700: Currency Printing, Inflation and How This Will Crash Economies - Energy Prices and Inflation

07-24-2022

PropertyInvesting.net team

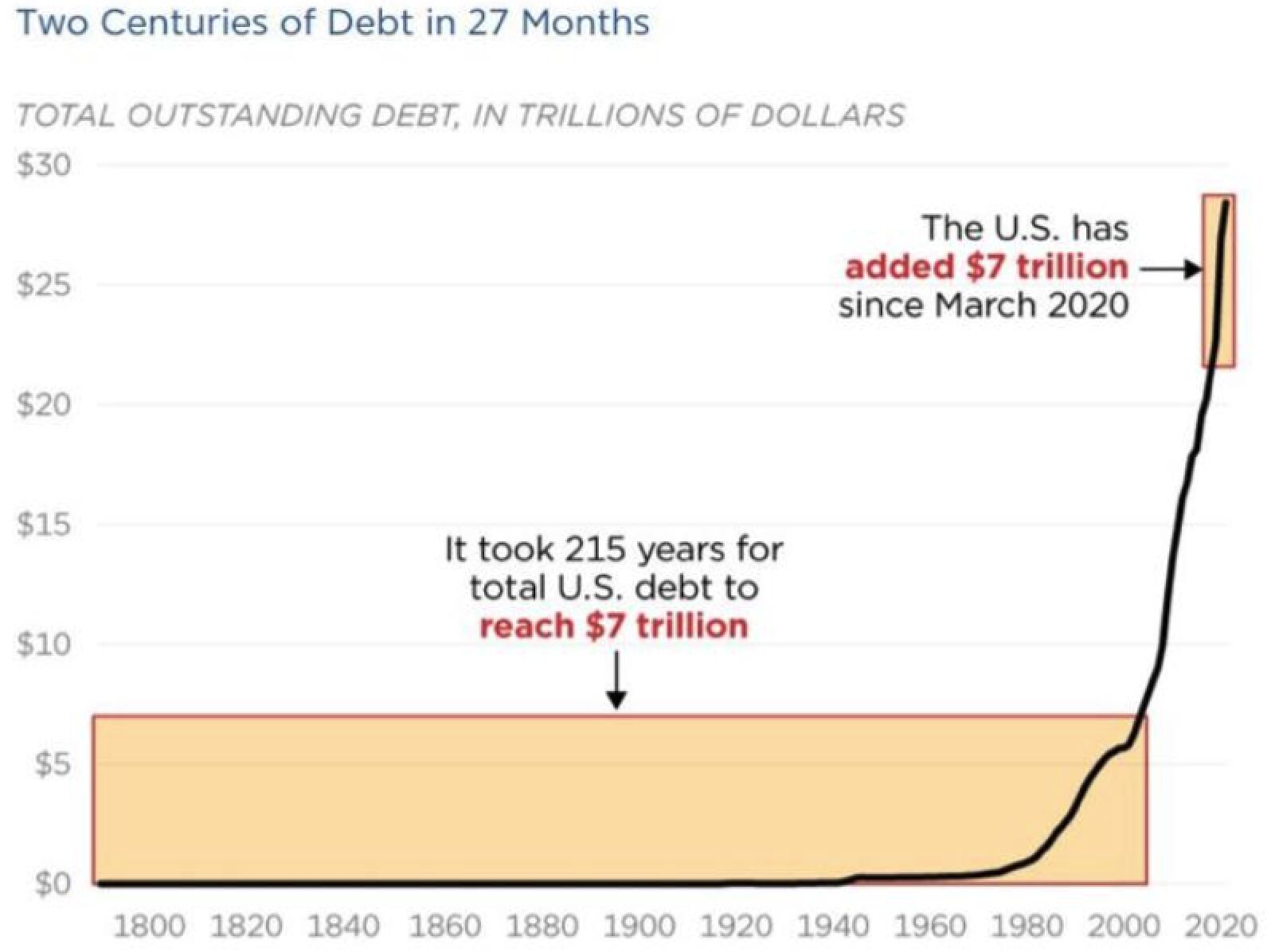

Central Banks around the world have made gigantic mistakes over the last few years in their response to COVID. Just prior to COVID affecting the world's economy in Q1 2020, we were due a recession since it was around 12 years since most countries last had one. As the economies around the world shut down – Central Banks went on the most gigantic currency printing session the world had ever seen by far, in USA, Europe, Japan and China – almost all countries joined in – with the ring leaders being the US Fed.

Policy Mistake 1 – Printing Too Much Fiat Currency: What should have been a major depression for well over a year – turning into a party as hand-outs and easy money with ultra-low interest rates fed demand for goods just when supply was constrained due to supply chain bottlenecks – lockdowns and shut-down. It did not take a rocket scientist to realise what this would cause – massive inflation. The Fed were trying to convince everyone this inflation was transitory all the way through to March 2022. The inflation tends to affect lower income people without assets more.

Policy Mistake 2 – Not Raising Rates Fast Enough: As inflation reared its ugly head in early 2021, Central Bankers all around the world just sat there and watched the crisis unfold. Then they said that the inflation was “transitory” and just a by-product of short term supply chain bottlenecks related to COVID. They were and have since then been “way” behind the curve with jacking up interest rates to kill off rampant inflation. In the last 100 years, its been normal for interest rates to be around 1-2% or more higher than inflation – to give savers some returns and encourage the efficient use of capital. That all went out the window. Inflation in the USA and UK is currently running at about 9+% but interest rates are around 2.5% - that’s a gigantic negative rate of -6.5%. You loose at least that amount each year. It’s a massive tax on savings. It’s a massive tax on anyone that has saved any cash. Its stealing your wealth through inflating the currency – a tax on cash and prudent saving.

European and German Energy: Then in February 2022 Russia invaded Ukraine which sent oil and gas prices skyrocketing, particularly in Europe. If you look at the benefit Russia gets from higher oil and gas prices, its probably more than the cost of the sanctions and war combined. Europe is therefore paying for the invasion. Germany in particular looks foolish. Consider this as a catalogue of mistakes:

- Germany closed down all their nuclear power plants as a knee jerk political reaction to Fukushima – a nuclear power plant that was built on one of the most seismically active and potentially devastating fault lines in the world (Germany has no such seismic activity or exposure to total waves).

- Germany started building wind turbines in the windy north – but they had no electric infra-structure to get this energy to where it was needed in the south of the country. The nimby environmentalists and homeowners then demonstrated about putting up new overhead power lines – the government was forced to build expensive and time-consuming underground lines, but then the nimbies put a slow down or stop to that. They were forced to burn CO2 emitting and highly polluting coal to generate their energy.

- Germany then decided it was best to try and replace the coal with gas as soon as possible. They helped Russia build Nordstream 2 gas pipeline to Germany - ready for commissioning Jan 2022.

- Russia invaded Ukraine. Germany decided they would play hard-ball and the refused operator licence for Nordstream 2 in March 2022. Gas prices skyrocketed for the gas Russia was exporting to Germany – and oil prices also skyrocketed.

- In mid-June 2022, the giant Nordstream 1 pipeline went down for schedule summer maintenance - some turbines were held up - probably on purpose by "The West". On 19 July – two days before the pipeline production was due to re-start, Russian announced Force Majeure – meaning they did not intend to flow gas down the pipeline and gas contracts have been suspended – a so called “force of nature” or unforeseen circumstance. Gas production has now recommended though at a lower rate.

- In June 2022 Germany commence de-mothballing more coal burning power plant.

- Germany and the rest of Europe is now not looking forward to a crisis winter situation where their depleted and inadequate gas storage and erratic gas imports from Russia are likely to lead to power outages and cold nights for Europeans - it's Putin's way of punishing The West for supporting Ukraine in the war.

Disastrous Energy Security: What an absolute catalogue of disastrous German decisions that have sent their energy prices into the strata sphere whilst massively increasing both CO2 emissions and dirty particulate pollution. They have played directly into the Russian's hands. As Germany helps Ukraine with the war effort, Russia is controlling oil and gas prices and giving back maximum economic damage to Germany in the form of sky high oil and gas prices. What a sorry story.

As the energy wars started – the European Central Bank thought it best to hold interest rates at record lows – in negative territory. The Euro then crashed around 25% against the dollar in the 6-12 months through to July 2022 - further fuelling inflation. They have now lost control of inflation – running at around 9-10% per annum in most European countries. The German industry is reeling from high oil/gas prices and raging inflation. Countries like Italy now have a debt of 150% of their GDP – meaning there is no way they can ever pay their debts back.

Guessing Putin’s thought process, he will want to invoke maximum pain to the European economy because that’s what they are trying - rather unsuccessfully - to do to Russia due to the sanctions, and their support for Ukraine against the Russian invasion.

Meanwhile Russia is cosying up to Saudi Arabia, India and China – trying to create a pack that can stand up to the USA and Europe. In particular Putin has been active with OPEC+ in keeping a lid on oil supplies and keeping oil prices elevated – something that helps both Saudi and Russia.

US Energy Strategy In Comparison: Now look at the USA. It’s a success story for the mighty dollar believe it or not – in large part because of their energy developments and policies. This is despite President Obama’s previous involvement, not because of it. The USA:

- Starting multiple fraccing of horizontal tight gas wells in 2006 that creates a flood of cheap gas driving gas prices to ca $2/MMBtu – this then kicked off a switch away from coal to far cleaner gas (gas gives off about 25% of emissions when compared to coal and half that of oil)

- Once gas prices crashed and by late 2008, they found many of the gas wells actually produced quite large quantities of light oil. They then drilled longer horizontal wells in spiral designs with even larger multiple fracked wells and boosted their oil supplies by around 5 million bbls in 8 years through to 2015. This made the USA energy sufficient – they were actually able to start exporting small amounts of crude oil and larger amounts of refined products.

- The gas pipeline infrastructure was developed further and the USA then started selling LNG via export terminals to Europe.

All this lead to far lower CO2 emissions – lead by the market – not environmental , woke or nimby policies. Now you would think Germany – because they seems to be a far more environmentally conscious country – would have dropped their emission substantially since Kyoto and Paris agreements – compared to the USA – but its actually the opposite. Because the government got heavily involved it's been a disaster – shutting down low emissions nuclear, opening up coal because wind was not ready then opening up more coal because they have fallen out with Russia over gas.

Dollar Strength: Why do we mention the above? Its to do with currency strength. When you look at the dollar versus Euro – you might now understand why the Euro has weakened and the Dollar has strengthened despite all the dollar printing. Europe has been looser with their printing, more dovish with their interest rates – and of course their energy policies have been a disaster and they are heavily exposed to Russian gas especially as they are supporting the Ukraine war effort. The environmental lobby has made energy prices far higher and in Germany lead to higher CO2 emissions – the law of unintended consequences.

A few months ago, the ECB was telegraphing that they would not be raising rates until end 2023 because of COVID and the weak economy. Last month they had to knee-jerk react to climbing inflation and the sinking Euro by raising rates despite a slowing economy and war on their borders in Ukraine.

In the next few months – our prediction is as follows – following on from all of the above:

- After a brief relief rally, stock markets in September will crash through to say February – many will be down around another 40% - the S&P500 and CAC to name a few.

- The dollar will continue to strengthen when the economic crisis starts to unfold

- Riots will break out in developing nations as the high value of the dollar and their declining foreign currencies and reserves plus high borrowing costs bankrupt many nations – Sri Lanka is just the beginning of a wave of countries where populations will rise up against what they believe is corruption – similar to the Arab Spring of 2011.

- Peripheral European countries with poor demographics – aging populations – and weaker economies will see their government bond yields go out of control – the credit markets in Europe will start to seize up. Countries most exposed are Greece, Italy, Spain and Portugal.

- By end of 2022 Central Banks around the world will be forced to stop putting up interest rates because governments, banks, companies and individuals will simply not be able to afford it – and the economies will start crashing into recession in Europe, USA and developing nations.

- Real estate around the world is likely to drop in price as interest rates rise, inflation rises, cost of living rises, banks have less to lend as tightening continues and people have lower disposable income because of inflation. Prices in Europe, UK and USA are likely to start dropping by August 2022 – and some areas could crash by over 20% we believe regrettably. Particularly in areas exposed to higher unemployment and higher inflation. Now is definitely not the time to buy real estate anywhere in the world in our opinion – except Guyana which is a boom countries off the back of 10 billion bbls of oil that has been discovered by ExxonMobil since 2015.

For investors, its best to either:

- Get out of the stock market all together – into cash – before the next leg of the crash – is likely to be in September 2022

- Buy dollars rather than any other currencies – because the dollar is the safe haven during a crash and they are self sufficient in oil, gas, coal and food – unlike most European and Far Eastern countries. Make sure you are in the dollar cash, or alternatively US Treasuries.

Even oil and gas companies will suffer as a prolonged recession will lead to demand destruction and lower oil and gas prices. Be careful investing in the energy sector – even though it looks like a winner at present, things can change rapidly in this cyclical industry.

During a crisis – investors have historically flocked to gold. But we also think gold is risky – it normally rises in price as the dollar drops – its price is inverse to the dollar strength. As interest rates rise with the dollar, people buy dollars rather than gold. When US interest rates drop, they buy gold as a hedge against inflation. But gold’s performance in the last 12 years has been lack-lustre. It seems never to have a good year. There is a thesis that its an old person’s (or an old fashioned person's) favoured store of value – and that these people are no longer very active – and Bitcoin has in part taken over as a store of value – so called “digital gold”. Since it’s inception during the last economic crisis in 2008, Bitcoin returns have consistent outperformed gold’s. We have also noticed that during a crisis, even golds price drops sharply because people liquidate their gold holdings into cash – normally the dollar. So if there is a big crash, expect gold prices initially to drop, then rebound and rise sharply. What we are saying is, unless you know the gold market well, best not get involved because you are not likely to make money in this market.

Silver is even more difficult to make money out of. They call it the devil’s metal. It often skyrockets rapidly then comes down over many years in stages. Very unpredictable. During a crisis, because it is an industrial metal, prices often initially drop as a recession would lead to less demand for the metal – for example, electronics like mobile phones, sterilization, solar panels etc. That said, it's the only thing we can think of that is cheaper in 2022 than in 1980 in dollar terms - it as $55/ounce in 1980 and is now only $20/ounce - an almost unbelievably cheap and rare metal. There are only 500 million ounces in the whole world with 7 billion people. That's 1/14th of an ounce each - which would cost a mere $2!

Bitcoin: Finally cryptocurrency. Many people have called Bitcoin and other cryptocurrencies a hedge against inflation – but at this time – this is simply not true. Bitcoin prices rise when:

- More currency printing takes place – dovish monetary policies - more liquidity

- Interest rates are low or dropping

- Technology stocks are rising

- The US dollar is falling

- In an 18 month period after a four year halving cycle starts (the next one is due May 2024)

- When the PMI index is rising - a growing economy

- As mass adoption of Bitcoin and cryptocurrency usage takes place or accelerates

If you look at all of these criteria – only number 7 is positive at this time. Mass adoption has hit the sweet spot of around 10% globally and is likely to reach 50% in the next 5 years. But everything else remains negative. The cryptocurrency bear market likely started November 2021 and will probably last 18-24 months. We are only around 40% of the way through this bear market. Bitcoin prices crashed from $69k in Nov 2022 to $17k in May before rising to $22k per coin today. Although it could rebound to say $28k/coin in the next few months, there is in our view a 65% change of another major drop to below the $17k recorded in May 2022 – some time in the next 6 months. This is most likely to coincide with another leg down – stock market crash – in the S&P500 – just before the US Fed “pivots” – or announces the end of the interest rate hikes and a return to quantitative easing.

Bitcoin Bear Market: However, it's worth pointing out that if there is a massive S&P500 market crash based on a severe recession and high interest rates, Bitcoin could easily crash to range $11k-$13k once a major capitulation event occurs. One extreme prediction is by Harry Dent who believes Bitcoin will bottom at $3.5k. Be under no illusion - we are in a Bitcoin bear market. One can still make money, but its a question of buying on the correct dips, selling on tops and being very careful one is not exposed to the giant rapid down moves that often happen in the crypto market - sometimes at 3am GMT in the morning when most investors in Europe are asleep and in the US having a beer in the evening!

Long Term: Without doubt, with restricted supply and booming demand, long term, Bitcoin has a brilliant future. There are only around 15 million Bitcoin coins in supply (many have been lost) with very restricted extra supply and 50% demand increase each year. That's only 0.3 Bitcoin per millionaire in the world - that would currently cost $7k. If you are a millionaire, there is a strong argument as a hedge to at least buy 0.3 Bitcoin for $7k. So one day, prices will be well over $100k in a few years time. It could bottom around range $11-$13k (as low as $3.5k) but eventually it will skyrocket likely 2024 to well over $100k. If one can barrel in once its crashed and time the high in a few years time, 10x gains are possible.

US PMI Index - Purchasing Manager's Index - on a reducing trend that is not good for Bitcoin price rising

Recession Required to Beat Inflation: The US Fed and other Central Banks are between a rock and a hard place. They either let inflation run very hot – say 5-8% for a few years, or they jack-up interest rates a few extra points, that then sends all the major economies into a recession that kills off demand and kills off inflation back down to the target level of 2%. With high oil and gas prices in part because of the Ukraine war and in part because OPEC has no extra supplies – they are in our view “maxxed out” due to decades of under investment and ESG committees putting a stop to investment in fossil fuels. The bottom lines is ESG (that’s Environment, Society and Governance) leads to lower oil/gas supplies and higher energy prices – that fuels inflation and lead to lower growth and higher unemployment. This is the price they say - that we have been saying for the last 3 years - that need to pay to save the planet from climate change.

So for investors, our steer is the following:

- Get out of the stock market before the next leg down and final crash – capitulation – likely another 40% leg down for the S&P500 for example - then jump back in - when there is mass panic – likely some time in the next 1-6 months – to take advantage of a strong rebound.

- Consider buying US Treasuries - in anticipation of a crisis

- Get yourself into the dollar rather than weaker local currencies – that will crash further as recession hits around the world (Pounds Sterling and Euro are exposed to Russia, war and high energy prices).

- Position to buy Bitcoin at the peak of panic and capitulation of the technology stock market S&P500 - likely some time in the next 1-6 months

- Try and keep your job – income coming in – because we are just about to enter a big recession

- Try and divest from property before a crash – albeit this might already be too late – since prices are likely to start dropping August 2022

- Long term, we believe Bitcoin will rise to price range £100k to $500k once mass adoption like the internet takes place, the next halving cycle nears and currency printing recommences.

Below is our prediction of the S&P500 and US Treasuries in the next 18 months.

In summary, inflation is raging caused by

- high oil and gas prices from low levels of investment in fossil fuels and the Ukraine war

- gigantic and irresponsible currency printing during COVID

- supply chain bottlenecks cause by COVID and under-investment in capacity

The net beneficiary is likely to be the USA and the US dollar. All other economies will slide compared to the States because of their difficulty paying debts with a high dollar. Countries particularly exposed are those with sanctions and those with high oil and gas import costs.

Countries Best Able to Weather The Storm: USA, Canada, Norway, Australia, Saudi Arabia, Qatar, UAE, Guyana

Countries Least Able to Weather The Storm: Italy, Greece, Spain, Portugal, India, Pakistan, Argentina, Sri Lanka – other developing nations with deficits, weak manufacturing, and high oil/gas import bills (possibly Thailand, Vietnam, Laos, Bangladesh).

So many people have been calling for the death of the US dollar for years now. But we see other currencies all being weaker. The reasons are - the US energy independence, military complex/security, food supplies and regional economy that is insulated from global problems like Russia, China and countries imploding on themselves. Anyone misbehaving - not wanting to accept US dollars - are sanctioned or invaded - like Iran, Russia and previously Libya and Iraq.

DXY Index: Below is the dollar DXY index which measures the strength of the dollar against a basket of other currencies - which is weighted around 60% Euro, 13% Yen, and 11% Pound Sterling. One can see since late 2021 the index has risen from 90 to 106 - and we believe it will rise to 125 by early 2023 as the crisis unfolds before reverting back to 100.

If you think the US is mismanaging their economy, then just look at the Eurozone, Japan and the UK - gigantic currency printing, deficits and massive oil/gas and food imports. Despite all the faults of the US - the dollar we believe will be stronger as this next crisis unfolds. It's the best of a bad lot!