696: Crypto Assets - an Education in the Basics - for investors

05-16-2021

PropertyInvesting.net team

Cryptocurrencies or Crypto Assets - Summary

Cryptocurrency probably has an incorrect name - instead of currencies that are used to purchase goods and services, they are better described as "assets" or crypto assets.

Currencies and Assets: It's generally understood that currencies are a "medium of exchange" and a "province of governments" - currencies are deemed to be non taxable on transfer. If someone exchanges a currency - no tax is due on transactions. However, with regard to cryptocurrencies (or crypto assets), tax is due on capital gains on the trading or exchange of "cryptocurrencies" - and for this reason and others - they are better described as crypto assets. The US IRS deem cryptocurrencies as "property" and most other countries do the same - e.g. an asset or property asset - not a currency. The main exceptions within the 6000 coins - that aim to be a currency rather than an asset - are : Dogecoin (DOGE), Lightcoin (LTC), Bitcoin Cash (BCH) and Nana (NANO).

Taxation on Assets: Governments and Central Banks are most likely to embrace crypto assets - as fairly new and other asset class - because of and as long as they are - taxed. Any capital gains tax it likely to be a deferred tax until the asset is sold back into a fiat currency.

Blockchain: All crypto assets use blockchain software technology for transactions and creating a secure ledger or database of transactions. The foundation of crypto assets is blockchain. Both blockchain and Bitcoin were invented after the year 2000.

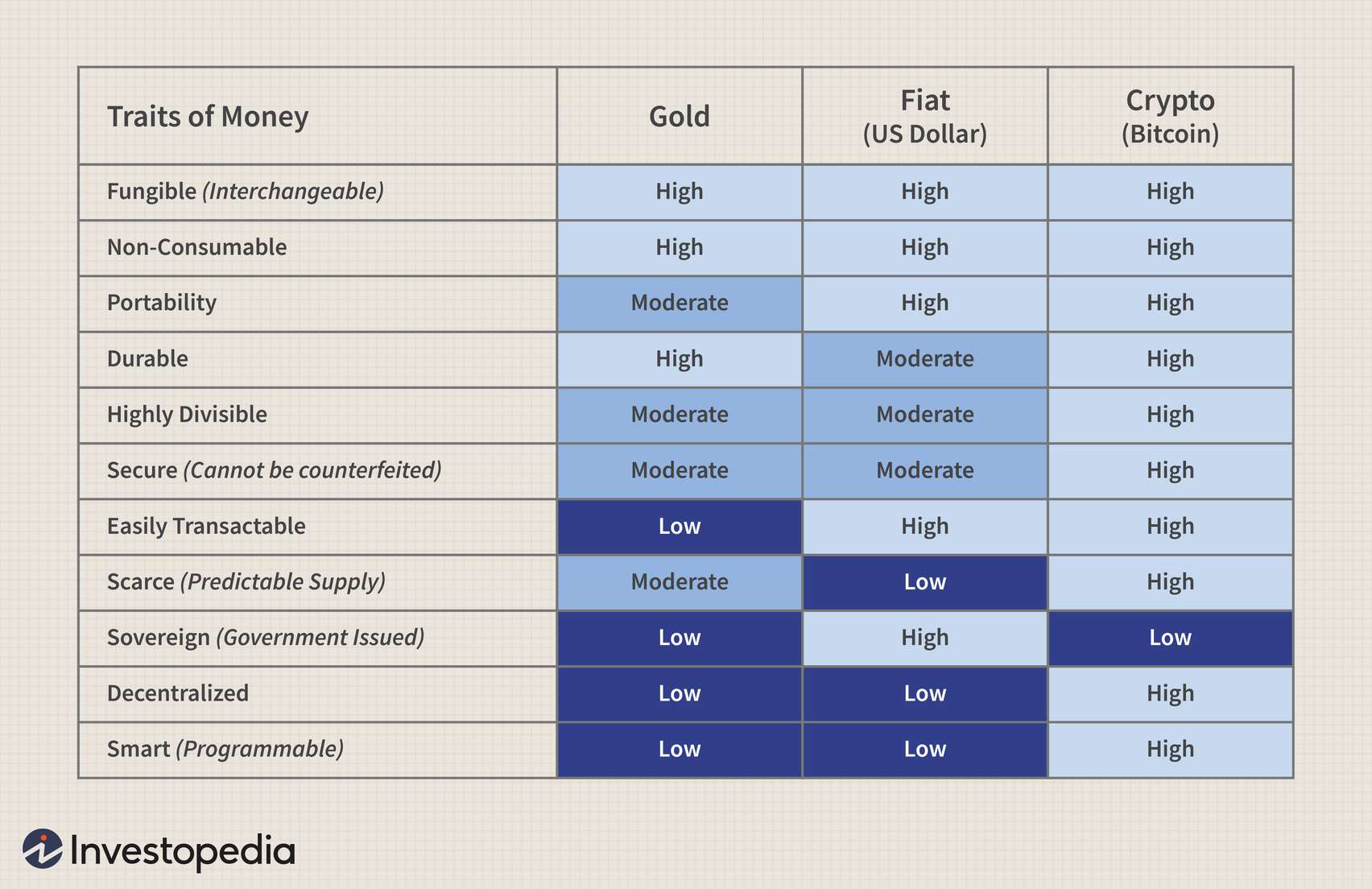

Competition: Most thought leaders think Bitcoin competes with gold and silver as a store of value, along with possibly bonds and ETFs and does not really compete against currencies. It is an asset, property and a store of value.

Bitcoin - is referred to “digital gold”, is a store of value, uses blockchain technology, it's code does not change, it is a digital store of energy akin to a gigantic battery. It has never been hacked since it's invention in 2008 and release Jan 2009. As store of monetary energy. This energy can be transferred around the world as lightening speed between two parties. It's market cap is ~$1.0 Trillion (May 2021).

Ethereum - can be referred to as “digital electricity, digital oil or digital energy”, it is software platform, is built using a hard fork of the Bitcoin blockchain software – it's code can be changed – it can be programmed, it is the foundation for DeFi (decentralised finance) and smart contracts, plus cryptocurrency transactions and e-business. It is an "Alt Coin". It's market cap is $0.4 Trillion (May 2021).

Other Alt Coins - these can be referred to as software coins, tokens or software companies-entities – that use Ethereum as a platform or other competing platforms to deliver Defi and smart contracts. All use blockchain technology. Some are cryptocurrency exchanges, websites for selling-trading NFTs (non fungible tokens), gaming site, fan/sports tokens and other financial-entertainment or business services entities. Their total market cap ~$0.6 Trillion, there are around 6000 coins-tokens offered on multiple exchanges available to every person who has access to the internet - in all countries of the world.

Investing in Alt Coins: One should consider "Alt Coins" as ventures. If you invest in one of these high risk ventures - you should be prepared to lose all your money. However there is also a huge upside, they might go up 10 to 1000x. There will be a few big winners and many coins will go to zero. You need to say to yourself - can I afford to lose all the capital I invest into these venture coins? They are very exciting, they can skyrocket, but they can also crash.

How Things Might Evolve - in the next 3-10 years - it's likely that Bitcoin will develop into the worlds "digital gold" and store of value displacing gold further. Many central banks are likely to create their own national digital currencies - e.g. USD, Euro, Sterling - and these are likely to be traded between Bitcoin and these new national owned currencies - the national digital currencies are highly likely to be "fiat digital currencies" - e.g. they can be inflated at will be central banks and governments/politician/treasuries depending on their fiscal and monetary policies of the day.

Applications of Blockchain Technology - Cryptocurrencies

1 Store of value - Bitcoin

2 Business – Ethereum and other Alt Coins

- Decentralised Finance (DeFi) – Lending, Payments, Transactions

- Smart Contracts – supply chain management – contracts and procurement

- Gaming and entertainment

- Non Fungible Tokens – for instance digital art, music, collectables, memorabilia

Types of Cryptocurrency - Digital Assets

- Digital store of value - Bitcoin

- Protocols and Platforms – e.g. Ethereum (like an IOS app store)

- Asset Backed Tokens – a token that is back by an asset or income stream

- Pass Through Tokens – loyalty token – for rewards, discounts, access to awards and special deals, the company can buy-back – burn thence price would rise over time (e.g. Binance’s BNB token)

Bitcoin – is the only coin or asset-entity like this - its is

- A store of Value

- An asset

- “Digital Gold” (in part competes with gold as store of value – “real money”)

- “Digital Energy Storage”

Bitcoin has four key attributes that create huge value -

- Trust - 12 year history, never been hacked, secure, known brand

- Network - rapidly expanding, global

- Asset - a store of value and investment or savings that has risen in price over time

- Protocol - a robust software protocol-system that has never been hacked and is decentralised

Bitcoin - has four key characteristics

- Scarcity (limited expansion)

- Secure – very been hacked

- Truly decentralised

- Democratic – not controlled by an entity

Market Cap of Sectors and Metrics for Comparison

- Cryptocurrencies - ~$1.4 Trillion (of which ~50% of this value is held in Bitcoin)

- Silver - $1.4 Trillion

- Gold – $10.5 Trillion

- Apple Inc - $2.06 Trillion

- US Stock Market – $50.8 Trillion

- M1 US dollar money supply – $18.1 Trillion

- Global real estate – $204 Trillion ($43 Trillion in China

- Bitcoins –18.5 million (0.0023 for each person of the world population)

- Cryptocurrency traders (owners of crypto coins) – 100 million (or 0.2 Bitcoin for each trader) - one in every 1.28% of the world population - portfolio value per trader average $10,000.

- Global population – 7.85 billion

Many people thing Bitcoin will firstly take the $10.5 Trillion of value from gold then eat into bonds, derivatives, stocks as a store of value (or an asset class)

Fiat Currencies

- US Money (M1) supply increased by ~30% in 2020 – triggered by COVID response

- Predicted to increase by 15% in 2021, 15% in 2022 and likely similar levels after

- Interest rates record low – 0.5% (savings rates in some countries negative)

- Inflation has therefore realistically been 15-30%

- Inflation levels for super rich >30%, middle classes 10-15%, poorer likely 0-10% - more like CPI basket

- Shift to stock market with fiat currency to gain returns at or above inflation - same is true of cryptocurrency markets - reason S&P500 boom in best companies (and Bitcoin-Ethereum in crypto world)

M1 Money Supply in the USA and global - Trillion US dollars over recent time

The adoption forecast for Crypto Assets

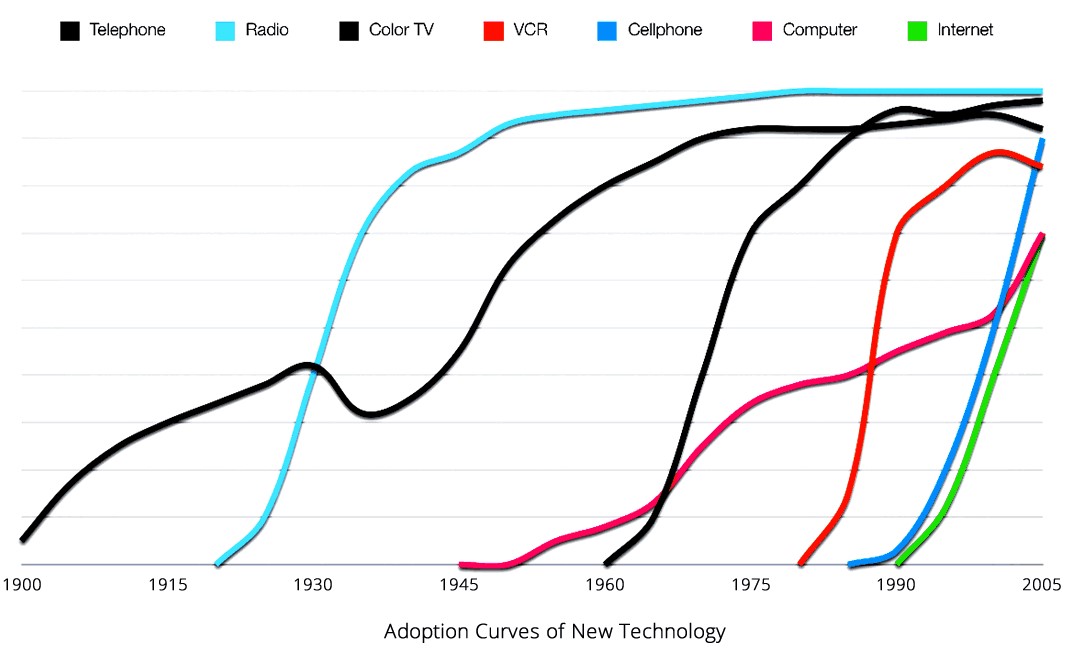

Technology Adoptions - similar new technologies and the speed of adoption

Bitcoin Is Non Fiat

- Cannot print Bitcoin – max 21 billion bitcoins, currently 18.5 million, increase 1.8%, halving cycles every 3-4 years, scarce, supply constrained, demand rising

- Adoption curve – at ~7% - likely to rise to ~75% in the next 10 years

- Battle between “Bitcoin maximalists”, Ethereum and Alt Coin fans – both have very strong use cases, both do different things

How Many Bitcoin Users Are There?

~100 million Bitcoin Owners

~0.4 million - Bitcoin Users added per day

~200 million - Bitcoin Wallets (25 million active)

~53 million - Bitcoin Traders

18.5 million – Bitcoins

Markets

Supply constrained - halving cycle every four years

Rapidly increasing demand from:

New private users

Future corporate treasuries, ETFs, institutional investment

Cycles (possible Super Cycle)

Halving cycle (started May 2020, ends Sept 2021)

Fiat currency printing cycles (started March 2020, unlikely to end

Markets for the Purchase/Use of Cryptocurrencies

“Perception” has been - nerds, geeks, cyber punks, anti-establishment, contrarian

Historically

Retail small investors – private individuals (small subset - people needing to escape countries, NGOs)

Family offices

Private small business people

From start of 2020

Corporate treasuries of some large US companies – Microstrategy, Tesla

Some hedge funds

Small number of investment banks

Predicted

Central banks of smaller countries

Other companies

Mainstream investment banks and financial services

ETFs

Hackernoon-internet vs cryptocurrency

Tax (not advice, seek professional advice) Governments and Central Banks are most likely to embrace crypto assets - as fairly new and other asset class - because of and as long as they are - taxed. Any capital gains tax it likely to be a deferred tax until the asset is sold back into a fiat currency.

- Cryptocurrencies are generally treated as “assets” by governments – capital gains taxes on profits (for UK – crypto to crypto trade is taxable).

- No tax if its never sold – or traded

- In future – as assets (such as Bitcoin and Ethereum) mature – likely to be able to borrow money against the asset value

- Many Crypto owners – the largest are called “whales” and people that never sell called “hodlers” – never sell or sell very little

- Countries can share records of owners of trading accounts on exchanges

- Important for everyone to pay any tax liabilities and disclose these as per tax legislation in respective country of your tax jurisdiction

- Hence question is – why sell – instead watch price rise and borrow money against for retirement etc

Central Banks Cryptocurrencies – could they compete with Bitcoin? Completely different – likely to be launched but:

- Could be digital fiat currency where supply would be controlled by governments – still fiat with endless increasing supply-inflation

- Software developments likely to be limited since the bulk of software talent, motivation and innovation working in the private sector

- All transactions would be monitored by governments – no option for privacy – could be launched as part of “cashless society” whilst increasing tax revenues – no more cash payments, all payments taxed

- Could be mechanism for governments to adopt different taxations on payments and income for different business services and individual depending on wealthy and service

Bull Market Timing

- Current Bitcoin halving cycle started May 2020 and ends Sept 2021 – many experts traders advice Bitcoin price most likely to top out by early Sept to late Nov 2021 – with Alt Coins possibly a month later

- No-one knows – always difficult to predict

- Some people even believe 2021 may be the start of a longer “super-cycle”

- Many Crypto owners plan to stay in the market regardless

- Other plan to “trade” and sell-down or even exit all together if they see a parabolic price spike – before entering back later in a bear market

- Everyone need to make their own call depending or risk tolerance, short (trading) or long term (hodling) strategies

- Bitcoin can easily decline to 30% of its peak value – with Ethereum may be to 15% of its peak and other far smaller Alt Coin can even go to zero – be careful

Network Effects - Bitcoin Ethereum and other Alt Coins have network effects – meaning:

- Increasing retail, business and banking consumer usage – seen in the number of crypto storage and trading accounts rising in every country around the world

- 100 million users likely to rise to 3-5 billion in the next 10 years

- More news flow about cryptocurrency

- More talk between friends, social media – Twitter, Reddit, Tiktok

- Network of users rising as people of all generations but particularly younger people get crypto accounts – seeing it as something for their futures

- There is also hype, it is cyclical, but like the internet and the environment – the network effects get more pervasive over time – they may plateau for a while then rise further

- There are many young and many very smart people working hard in cryptocurrency - "some of the best brains in the world" - its normally good to invest in the best brains (e.g. historically Apple, Google, Tesla, Facebook).

National Usage Cryptocurrencies Crypto Assets

Cryptocurrency - are unlikely to be banned by governments because:

- They are an asset class of savings and/or investment

- They are taxable on capital gains

- Their tax treatment has been communicate – principles set (currency transactions-exchanges are not taxed)

- Blockchain is a transparent ledger – can be investigated forensically

- Bitcoin and Alt Coins are not really a currencies!

- It runs in parallel with major currencies

- Bitcoin is like gold

- Alt Coins do transactions and smart contracts in a very fast efficient way (low energy usage) – progressive for business and technology

- The technology has been invented – it cant be un-invented

- Any nation that bans its use will be left behind by the global technological revolution that it brings – technologist-business would move somewhere else

- Its like the internet –or the internet of assets – banning is like sensoring – non democratic

Instead, government likely to focus more on the on and off ramps for fiat currency into cryptocurrency– and use of “stable coins” pegged to their currency – albeit these support their currencies

Traits Gold, Bitcoin and Fiat (national currencies)

Bitcoin Size and Brand

Took 12 years to reach $1 Trillion – the world’s first digital economic network (or digital monetary network)

It is not a company. It is a brand. It is a decentralise blockchain technology computing network.

- This is faster than the fastest ever growth of a company to £ 1 Trillion

- Apple took 42 years

- Amazon took 24 years

- Google took 22 years

- Bitcoin took 12 years

Questions: The question investors should ask themselves – should I learning about Cryptocurrency now, potentially invest in the asset class – after 12 years, or wait and see or not ever invest in this asset class? In any case, should I not at least educate myself on blockchain technology?

Competitors in a financial portfolio: gold, cash, bonds, stocks

Key Threats - Risks

- National government(s) ban Bitcoin and Cryptocurrency

- National government implement draconian taxation specific to Bitcoin and Cryptocurrencies

- Collapse of a large Crypto exchange(s) – reputational-security aspects

- Someone hacks Bitcoin blockchain

- Demand dries up after a price crash – whilst money printing stops – people believe it’s all been hype

- Regulation implemented to slow pace of growth down

- Crypto asset prices crash - stay depressed - investor lose money

Key Opportunities - Upside

- Massive demand increase from

- Private retail, family offices and high net worth individuals

- Corporate treasuries

- Hedge funds, Investment banks, Banks

- Central Banks

- Technological take-up of blockchain and all its uses skyrockets – exponential growth along with applications-use cases for the coins-tokens

- DeFi and NFT uses and demand skyrocket

- Money printing accelerates amplifying “digital gold” – eats away golds value

- Crypto asset prices rise sharply - stay elevated - investors make high returns

Gross Domestic Production - projected blockchain storage - (Courtesy Technology Use Compressor)

Bitcoin vs Ethereum-price

Humanitarian Use Cases

- Oppressed nationals or political asylum – use of Crypto to safely exit country

- Poorer people who have not access to bank accounts – to save money and trade – become economically active – and reducing threats and theft of cash

- Hedge against gigantic currency printing that leads to hyperinflation – so they cannot feed themselves or provide shelter and heat

- Secure encrypted savings – with password “stored in the head” – less chance of extortion

- NGOs workers able to use to provide much needed financial support for refugees, desperate people, and families in war zones

- Can help poor users in some desperate situations – not beholden to a central government that might be acting unfairly to certain sections of their population

Bitcoin Energy Usage (~2020)

Yearly Cost $Bln Energy Used (M GJ)

Gold Mining 105 475

Paper Currency and Minting 40 25

Banking System 28 2340

Governments 1870 5861

Bitcoin Mining 4.5 183

Bitcoin energy use 38% of gold mining and ~8% of banking system

Renewable Energy: Bitcoin stimulates renewable energy – estimated cost of electricity 0-2 cents (rather than 8-11 for normal industry) because using unwanted or off-peak electric from hydro, solar, wind – small amount from coal/fossil fuels mainly in China – energy usage likely to drop after price decline. Energy use will crash once mining ends 2040 (19 years time). Its worth noting that Bitcoin mining is estimated to use 76% renewable energy (and only 24% from hydrocarbons, oil-gas-coal). This proportion is far higher than the banking sector as a whole.

Investing in Crypto Assets: Anyone interested in investing in crypto assets should firstly get themselves familiar and educated in crypto assets - there are many good YouTube videos that can be seen. Then one can sign-up to a Cryptocurrency Exchange - examples (7 top exchanges in terms of daily traded volume 15 May 2021 - in Billion $):

Binance 46.9 - 356 coins (largest, most varied offering)

Huobi Global 14.7 - 332 coins

Coinbase 6.9 - 64 coins (US based, floated in US stock market)

Kraken 2.3

KuCoin 2.6

Bitfinex 1.8

Ventures: You should consider yourself privileged to have the opportunity to invest like a venture capitalist in early stage start-up companies (coins, tokens) or more established entities like Bitcoin (BTC), Ethereum (ETH), Binance (BNB), Coinbase (COIN) and possibly Ripple (XRP), Polkadot (DOT) and Cardano (ADA). Another very exciting aspect is that the crypto markets are open 7 days a week, 24 hours a day - they are truly global. This means there is action on all crypto asset prices levels all the time. Some might find this exhilarating though others might find this stressful and/or distracting, so you need to consider the type of person you are and the risk level-appetite you have before investing (buying) and/or trading (buying and selling) and the tax considerations of trading.

Technology Innovation: One should consider Crypto Assets as one of a number of superb new innovative technologies that will change the face of business in the next 3-10 years - all disruptive. We will cover these in more details in the next few months, but just to highlight this for now:

of superb new innovative technologies that will change the face of business in the next 3-10 years - all disruptive. We will cover these in more details in the next few months, but just to highlight this for now:

- Crypto Assets (e.g. Defi, NFT, crypto exchanges and currencies)

- 5G

- Biotech (e.g. gnome science and vaccines)

- Autonomous vehicles

- Electric cars (and batteries)

- Renewable energy (solar, wind and target zero carbon businesses)

Closing Comment - We hope this special report is insightful and good educational material to get property investors and all investors up to speed with cryptocurrencies - their uses, benefits, risks and opportunities - and how crypto assets will have a huge impact on the global internet and financial system in the next decade. If you have any queries, please contact us on enquiries@propertyinvesting.net

Disclaimer This presentation material and discussion around it – is for education and information purposes only. It is not financial advice. Investors in cryptocurrency do their own research and seek professional advise as appropriate.

Disclosure We are not paid by any entity. We do not get paid for this material. We do own a portfolio of crypto assets.

Recommended search engine: www.google.com