to sell papers by reconfirming the fear of the exit and the unknown. Most sensible people thing they are completely over playing things – which is certainly borne out in the hard data. So far hardly anyone has left the UK – business have made threats but not many people have either moved or started to move. Fearful headlines that Airbus will be leaving is hardly surprising since they are more of a German-French company and they only gave the Uk a few bits of business in the first place.

Brexit could go either way: Anyway its early days and of course Brexit could cause a recession and lots of turmoil – we don’t doubt the possibility. But when you look at the pressur es the EU block is in with the migration issue, sparks flying over EU budgets and trade wars with the USA – we can understand how half the population would think its best unshackle from this low growth mess as soon as possible before the a break-up starts that could also precipitate a financial and/or EU currency crisis off the back of huge debts in Spain, Italy, France, Portugal and other EU member states. One thing we are almost 100% sure about is that Brexit will happen. The reason why is 70% of Tories voted for Brexit and Corbyn also definitely wants Brexit – its just he has not made it obvious.

es the EU block is in with the migration issue, sparks flying over EU budgets and trade wars with the USA – we can understand how half the population would think its best unshackle from this low growth mess as soon as possible before the a break-up starts that could also precipitate a financial and/or EU currency crisis off the back of huge debts in Spain, Italy, France, Portugal and other EU member states. One thing we are almost 100% sure about is that Brexit will happen. The reason why is 70% of Tories voted for Brexit and Corbyn also definitely wants Brexit – its just he has not made it obvious.

Housing: With regard to UK housing, what we were predicting since the shock 23 June 2016 Referendum results is certainly happening – namely:

- Net inward migration levels have dropped by around 40% - from a high of 480,000 people a year to something like 310,000 people a year

- Levels of building have dropped back – from levels of around 180,000 homes a year to something like 140,000 homes a year

- The level of demand for homes has hardly changed – running at around 320,000 homes a year – hence the UK is building only around half of the property requirements

- There has been a big increase in the number of extensions and loft conversions in the last two years – particularly where property prices have risen the most int eh last ten years in places like London and southern England. Its seems to be very difficult still getting planning permission to do anything, but extensions are a bit easier generally than they used to be

- London stagnation: Property prices have stagnated in London and dropped slightly in some of the more extensive areas – this is hardly surprizing because London competes with Paris, Frankfurt, Amsterdam and Berlin – some of the global super-rich have decided to go slo

.jpg) w on investing in London because of the Brexit uncertainties and the drop in the value of Sterling, plus high stamp duty and the constant threat of a populist socialist government taking power in the UK through Corby that would undoubtedly clobber the housing and property industry with punitive taxes and regulations.

w on investing in London because of the Brexit uncertainties and the drop in the value of Sterling, plus high stamp duty and the constant threat of a populist socialist government taking power in the UK through Corby that would undoubtedly clobber the housing and property industry with punitive taxes and regulations.

Ripple Affect Fanning Out: The house price ripple affect has been fanning out from London since mid 2016 so house prices in places like derby, Manchester, Bristol and Leeds have been rising strongly – something we predicted – albeit its hardly a tough prediction to make. We expect the ripple affect to continue further north and into more remoter areas like Wales and Scotland in the next year or so, as London property prices continue to stagnate.

The Next House Price Cycle: Now here is the critical point. We are now approaching a “potential” new cycle of house price growth starting in places like Kensington and Chelsea after around 3 years in the doldrums. But the two key risk areas – which are also depressing the housing prices in such prime London are:

- Brexit

- Labour government

If you a positive and think Brexit will be a success and the Tories will stay in power, you should now be buying prime London real estate.

If you are negative on either – and a bad Brexit could also lead to a Labour government – then you should not touch prime London real estate with a barge poll.

Uncertain: We currently can’t make up our minds which way its going to go – its like a tipping point. Therefore we are in a holding pattern, not buying but not selling, like so many other investors. If you are sure Labour will get in or a bad Brexit will happen – then you should be selling up your London property portfolio now – before it happens of course – get out while the going is good.

Wait and See: Our feeling – if you are very young – is that the next cycle could start now. But if its not now because Labour get into power, we just can’t believe they would last more than 4 years – so the next election is due in 2021 – which would mean Labour would be out by 2025. So one could argue to wait until the low is reached at the end of a disastrous Labour tenure – with property lows around 2025 before the Tories got back into power. Of course its possible that Labour would get in before 2021 because the Tories have a minority – but its looking less likely now – since the Tories seems to be experienced at mottling along and know that they should avoid self imploding and letting Corby into power.

than 4 years – so the next election is due in 2021 – which would mean Labour would be out by 2025. So one could argue to wait until the low is reached at the end of a disastrous Labour tenure – with property lows around 2025 before the Tories got back into power. Of course its possible that Labour would get in before 2021 because the Tories have a minority – but its looking less likely now – since the Tories seems to be experienced at mottling along and know that they should avoid self imploding and letting Corby into power.

Extensions: One of the reasons why there has been such a big increase in people extending their home in London and other cities is that stamp duty is so huge and punitive people would rather spend £50,000 on a loft conversion than moving home. They also think the uncertainty means its best to invest in what they have – increase its size for the future – rather than up-sizing. Its lower risk.

May 2017 Election Analysis: When we look back at Teresa May’s decision to hold anot her election May 2017 – which of course was what most people viewed as a disaster for the Tories, we might eventually acknowledge that whilst she did not quite achieve a majority, she bough another two years – and of course the last thing she wanted was an election just when the UK was leaving the EU. Because we will leave March 2019 – it will be 2¼ years before the next election and she will start a spending spree and try and create a housing boom just the election. At the moment she is try to reducing government borrowing, get the finances in shape – improve Sterling’s standing, creating an orderly Brexit – with a strategy of creating a booming economy by early 2021 just before the May elections. She will probably also try and hold onto power – Prime Ministers normally do – albeit we have Boris Johnson and Michael Gove waiting in the wings to pounce – a get involved in a leadership battle at any stage.

her election May 2017 – which of course was what most people viewed as a disaster for the Tories, we might eventually acknowledge that whilst she did not quite achieve a majority, she bough another two years – and of course the last thing she wanted was an election just when the UK was leaving the EU. Because we will leave March 2019 – it will be 2¼ years before the next election and she will start a spending spree and try and create a housing boom just the election. At the moment she is try to reducing government borrowing, get the finances in shape – improve Sterling’s standing, creating an orderly Brexit – with a strategy of creating a booming economy by early 2021 just before the May elections. She will probably also try and hold onto power – Prime Ministers normally do – albeit we have Boris Johnson and Michael Gove waiting in the wings to pounce – a get involved in a leadership battle at any stage.

Wait Until end 2019: One idea would be to wait and see with regard to further property investment, and if it looks like the Tories have weathered the Brexit storm by end 2019 and look like they are on an ascending trend – we could then anticipate a housing boom in London and southern England in 2020 and 2021 before the elections, with a Labour victory being “de-risked” – the chance dropping markedly.

Labour Waiting In The Wings: Its our view that Corbyn wants Brexit but he wants to make the Tory party very unpopular with it – and blame the Tories for any chaos – then he  would hope to win an election. He’s keeping his powder dry waiting int eh wings to pounce also. They would hope to watch the Tory party implode with in-fighting and a weak minority government, but for now he hasn’t got enough ammunition – he’s building it up. But whether Corbyn and Labour actually want to govern is debatable – probably yes but they don’t seem as keen as the Tories and they have their own infighting issues.

would hope to win an election. He’s keeping his powder dry waiting int eh wings to pounce also. They would hope to watch the Tory party implode with in-fighting and a weak minority government, but for now he hasn’t got enough ammunition – he’s building it up. But whether Corbyn and Labour actually want to govern is debatable – probably yes but they don’t seem as keen as the Tories and they have their own infighting issues.

Tories or Labour Has A Huge Impact: The overall message though is that whether the Tories or Labour govern has a huge impact on property investment If Labour get into power then:

- Rental regulations will tighten even further

- Building levels would likely drop because confidence levels would dip

- Taxation would increase for businesses and private individuals – th

is money would be spend on social pay-outs and projects

is money would be spend on social pay-outs and projects - After a while unemployment would rise sharply

- Sterling would drop sharply and general inflation would rise putting pressure on household budgets

A spending spree on public sector jobs and projects focussed in the north and industrial areas would create a feelgood factor for a few years – could even boost house prices int the north for a while, but eventually the money would run out as tax receipts dropped and then we’d have another crisis like in 2008-2010 – when Labour got the UK into a giant debt hole

Reducing The Debt Burden: People will always complain about the so called “austerity” but all it is – is spending within the governments means – wisely – and trying to reduce debt dependency – staving off bankruptcy. Labour’s so called “investment for growth” is actually “spending on public sector projects many of which are a complete waste of money” – many of these projects generate a negative cashflow – they keep costing on an annual basis. What the UK needs is the encourage cash flow generating manufacturing businesses that create employment and generate tax receipts, rather than “spending” on public sector jobs that then lead to more regulation, pension payments and sucking the UK down through higher taxation.

We hope this Special Report has given you some interesting insights into how the property investment scenery cold change and some of the key risk areas. If you have any queries, please contact us on enquiries@propertyinvetsing.net