698: Technological Innovations for the next decade - high growth investment options and insights

07-01-2021

PropertyInvesting .net team

.net team

This Special Report describes the most exciting innovations and technologies to consider investing in within the next ten years, that could see spectacular returns.

History of Technological Innovations: Historically there have been many technological revolutions that drove monumental growth and development – drove down costs and increased efficiencies – lets remind us of some of these:

• Electricity 1900

• Steel for building skyscrapers in the USA 1890-1930

• Railroads in USA and Europe 1870-1940

• Automobiles, trucks (internal combustion engine) 1915 – 2050

• Airplane travel (jet engines) 1945-1985

• Radio, TV, cinema, phones 1920-1960

• Internet 1993-2010

• Social media 2005-2021

• i-phones, mobile hand held computers 2005-2015

Bricks and Mortar: For property investors, the basis of bricks and mortar have not changed very much over time – and people's desire to live in a house, apartment or building also has not changed much and is not likely to in the future. Whilst home building may become more efficient – costs of raw materials rise as does land. Homes are a manifestation of energy translated into building materials and construction. Property prices tend to keep pace with overall inflation (somewhere between the total money supply and the far lower CPI and RPI inflation measures). Wealthy people and the average person alike all want to park their money in bricks and mortar to help preserve their wealth whilst leveraging the bank’s fiat currency to gain asset price increases – thereby achieving in a rising market very high annual compounded investment returns. There are few years where property prices don’t rise – in part because of the monumental amounts of printed currency swirling around the financial markets that end up in property. Property is almost always part of someone’s “investment portfolio” – it's just a question of the proportion. Some people prefer a lower amount – say 30% - whilst other’s might chose a higher amount – something like 85% for those focussing on property investment.

Options: The purpose of this Special Report is to give our readers some ideas about alternative high growth stocks and portfolio options than can diversify a portfolio but hopefully add to the high returns of a portfolio. We have to start by describing the macro-economic framework and trends – because these are very important. If you invest in the very best high growth stocks – you will one day have a gigantic value portfolio of stocks that you can actually borrow money against instead of sell – to reduce your tax bills (there is no tax on borrowings). Borrowing money at a low interest rate and investing in high returns stocks, property and cryptocurrency is normally a good strategy as long as asset prices keep rising and interest rates don't shoot up.

Lets describe two types of stock investments:

Commodities – Mean Reverting Stocks: These are companies that tend to go up and down in cycles depending on changes in supply and demand for things like commodities and services that are difficult to differentiate – for example oil production, copper mining, airline travel, tourism, basic retail/shops. These don’t tend to show exponential growth – just fast growth then a decline to the mean and often over-shooting (mean reverting). To make serious money you have to try and time the cycles – like the oil price rising then predict it crashing – for example, as oil prices rise, more production tends to come on-stream, demand reduces then there is an oversupply and prices often crash – particularly if the high oil prices trigger an economic slowed cause by higher inflation and higher interest rates. After the crash March 2020 that triggered oil prices crashing from $55/bbl to around $15/bbl, prices have now risen to $74/bbl – and oil stocks have outperformed after crashing March-April 2020 – but how long this continues before they drop again is difficult to judge.

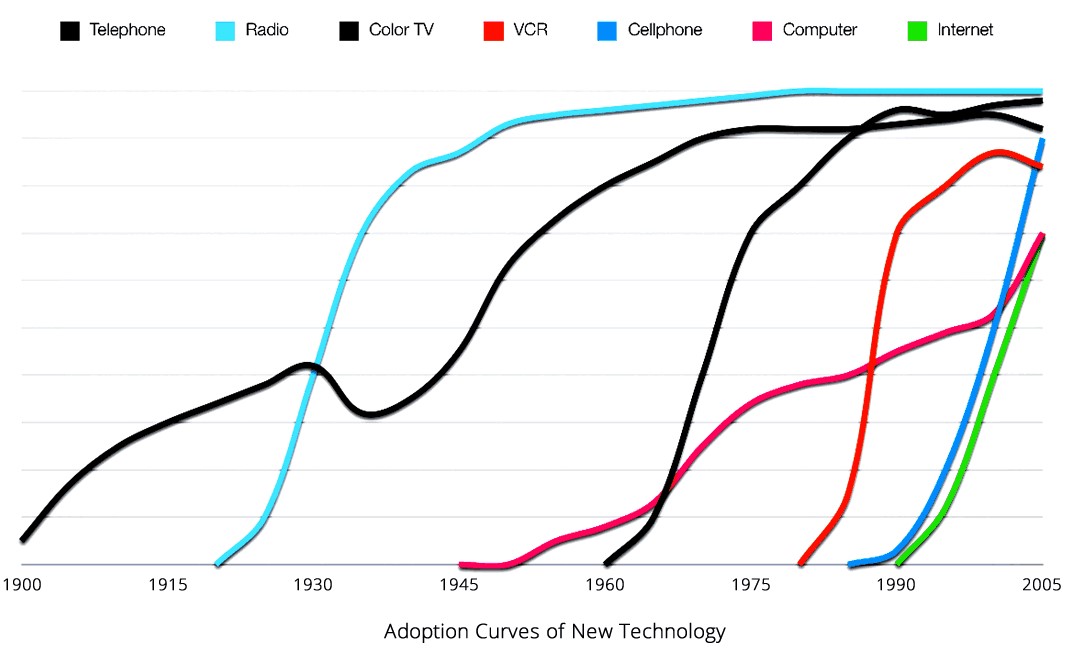

Technological Innovation – Exponential Growth - There are companies that tend to go up if their technology is perfected and widely adopted. The key is that once adoption within a population or market rises then gets to around 8%, it can easily go exponential as adoption skyrockets – like it did with TV, radio, iPhones, the internet etc. The companies that gets to the top often dominate a technological or innovative theme – others trying to play catch-up. The key to successful adoption is a company that has:

• Network Effects – a community of users that are passionate about the product or service and tell other people to try it or buy it

• Platform – the customer use a consistent platform that locks them in

• Good Technology – the company uses a break-through disruptive technology that attracts new customer that are willing to pay to use or access the product or service

If you look at the most successful large technology firms in the last ten years – all worth around a stagging $1 Trillion or over – they are have a Network, Platform and Good Technology. Lets list t hem for context:

hem for context:

• Google

• Facebook

• Amazon

• Microsoft

• Tesla

• Bitcoin (not a company, an asset class, store of value)

Backing a Winner: Now you might think you have missed the boat with these huge companies, but many smart investors believe their stock prices will continue rising over the next 5-10 years – most expert investors believe they are fairly well priced at this time – and Amazon (with its cloud computing brilliance) could go up 2-3 fold in the next 4-5 years for example. They are relatively safe bets because of their market dominance.

Of course people are looking for the next Google and Microsoft – or very high exponential growth stock – and there are plenty out there to chose from. They are higher risk – because if the technology adoption fails, their value can shrivel to zero in an extreme case (like Netscape that was beaten by Google for example, whilst Yahoo was once leader but has shrivelled up in value).

The highest growth stocks tend to have a very high level of volatility particular when they are smaller market capitalization – as price discovery and investor views constantly change. They dive between extremes of euphoria and fear. For example, Bitcoin goes up and down 50-85% as did Amazon in its early days – though now Amazon has been adopted and is far more mature – its volatility is far less.

So what are the big new technological themes that you should be interested in for potential exponential growth?

This is our view after much research of the key themes you should be considering investing in – for huge growth. All these technologies are disruptive and should show exponential growth as there adoption accelerates.

• Crypto Assets including Bitcoin (e.g. Defi, NFT, crypto exchanges and coins-tokens-currencies)

• 5G

• Biotechnology - including genome science and vaccines)

• Autonomous vehicles (SAV – Shared Autonomous Vehicles)

• Electric cars (and batteries)

• Renewable energy (solar, wind, and zero carbon businesses)

Other sub-sectors that are particularly exciting are:

- Spatial computing (e.g. Virtual Reality VR and Cross Reality XR)

- Quantum computing (super fast computing using light-photons)

- Biotech – including DNA/genome science, marijuana and possibly psychedelic pharma applications

- Mining – in support of renewable energy expansion – lithium, copper, tin, nick

el, cobalt

el, cobalt

So why are we so bullish on technology stocks in the 3-10 years timeframe?

$10 Trillion of Fiat Currency Printing – the gigantic debasement of almost all currencies caused by Central Banks printing fiat currency out of thin air means annual monetary supply inflation is running at around 15-30% - in 2020 the US money supply increased by 30% and 2021 and 2022 are likely to increase by around 15% – and it's likely to continue indefinitely as the economy struggles and the debt burden expands. This means that to preserve your spending power – people normally shift cash or savings into the stock market and in particular high growth technology stocks to keep pace with inflation.

M1 Money Supply in the USA and global - Trillion US dollars over recent time

Technology Stocks – most smart investor realise that post COVID-19 everything changed – there was 5 years of innovation adoption within the teleconferencing world smashed into a few weeks for example. Zoom stock skyrocketed.

Technology Adoptions - similar new technologies and the speed of adoption

Crypto Assets: One of the most explosive, if not the most explosive and most disruptive growth, is likely to come from Crypto Assets in the next 10 years. Crypto Assets that use blockchain technology are the “internet of financial assets and money”. Recall the internet that became popular from 1993 onwards – and created a platform firstly for the global flow of information (e.g. Google) – then social media (e.g. Facebook/Twitter) – engaging with huge global communities. At the start of significant take-up in 1995 there was much talk of governments shutting it down because it was not regulated and did not pay taxes – there is still talk today that this might happen with Crypto Assets but this is unlikely because Crypto Assets have been deemed assets or property by the US, UK and European governments that are liable for capital gains taxes on price increases – they are truly global and internet based and it would be almost impossible to close this new asset class down in large part because it is on the whole decentralise, particularly Bitcoin. Roll on from 1995 to 2003 - and we also had e-commerce – ebay and Amazon – using their platforms and communities. Established banks created their own internet banking websites using old world transactions.

Traits of the Younger Generation: But the young populations around the world tend to have the following traits - they are:

• Computer savvy

• Not particularly loyal to any particular service or offering compared to elderly people

• Like to transact peer to peer

• Have virtual communities that they join and communicate within

• Likely to use YouTube to learn – rather than books, written material and lectures

• Fast moving, quick thinking

• Environmentally conscious

• Likely to use Twitter, Tiktok, Netflix, Messenger, Facebook rather than TV, email, radio

• They understand what blockchain technology is

• They are very quick thinking, highly intelligent, on the whole far better educated than people 50 years ago and have short attention spans - are fast moving intellectually.

Meanwhile many of these people have got well versed with Crypto Assets (or Cyptocurrencies, like Bitcoin, Ethereum, Cardano, Polkadot, Polygon) – there is around a 6% crypto asset global take-up now – the early adopters. With this in mind, for the next 3-5 years we firmly believe there will be a gigantic boom in the use of:

• Defi – or “decentralized finance” – using crypto assets (or coins-tokens) to perform low cost ultra efficient transactions, banking and financial services

• NFT – or non fungible tokens – the "tokenisation" of all assets onto the blockchain - including artwork and property.

So with this as context, let's consider the three key pillars:

Platforms – yes, the global encrypted blockchain technology platform has been invented with new secure platforms for huge communities – these communities help code and develop the “coins” or “tokens” or “software entities-services" – e.g. Ethereum, Cardano, Polkodot, Polygon, Solano for DeFi and Bitcoin as a store of value (so called "digital gold")

Communities – yes, these young communities are democratising the financial system – also using social media to communicate their messages – working on crypto asset platforms to develop this alternative banking system that is hugely disruptive to the “stuffy old highly inefficient banking system” that have huge offices using huge quantities of CO2 emissions to produce very slow banking transactions with very high fees and slow rates of checking – these are the so called “too big to fail” banks and the fiat banking system that was bailed out in 2008 and 2020. Many believe things are stacked up against the younger people – and the disruptive democratization of financial services and transactions in an environmentally efficient manner is a way of extracting appropriate levels of wealth for themselves in the longer term - the younger people, In any case, these younger people are in line for huge inheritance payments in the next 20 years and many smart people believe they will use this inheritance to invest in Crypto Assets and the Blockchain technological revolution.

Environment – Crypto Asset users believe Crypto Assets are a highly efficient new way of transacting – using secure blockchain technology – that encourages renewable energy development and over time will see a huge reduction in CO2 emissions compared to the conventional fiat banking system – partly through low emissions coins like Cardano, Solano and Nano (plus Ethereum later in 2021) (note: 78% of Bitcoin miners use some renewable energy in their power-mix, with Chinese bitcoin miner using around 50% in mid 2021 and the energy is normally wasted energy that is not required at that time - low cost and "on the fringe" of the grid, often in remote areas where the hydro-electric or solar cannot be used).

Other Key Technologies

• 5G – this broadband internet using satellites to assist coverage and provide a giganti c increase in the speed and amount of data that can be streamed also in rural areas – will have a big impact and help facilitate businesses like – Artificial Intelligence (AI), autonomous vehicles and biotechnology – aiming to irradicate cancer, malaria and improve health for the 7.5 billion people across the planet

c increase in the speed and amount of data that can be streamed also in rural areas – will have a big impact and help facilitate businesses like – Artificial Intelligence (AI), autonomous vehicles and biotechnology – aiming to irradicate cancer, malaria and improve health for the 7.5 billion people across the planet

• Biotech (e.g. gnome science and vaccines) – partly triggered by COVID-19 and breakthroughs in DNA and genome sciences, with a malaria vaccine is close and a breakthrough to irradicate cancer is likely not far off now – companies that patent/invent the drugs and equipment to prevent these diseases will skyrocket in value

• Autonomous vehicles (SAV – Shared Autonomous Vehicles) – Tesla are leading the charge using powerful computers using AI technology (artificial intelligence) – the first vehicles are likely to receive licences in the USA by end 2022 and become mainstream between 2025 and 2030. These electric cars and trucks – instead of having a utilisation rate of say 5% (like normal cars) will be shared (rented out) within communities and business – and could have utilisation rates of 60% in a day (15 hours) – this would bring the cost of each mile down from 50 cents to say 8 cents a mile – and owners of such vehicles could earn $50,000 over a 3 year period renting out their car in off peak times, more than paying off the car and its running costs.

• Electric cars (and batteries) – adoption is set to hit around 8% in many developed countries in the next year or so– then growth with be exponential. By 2028 we are predicting that 70% of all new cars will be either electric or hybrid electric. The best and most efficient battery manufacturers are likely to see exponential growth. It's worth considering investing in copper, nickel and heavy earths required for the transition from the fossil fuel world to the renewable world - more in metals mining later.

• Renewable energy (solar, wind, and zero carbon businesses) – wind and solar power for electric power generation in the last year has become economic without any subsidies compared with oil and gas (fossil fuels). Returns on these utility companies are not likely to be massive – their revenues are likely to grow strongly - though the return on investment is normally not that high. Yes, these stock prices can rise sharply but they probably wont go exponential (this is evidenced from BP's stock market price decline after announcing in 2020 they were transitioning to low carbon energy (solar-wind) world. A safer way to invest in renewables is likely to be picking the highest growth copper, nickel, tin and lithium mining stocks, or buying these as commodities and holding them.

Summary - We hope this special report has been insightful – giving an overview of why networks and platforms are so important for innovative growth businesses and potential future investment returns. If you have any queries, please do not hesitate to contact us on enquiries@propertyinvesting.net